Why Did India’s Fintech Unicorns Hit a Capital Wall?

India’s fintech unicorns rode the wave of digital public infrastructure, state-backed innovation, and massive venture capital. But with regulatory tightening and global capital caution, many are now navigating their hardest phase yet.

1. Funding Slowdown Hits Fintech Unicorns

- Funding Falls: India's fintech sector, once the undisputed magnet for startup capital, is witnessing a significant deceleration. According to data from the Startup India portal (DPIIT), fintech remains among the top three sectors in terms of funding, but momentum has slowed in FY24.

- As per Invest India, total fintech investments in India dropped to USD 1.9 billion in 2023–24, down from USD 2.8 billion the year before, a 33% year-over-year contraction.

- Investor Caution: While India remains globally competitive, ranking third in fintech funding behind the US and UK, domestic signals show investor appetite has become more cautious. Late-stage deals, typically the lifeblood of unicorns, declined by over 40%, reflecting a broader correction in risk sentiment.

- This aligns with macroeconomic headwinds, including sustained repo rate hikes by the Reserve Bank of India (RBI) through 2022–23, which have tightened liquidity across financial markets.

- For investors now prioritizing regulatory clarity, governance quality, and bottom-line visibility, the old model of "scale now, monetize later" is increasingly untenable even for India’s most visible fintech brands.

How India’s Fintech Unicorns Were Built

- Powered by Digital Infrastructure: Between 2015 and 2022, India’s fintech story was one of acceleration powered not just by market demand but by state-designed digital infrastructure.

- The India Stack, comprising Aadhaar for identity, eKYC for onboarding, and UPI (Unified Payments Interface) for payments, laid the foundation for hyper-scalable financial services.

- Government-Led Innovation: This infrastructure-led innovation, largely stewarded by NPCI (National Payments Corporation of India) and supported by the Ministry of Electronics and IT (MeitY), enabled startups to skip traditional banking bottlenecks.

- Between FY16 and FY25, UPI transaction volumes grew from ₹69 crore to over ₹260 lakh crore, according to data from the National Payments Corporation of India (NPCI). This expansion reflects a significant shift in India’s payments infrastructure, driven by state-backed digital public goods.

- The scale and accessibility of UPI enabled companies such as Phone Pe, Paytm, and Razor pay to integrate real-time payments into their platforms, reducing reliance on legacy banking systems and accelerating user acquisition in both consumer and merchant segments.

- Startups on Public Rails: These firms, while private ventures, were built atop public rails. Razorpay enabled B2B digital payments; Paytm pivoted from wallets to full-stack finance, backed by its payments bank license; BharatPe focused on underserved MSMEs with QR payments and lending; Pine Labs transformed point-of-sale credit into EMI financing solutions.

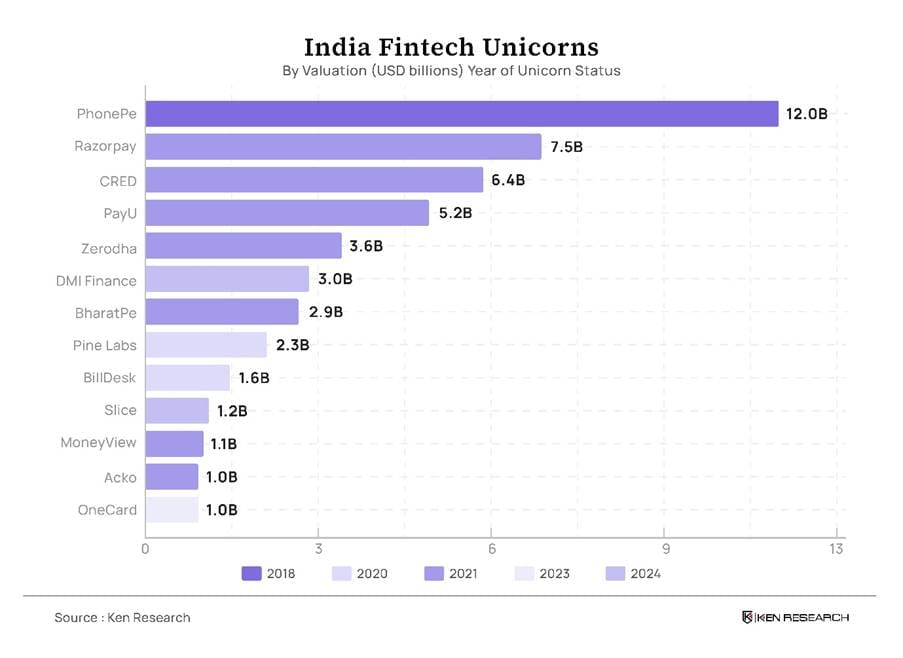

- Fast Growth, Loose Rules: Backed by DPIIT-registered VC funds and foreign investors, Paytm, Razorpay, and PhonePe raised substantial capital and attained unicorn status in record time.

- Paytm's e-commerce unit reached a valuation exceeding USD 1 billion in March 2017 following a USD 200 million investment led by Alibaba.

- Razorpay joined the unicorn club in October 2020 after securing USD 100 million in a Series D funding round co-led by GIC and Sequoia Capital India.

- PhonePe surpassed a USD 5 billion valuation in December 2020, marking its entry into the unicorn club. raised billions of dollars and became unicorns in record time.

- However, much of their initial growth was burn-heavy, dependent on subsidies, and scaled in an era of loose regulatory oversight, a dynamic that has now reversed.

3. Why Funding Is Drying Up

- Global and Local Pressures: Much of the funding reset can be traced to two forces: global macro caution and domestic regulatory recalibration.

- Tighter Lending Norms: Since mid-2022, the RBI has issued a series of tightening circulars aimed at bringing fintech operations closer to the formal banking framework.

- In its August 2022 Guidelines on Digital Lending, the RBI mandated that loans must be disbursed directly from lenders’ bank accounts, effectively ending the practice of FLDG (First Loss Default Guarantee) without disclosure.

- It also enforced clearer customer disclosures, prohibited automated lending apps from accessing user contact lists, and introduced standard reporting protocols.

- License Delays: Simultaneously, payment aggregators such as Razorpay, Cashfree, and others were directed to obtain formal authorization. Many of these approvals were paused or deferred in 2022–23, creating temporary friction across merchant payment ecosystems.

- Market Shock: Public market performance added to investor caution. Paytm, which was listed in November 2021 in India’s largest-ever tech IPO (₹18,300 crore), saw its shares decline 27% on day one.

- As of March 2024, its valuation remains below the IPO level. While regulatory intervention, including the RBI's February 2024 directive barring Paytm Payments Bank from onboarding new users, was framed as risk containment, the signal to investors was clear: scale is no shield against scrutiny.

- Governance Concerns: Adding to the concern were governance lapses at firms like BharatPe, where allegations of financial impropriety and board-level disputes raised flags about internal controls, prompting many VCs to enhance diligence before deploying capital.

Operational Challenges Facing Fintech Unicorns

- Rising Costs: Today’s fintech unicorns are grappling with cost-heavy operations, unclear monetization levers, and growing compliance burdens. Customer acquisition in Tier-1 markets is saturated, and the cost-per-user has risen substantially.

- With wallet-based subsidies and zero-MDR regimes no longer applicable as per the RBI’s 2020 clarification on UPI-based merchant discount rates, many players have lost their easiest user hooks.

- Slow Lending Pivot: The pivot to lending has been slow and heavily supervised. Unlike tech startups in e-commerce or media, fintechs operate under financial sector regulation, and even partnering with NBFCs or banks comes with audit trails and data localization requirements.

- Heavy Compliance Load: Meanwhile, infrastructure upkeep has become a non-trivial cost center. Compliance with Account Aggregator (AA) norms regulated by RBI and operated under ReBIT (Reserve Bank Information Technology Pvt Ltd) requires secure API integrations, consent-based data flows, and information security management systems (ISMS) that align with ISO 27001 standards.

- In short, fintechs are now being asked to act like financial institutions, not tech companies, without always having the capital or licenses to do so at scale.

5. Strategic Pivots and the Road Ahead

- Recognizing this shift, fintech unicorns are gradually pivoting their strategies. Razorpay has paused several credit-linked products and doubled down on its B2B core.

- PhonePe has launched Indus Appstore and insurance aggregation, betting on broader digital services with monetizable layers. Paytm, under regulatory pressure, has reduced cash burn, focused on UPI incentives recovery via MDR on merchant payments, and emphasized partnerships with formal banking institutions.

- The Ministry of Corporate Affairs (MCA) has noted a rise in merger activity in the financial services sector, particularly among smaller NBFCs and fintech entities, as cost synergies and license access become critical.

- The most significant shift, however, may come from how fintechs align with India’s Digital Public Infrastructure (DPI) going forward. ONDC, OCEN, and AA create interoperable frameworks for commerce, credit, and data.

- Players who build on top of these stacks with strong governance, capital discipline, and regulatory cooperation will likely define the next phase of Indian fintech.