Southeast Asia: The New Market for the Chemicals Industry

The Southeast Asia’s (SEA) chemicals industry has been performing adequately, contributing to 3.4% of the overall GDP across majority of the southeast Asian countries.

The Southeast Asia’s (SEA) chemicals industry has been performing adequately, contributing to 3.4% of the overall GDP across majority of the southeast Asian countries. It shows potential to outperform demand growth and shareholder wealth creation in the coming decade. This region has a strong starting point making it the center for downstream chemical products.

With a combined GDP-PPP of $10.7tn and an average growth rate of 6% this region indicates strong and powerful economic activity. Together, the combined GDP growth is around 5-6% where goods worth $1900Bn were exported and $1800Bn were imported in 2022. This indicates a favorable balance of payments as there is a trade surplus indicating the positively for SEA;s performance on capital and financial accounts.

While the overall trade balance in the region is substantial, there are high values of imports and exports with Singapore standing out in both, hence attracting the highest foreign direct investment of $141bn. But most importantly, the chemical sector’s rising imports contributes significantly to the GDP of Philippines and Malaysia, showing its importance in their economies.

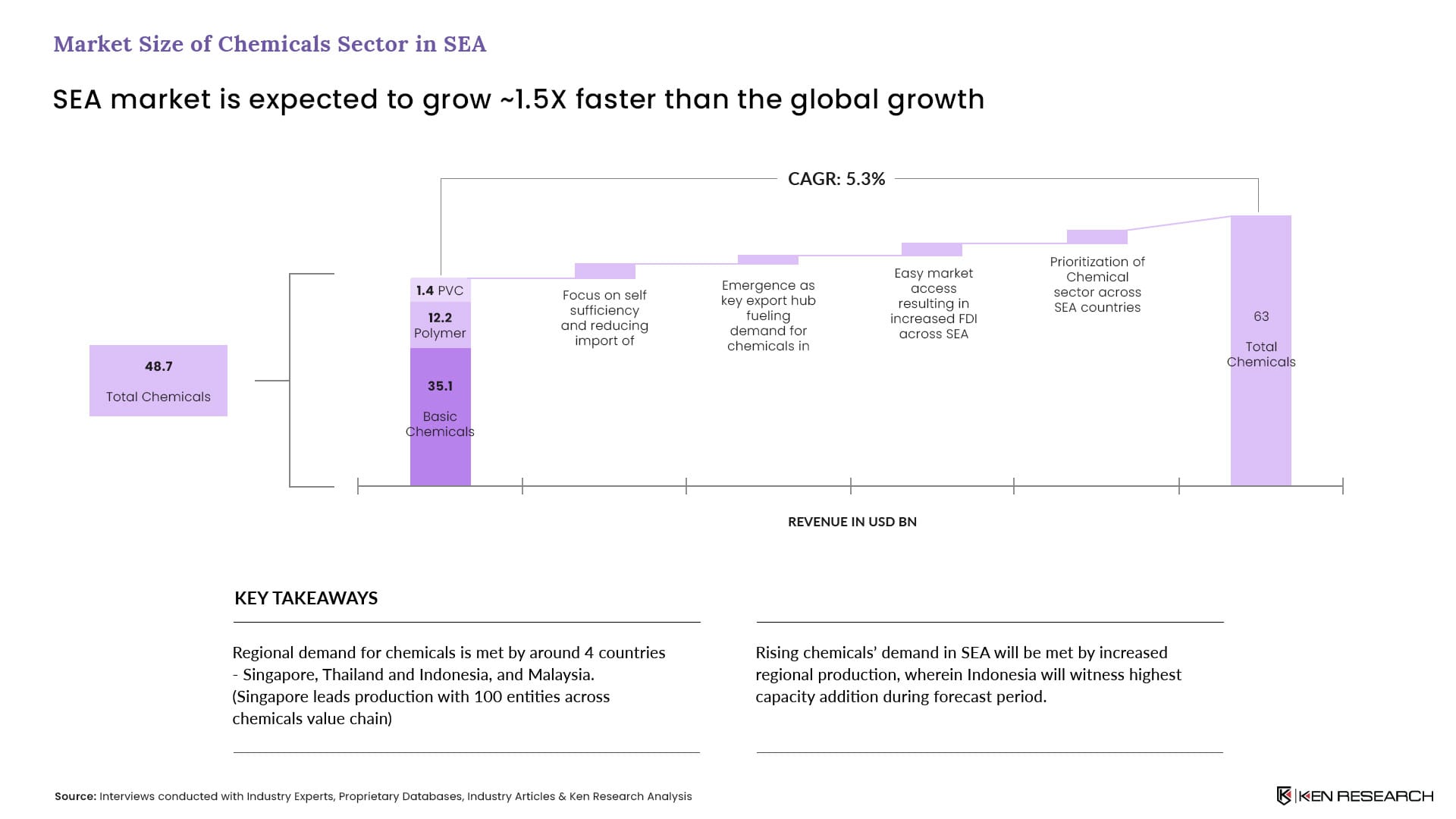

The total revenue of the SEA in 2023 was $48.7Bn where polymer and PVC stood out generating $12.2Bn and $1.4Bn respectively. The SEA chemicals market which is expected to grow at a CAGR of 5.3%, is driven by a range of factors:

Reducing overall import of chemicals and focusing on self-sufficiency: The countries in SEA are focusing on self-sufficiency and decreasing their reliance on imports, initiating demand for local production and driving demand in the chemicals sector. Increase in domestic production leads to higher employment and this shift towards self-sufficiency in trade, reduces the outflow in foreign currency, increasing national income.

Rise as Key Export Hub: This region is converting into a hub for major exports which is in turn increasing demand for chemicals especially in the industrial sector, later giving rise to the expansion of this sector. This not only strengthens the economy by improving balance of payments but also drives growth in logistics, manufacturing and infrastructure. The expansion of the chemical sector has also led to the increase in industrial activity, job creation and advancements in the technology.

Ease of Access in the Market: Improvements in access to markets are leading to an increase in the foreign direct investments across the region. This inflow of investments is supporting the development and growth of the chemical industry. The FDI often leads to the establishments of new industries, expansion of existing ones, and creation of high-value jobs. This inflow of capital also stimulates economic activities in construction, services, and other supporting sectors, further driving GDP growth.

Governments and policymakers prioritizing growth: The focus in this region is to provide support and create a favorable environment and conditions for the growth and development of the chemicals sector which includes regulatory support, incentives and infrastructural development. These measures lower the cost of doing business, attract more investments, and lead to the growth of domestic industries. As the chemical sector grows, it generates a multiplier effect, boosting other sectors such as agriculture, manufacturing, and pharmaceuticals, thereby contributing to overall GDP growth.

Challenges, Scenarios and Impacts

- Inadequacy in Production Capacity: All countries in SEA are importers of chemicals except for Singapore and Malaysia. In 2022, organic chemicals and chemical products were 9th and 10th top imported commodities in the SEA at $38Bn and $30Bn respectively. This impacted as the higher bills caused balance of payments challenges with 2.6% regionally in 2023 and causing risk for supply chain disruptions.

- Gaps in Infrastructure: Indonesia, the largest importer of chemicals lacks in infrastructure so to add more value to its chemicals sector. Philippines on the other hand has low-capacity utilization, an outdated storage and port facilities. Thailand lacks domestic technologies to scale its production. This impacts the market as there are difficulties in scaling to high value-added chemical products and inefficiencies rendering local production leading to higher costs and delays in production processes.

- Strict Rules and Regulations: There remains compliance with safety standards and regulations handling hazardous materials, transportation and storage adding extra burden to it. The impact of this will be that solutions that obey the rules and regulations add on to gradual costs and these can also be of substantial financial and operational burden.

Increase in Demand for Chemical-Derived Products

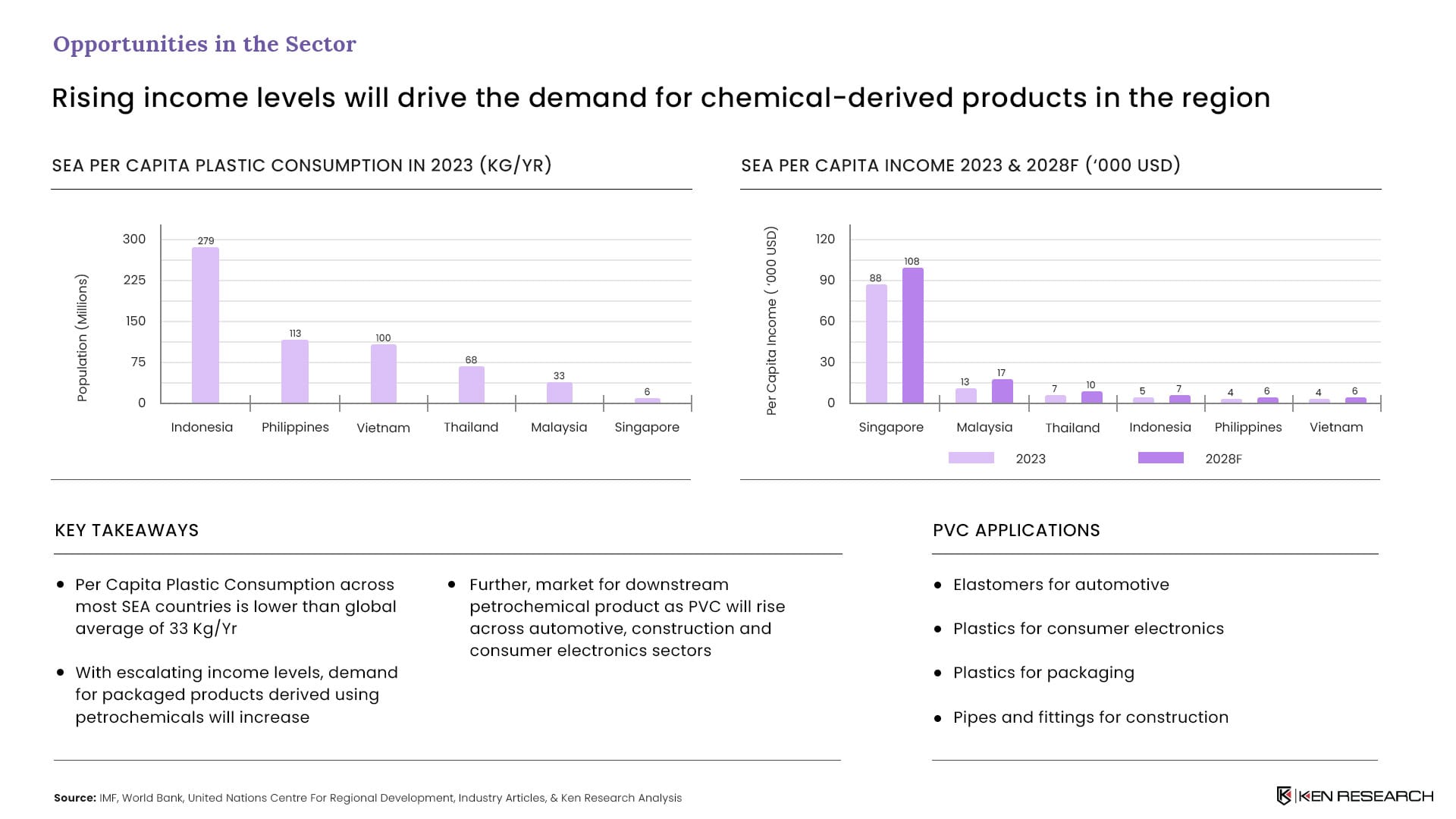

Per Capita Plastic Consumption: The consumption across most SEA countries is lower than the global average of 33kg/yr, indicating a potential for growth in the use and demand for plastics as economies develop and there is a rise in income levels.

Demand for Packaged Goods: With the rise in income levels, the demand for packaged products from petrochemicals will increase. Higher incomes also mean the need for goods that call for packaging, driving the requirement of more petrochemical products.

Need for Market of Downstream Petrochemical Products: Downstream petrochemical products like polyvinyl chloride (PVC) used in automotive for manufacturing elastomers, manufacturing of consumer electronics like durable and safe electronics, pipes and fittings and packaging products are expected to increase activity due to economic growth.

Initiatives for Meeting Escalating Demand

Indonesia: Initiatives like 100% income tax waiver for a period of 5 to 10 years to encourage investments in the chemical sector and a further deduction of 50% on income tax for the next two years following the initial waiver period to continue incentivizing investments.

Singapore: The government aims to increase the country’s output of sustainable products in the energy and chemicals sector by four times from 2019 levels. It also wishes to achieve more than 6Mn tons of carbon abatement by 2050, highlighting a commitment to environmental sustainability.

Thailand: This country plans on creating an eastern economic corridor that includes 15-year corporate tax waivers and non-tax benefits to attract foreign direct investment (FDI) in the chemical sector.

Malaysia: An initiative called Chemical Industry Roadmap 2030 aims to increase the revenue generated from chemicals from approximately $18Bn to around $27Bn by 2030, focusing on long-term growth and development.

Vietnam: The Chemical Sector Vision for 2040 plans on growing the chemical industry at a CAGR of 8% while maintaining the chemical industry’s share of 5% in the industrial sectors by 2030 and continue this until 2040 making sure that the sector remains important in the national economy.

Philippines: It aims to transition the country from being an importer to a net exporter of chemical products by 2030, setting a clear strategic direction for the industry’s growth.

Way Forward – 2028

Profitable Market Potential of $63bn: The future market size of the chemical industry is expected to reach $63Bn by 2029 in SEA is indicating significant growth potential and investment opportunities in the sector.

Increase in GDP Contribution by 5%: By 2028, the chemical sector is expected to contribute more than 5% to the nominal GDP of SEA, indicating the sector's increasing importance and its role in driving economic growth in the region.

Opportunity of $2Bn in PVC Segment: This market’s growth particularly in the PVC segment shows the opportunities that are present within the specific segments of the chemical industry while focusing on the targeted investments and growth.

Facilitating Growth of 25,000 Enterprises: The aim is to grow and develop 25,000 enterprises by 2028, expanding the industry while strengthening the industry and entrepreneurial activities and establishing new businesses.

Expanding Sectoral Employment to 6,30,000: This sector plans to employ 6,30,000 employees by 2028 reflecting expansion and the ability of this industry to create job opportunities and contribute to socio-economic development in the region.

Implications and questions for the Southeast Asian industries to ponder on

The Southeast Asian chemicals market is growing into the new hub for trading and manufacturing. But there remain several challenges including gaps in infrastructure, inadequacy in the production capacity and strict rules and regulations. Even with these, this market continues to grow.

This feels like the right time to invest in this growing for global as well as local chemical companies to gain majorly from it. What type of market entry is the best mode to play the long game in this sector?