Singapore’s Path in the growing Cold Chain trajectory

Singapore's cold chain sector has surpassed all stakeholder expectations, outperforming all other sectors and segments with merchandise trade of $ 991.4 Bn.

Singapore’s Cold Chain industry has been a global outperformer in demand growth and stakeholder wealth creation for a decade. Cold storage in Singapore is an essential backbone for pushing the trade economy.

In recent years, Singapore's cold chain sector has surpassed all stakeholder expectations, outperforming all other sectors and segments with merchandise trade of $ 991.4 Bn. Its exceptional performance has solidified its global position as a leading trade hub with commercial services trade of $ 549.3 Bn. The country's thriving food and pharmaceutical industries are heavily dependent on advanced cold storage solutions.

The sector exhibits potential to grow from $320 Million in 2023 to $460 Million by decoding and utilizing untapped opportunities, growing by 1.5x of momentum. This growth will be driven by a range of factors:

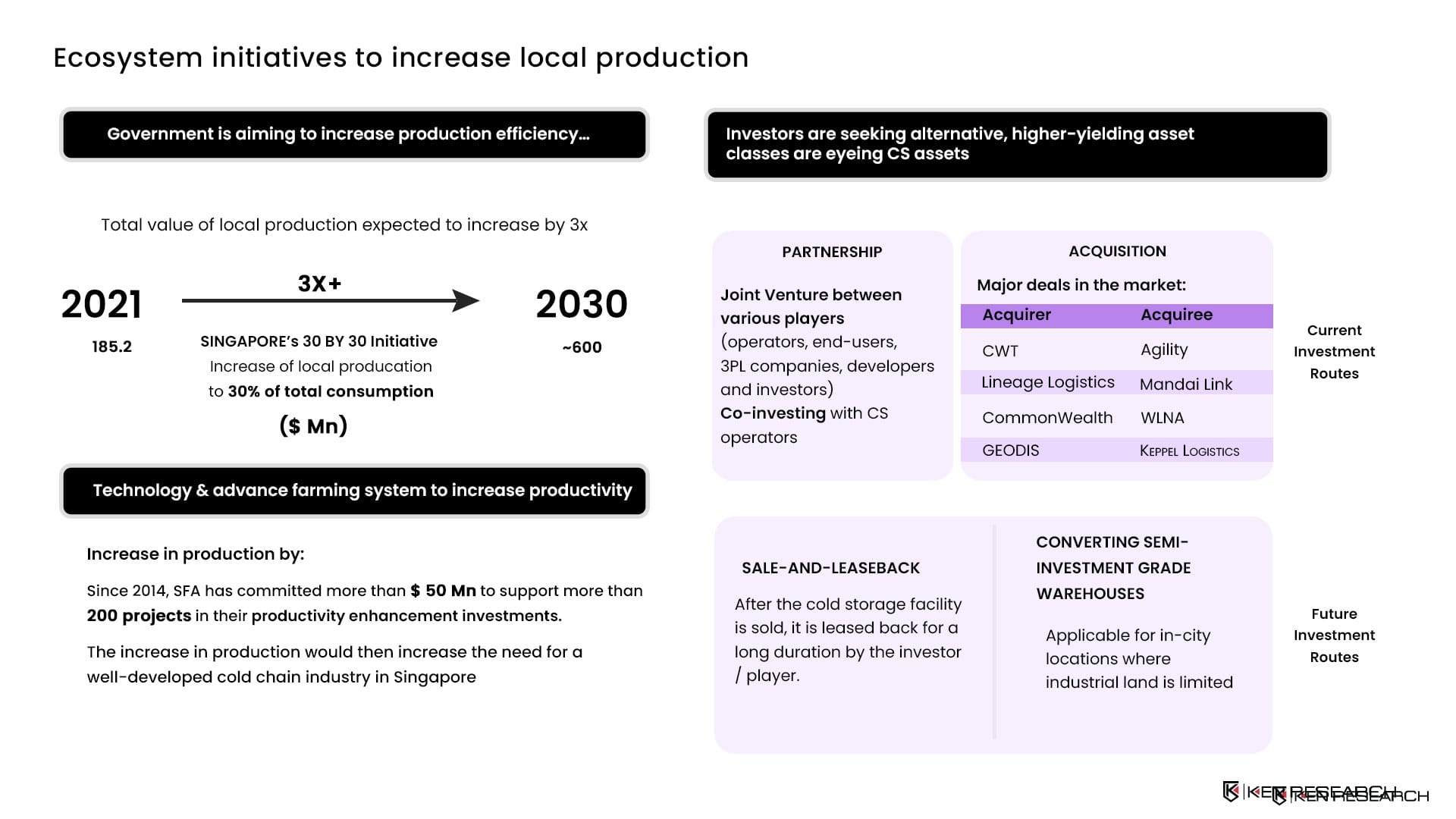

- Singapore’s 30 BY 30 Initiative: Singapore's "30 by 30" initiative, which aims to boost local production to 30% of total consumption of $600 Mn by 2030 from $185 Mn in 2021. Singapore not only seeks to secure its food future but also sets an example for other urban centers facing similar challenges globally.

- Increasing Meat Consumption by $500 million: The rising meat consumption, coupled with a growing Muslim population in Singapore, has led to a significant increase in spending on Halal dining, totaling $500 million. Additionally, with each person in Singapore consuming approximately 390 eggs, 176 kg of fruits and vegetables, 22 kg of seafood, and 62 kg of meat, the demand for cold storage and transport solutions is on the rise.

- Entry of New Players and Expansion to support more than 200 projects: Since 2014, SFA has committed more than $ 50 Mn to support more than 200 projects in their productivity enhancement investments. The entry of new players and expansion efforts by existing industry leaders like YCH and Commonwealth Kobubu by Joint Venture between various players (operators, end-users, 3PL companies, developers and investors), Co-investing with CS operators are further contributing to the market's growth, creating opportunities for innovation and service expansion.

An analysis of Singapore’s competitiveness

- Value Chain: Singapore is self-sufficient in Cold Chain but lags in Value Chain Gaps. Singapore is considered as the major force of push to the city state’s trade economy with $ 1.81 Mn tons of transit in terms of exports. But cold storage and transportation value chain in Singapore exhibits supply gap of 70-75% since more than 80% of cold storages do not have pack houses, ripening chambers, and reefer freight currently.

- Food & Pharma: Singapore exhibits efficiency in Cold chain but lags in management of Imports. Singapore being the major driving force of development for the city-state also manages 90% of imports and 10% of local produce for the trade economy to develop. On the contrary, with 90% of food imports. Singapore's thriving F&B and healthcare industries heavily rely on cold storage solutions for preserving freshness and efficacy.

Food Loss & Considerable Lag in Cold Chain Infrastructure

Singapore is facing noticeable glitches and problems in the cold chain as tons of fruits and vegetables (167,000 tons); fish and seafood (25,000 tons); and eggs (5,500 tons) get lost within the chain and the numbers are critical and crucial. This concern is highlighted with big numbers and quantity of lost food which is significant to the sector’s functioning and growth.

Current efforts in Singapore are predominantly directed towards creating cold storage facilities, with an emphasis on supporting local production through pack houses and ripening chambers, indicating a shift towards self-sustainability in food production.

The city-state boasts an impressive fleet of over 6,000 reefer vans primarily used for transporting frozen goods and pharmaceuticals, indicating untapped opportunities in this sector.

Benchmarking Singapore’s Cold Chain Competitiveness

While it is clear that Singapore’s Cold Chain sector is geared up for massive growth, its cold chain competitiveness is uncertain. Benchmarking the sector against five global Cold Chain clusters—India, China, Vietnam, Philippines, and Indonesia—across several variables. India's cold chain market is expanding rapidly due to a larger agricultural base and lower labor costs, while China's market is one of the largest globally, benefiting from urbanization and significant investments in IoT and AI technologies. Vietnam's cold chain sector is emerging with a projected CAGR of over 20%, driven by infrastructure investments and lower operational costs. The Philippines faces challenges like inadequate infrastructure but has growth potential due to rising demand from its middle class. Indonesia's market is growing due to its large population, with government investments aimed at improving infrastructure, despite logistical challenges posed by its geography.

Potential winning opportunities in Singapore’s Cold Chain

Despite Singapore's leading position in the Asia-Pacific cold chain market, there's significant growth potential of $460 Million Opportunity as it's yet to reach maturity like other developed countries. Singapore ranks 4th in Per Capita Cold Storage Capacity, indicating opportunities for expansion.

Cold Storage Facilities to reach $340 Mn: There is a compelling opportunity for investment in specialized cold-storage facilities which is expected to reach from $240 Mn in 2023 to $340 Mn in 2028. The demand for these facilities is anticipated to surge, particularly for multi-temperature-controlled environments.

Technological Advancements focusing on lucrative opportunities: The adoption of new technologies such as warehouse management systems (WMS), automation, and the Internet of Things (IoT) is likely to enhance operational efficiencies within the cold chain sector. Investors focusing on technology integration may find lucrative opportunities in this area.

Implications for Singapore and global companies to reflect on

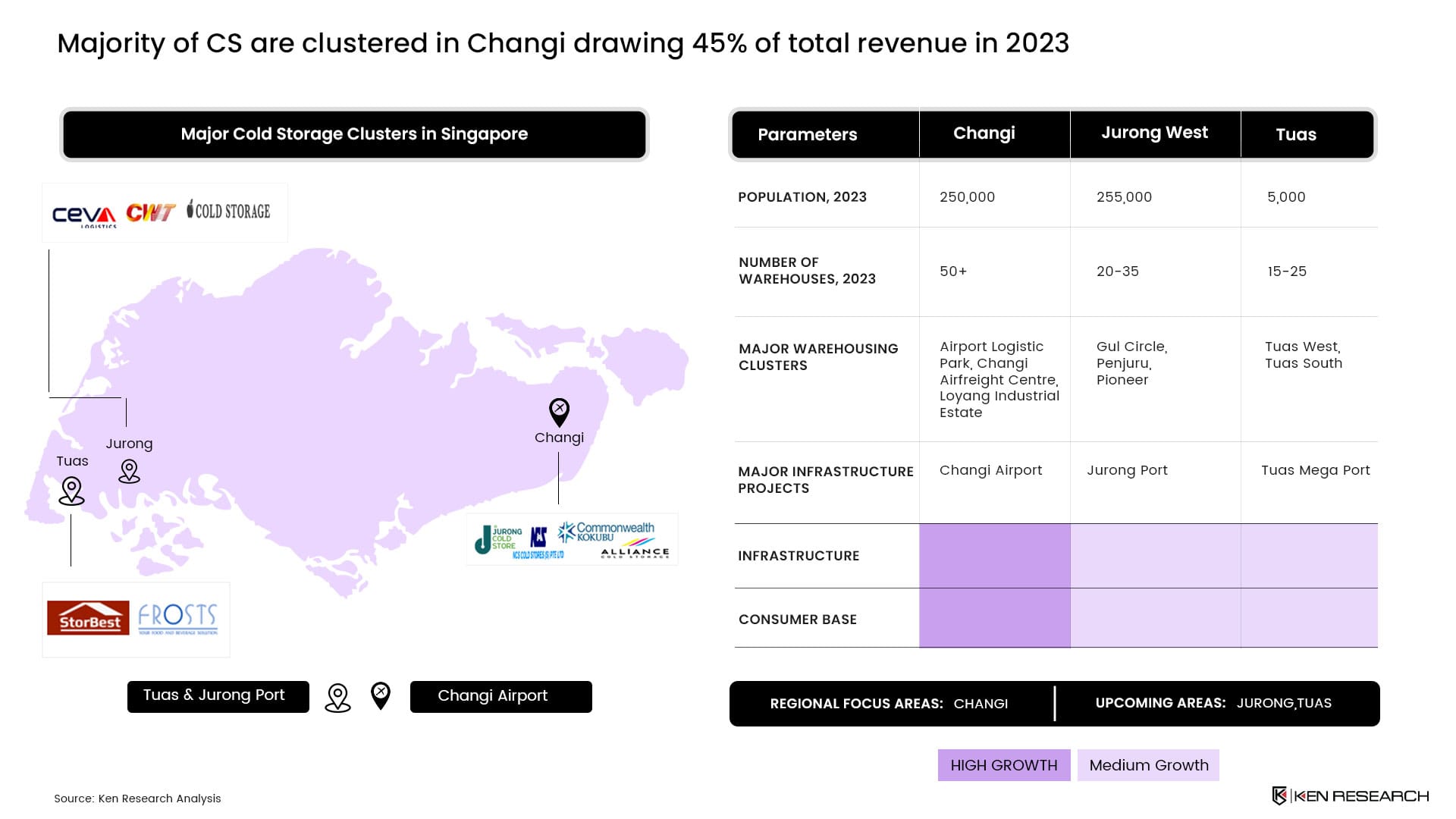

Changi accounts for over 45% of Singapore's cold storage revenue, leveraging its strategic position as the host of the world's busiest airport and seaport, making it a primary cold storage hub. The real estate sector for cold chain facilities is promising, yet it faces challenges such as stringent regulations and limited land availability, which may drive up rental prices for existing spaces.

Questions to be addressed

Global cold chain companies interested in entering or scaling up their businesses in Singapore should, however, strategically ponder upon several questions, such as: What is the current market size and growth potential? What are the key drivers of growth in the market? Who are the primary end users and what are their needs? What are the regulatory requirements for cold chain operations?

Similarly, Singapore Cold Chain Companies need to reflect upon numerous questions, such as: What are the implications of local laws on operational practices? Who are the key players and what is the competitive landscape? What regulatory standards must be met? How can we leverage trends in consumer behavior?