The Next Big Lubricants Market

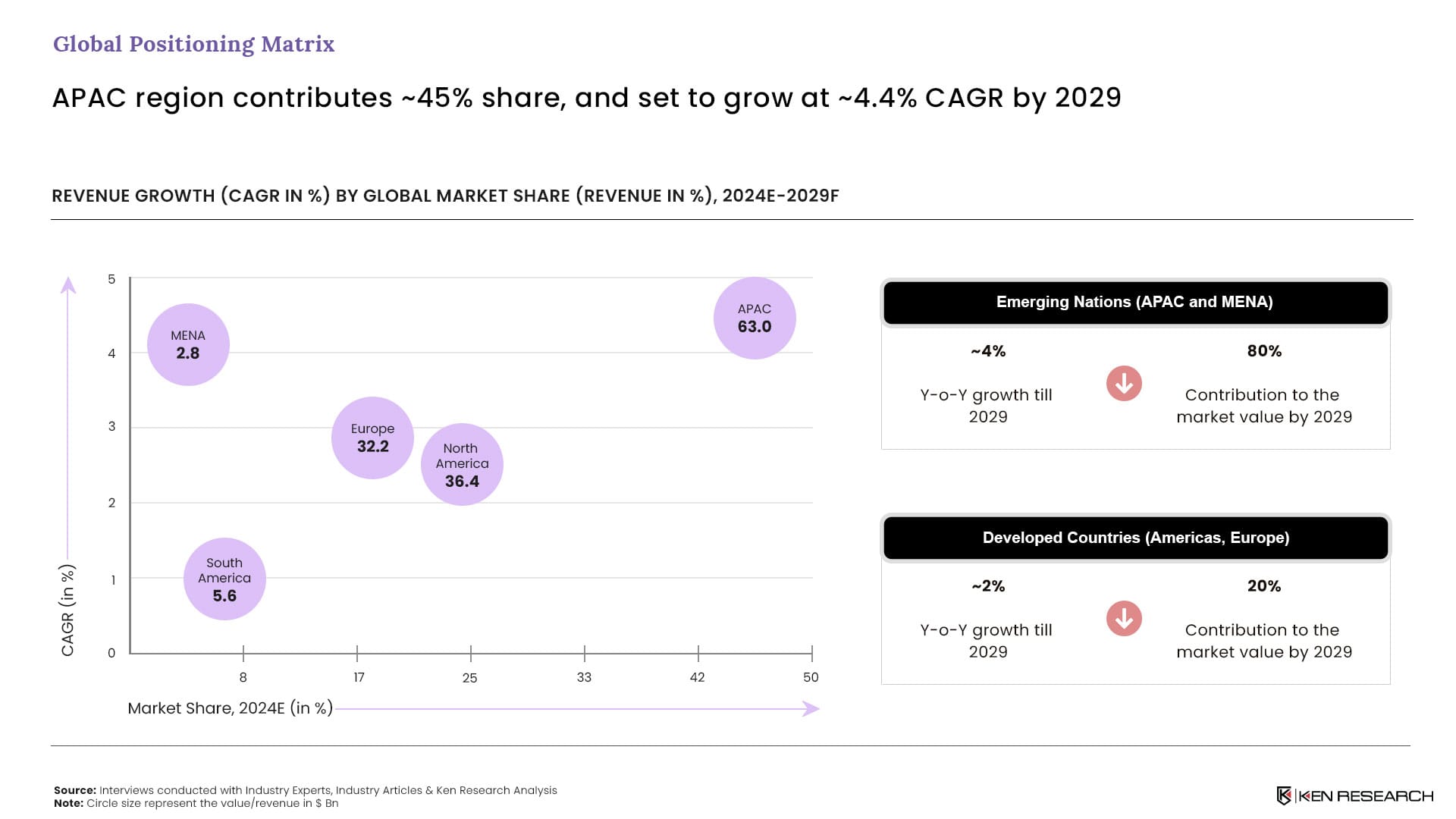

Globally, the sector is projected to grow by 3.5 percent by 2029, reaching a market share of $140Bn.

Over the past few years, the Southeast Asian lubricant market has exceeded all shareholder expectations, outperforming as a sector in not just in revenue but with its emerging market and aftermarkets. This growth is led by constant revenue expansion, increase in industrial activity and installing smart lubricating systems.

Globally, the sector is projected to grow by 3.5 percent by 2029, reaching a market share of $140Bn. This growth is expected to be driven by a range of factors:

- Demand for High-grade Lubricants: The increase in industrial activity results in a growth of output of 12%. This directs a need for high-grade lubricants with advanced formulations for enhanced performance and environmental sustainability.

- Diversifying into E-Fluids: There are expectations that EVs penetrate the market by 50% till 2030. It gives an opportunity to the lubricant players to capitalize on this by diversifying into e-fluids with the help of global leaders like Shell and Castrol, who already have a full range.

- Opportunity in First Fill Market: By 2025, the first fill market for e-fluids will account for more than 90% of the market. The parallel increase of EV production volumes will also add to the increasing opportunities in the service fill market accordingly.

- Integration of Smart Lubricant Systems: The increase in the integration of IoT will allow for real-time monitoring and maintenance. The continuous efforts in R&D will offer enhanced properties like thermal stability and resistance for extreme conditions.

Opportunities for Growth in Southeast Asian Markets

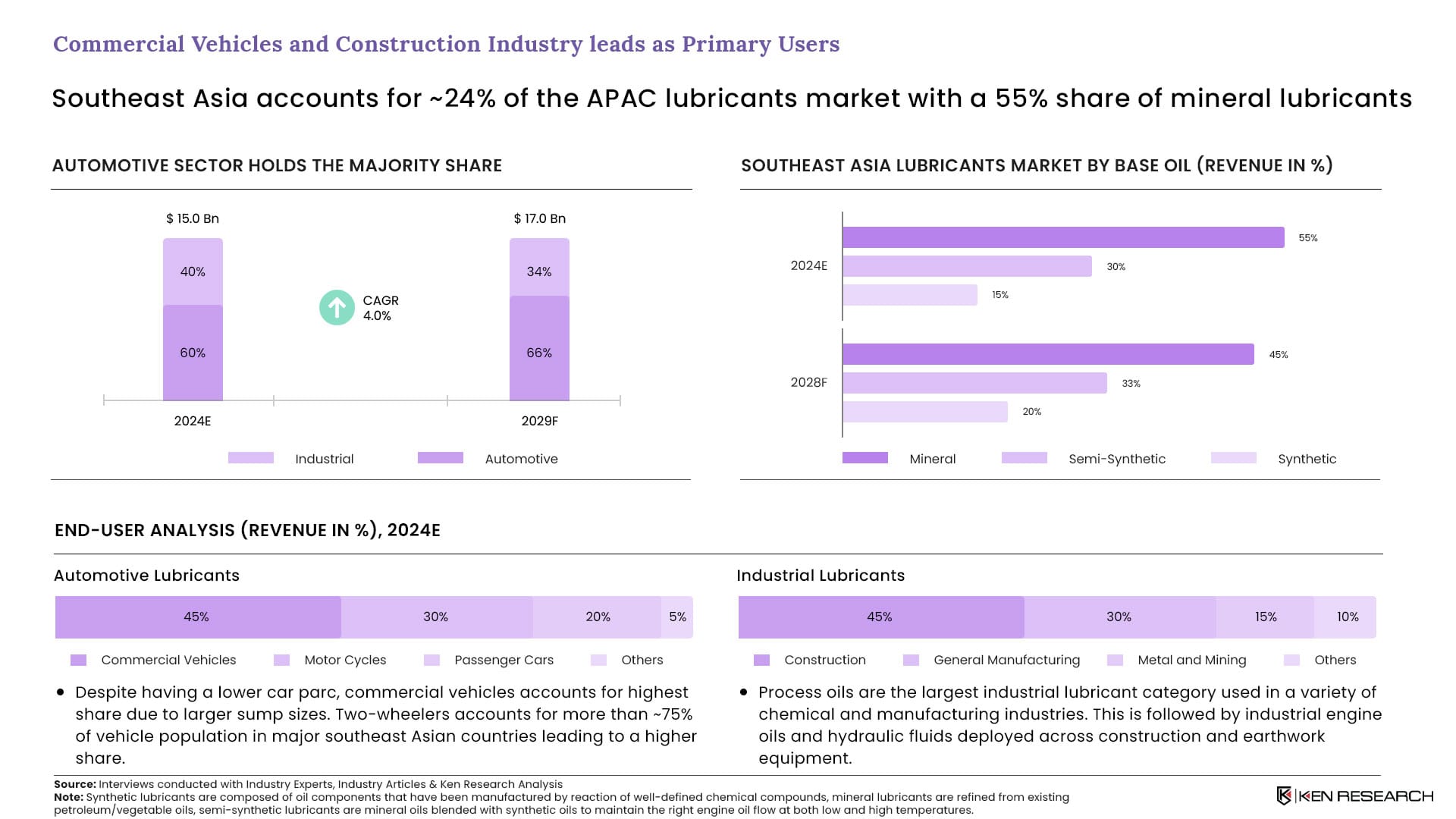

This sector accounts for 24% of the Asia Pacific lubricants Market with a 55% share of mineral lubricants. As this market is projected to grow further, there are several opportunities for substantial growth. But they come with its set of challenges.

Bio-based and Synthetic Lubricants: The growing consciousness and strict regulations for eco-friendly lubricants are driving its demand, where there is a first-mover advantage. This region also has ample resources for bio-based production such as palm oil and jatropha. But this process involves higher upfront costs and a stable supply chain remain a challenge.

Collaborations with OEMs and Equipment Manufacturers: Developing tailored lubricant solution and partnering with manufacturers to gain access to distribution channels will expand market reach. Although securing partnerships with major OEMs is highly competitive while marking sure the goals of both parties are aligned.

Heavy Duty Lubricants for Commercial Fleets: The trend towards fuel-efficient and technologically advanced commercial vehicles is increasing demand for specialized lubricants and presenting opportunities for aftermarket sales. But these heavy-duty lubricants markets have intense competition, price pressure and with increasing emission regulations needs regular product development.

Lubricants for the Automotive Market: There is an increase in the variety of vehicles creating demand of specialised lubricants. The expanding automotive aftermarket also offer potential for lubricants sales. But keeping up with the evolving engine technologies need continuous product development and catering to a wide customer range will be complex.

Winning Countries in the Southeast Asian Market

There are five countries – Indonesia, Thailand, Singapore, Vietnam and Malaysia that are set to offer the highest growth opportunities in the lubricants market.

Projections indicate a combined market size of $14Bn. The expanding industrial sectors and increasing vehicle ownership are the main reasons for growth in this sector. Indonesia, Thailand and Malaysia are the main players, with Indonesia having 30% of the market share because of the vast population and largest vehicle parc size of 150Mn units.

With Vietnam leading the market with a growth rate of 4.5%, overall, the region’s CAGR is expected to be around 4% from 2024-29 where there will be a shift towards high-quality synthetic lubricants influenced by government policies and initiatives.

The automative sector is the major driver of growth with a vehicle parc size of 250mn across regions. Indonesia is leading the market with 150mn vehicles, followed by Thailand and Malaysia with 45mn and 35mn. This will lead to more demand for regular maintenance lubricants, engine oils, transmission fluids and other automative lubricants.

Two-wheeler sales will also increase, especially in Indonesia, the second largest market for two-wheelers globally. With the help of government initiatives and increasing trends of affordable motorcycles, it will help in increase the international presence of original equipment manufacturers (OEMs) leading to the growth of high-quality lubricants.

Rising demand for wide range of lubricants for manufacturing, construction and agricultural activities. The presence of large-scale industries and the expansion of industrial infrastructure will create a demand for industrial lubricants. 90% of the lubricant demand in Singapore comes from the marine sector which will lead to higher demands for marine lubricants.

Malaysia on the other hand is the only country in the entire region where the passenger car demand exceeds the two-wheelers. This indicates a shift towards a more efficient and consumer friendly supply chain.

The Southeast Asian market is the new hub for imports and exports. Singapore’s trade activities are the highest with it importing around $54mn goods and exporting $55Bn. This trade balance showcases Singapore as the major transshipment and logistics hub, creating an easy flow of lubricants.

Indonesia has a substantial trade deficit as it is importing $23n and exporting only $3Bn. Thailand shows a thriving market, exporting $7.5Bn but importing only $4.5Bn, supporting and creating a new hub for the lubricant market.

Staying strong for the future

The global market is growing at a CAGR of 3.5% till 2029 as the demand for high-grade lubricants has increased to 12%. It is diversifying into e-fluids with market leaders and the increasing EV production is creating opportunities for service fill market. With continuous efforts in R&D for creating thermal stability and improving resistance for extreme conditions, this will add to the current revenue of $140Bn.

Economic expansion leading to industrialization will increase demand: The combined GDP of Southeast Asian market is expected to reach $5.7tn by 2029 with a growth rate of 7.2% reflecting the economic health and rising industrial activities creating a need for supply of high-quality lubricants. Manufacturing, mining and energy sectors will create demand for industrial lubricants as countries like Indonesia, Thailand and Vietnam continue their path of industrialization creating requirements for lubricants in machinery, equipment and manufacturing, creating a market for lubricant suppliers.

Rising vehicle ownership with a growing middle class: Despite the anticipated rise of EV penetration to be 1% by 2029, the demand for traditional automotive lubricants remains strong. The increase in number of vehicles on the road will drive the need for engine oils, transmission fluids and other automotive lubricants. Thailand and Indonesia have larger automotive manufacturing bases and expanding vehicle parc sizes, maintaining consistency is demand for lubricants.

The population of Southeast Asian countries will reach 712mn by 2029: This will increase the demand for passenger vehicles adding to the demand for automotive lubricants. Urbanisation in these countries will bring higher construction activities, driving demand for industrial lubricants used in construction and machinery equipment. Development of infrastructure, housing, transportation and networks due to the growing urban population will require lubricants for their construction and maintenance.

Construction industry will reach $727Bn by 2029: The construction industry will grow at a CAGR of 6.2% which is the major user of industrial lubricants, required for the operation of construction equipment and machinery. Indonesia and Vietnam will be the next important markets for industrial lubricants because they are experiencing urbanisation and infrastructure development. This will necessitate the demand the for high performance products that can stand the harsh conditions of construction environments.

Conclusion

Southeast Asian nations have the potential to become the consumption and manufacturing engine of the global lubricants market. It is seeing immense growth, is home to a rising middle class and requires comparatively lower capital and operating expenses.

However, there are several challenges that are coming in its way including supply chain disruptions, competitive pricing, strict emission norms and performance consistency. These enablers and obstacles have influenced the spectrum of lubricant subsegments falling in the consideration pool in terms of both market attractiveness and cost competitiveness.

Global lubricant companies interested in entering or scaling their businesses in Southeast Asia should think about what should be the right strategy to cater to this wide range of customer base while dealing with price competitiveness and increasing customer regulations?

Similarly, Southeast Asian companies need to think about how they compete with the global giants in the most cost-efficient way.