SEA’s Buildout to Agri-advancement

Agriculture powers nearly 40% of Southeast Asia’s GDP, with countries like Indonesia, Thailand, the Philippines, and Vietnam leading the charge. This sector's growth is crucial to driving economic advancement and ensuring food security across the region.

Southeast Asian Countries have been a global outperformer in agri-equipment growth and agricultural wealth creation recently. This strong starting point shows great potential to make them the next crop production hub with mechanization.

Agriculture contributes approximately 40% to the GDP of Southeast Asian countries, notably impacting economies like Indonesia, Thailand, the Philippines, and Vietnam. Regarding employment, Indonesia has 139 million workers in agriculture, followed by Vietnam with 52 million, while the Philippines and Thailand also contribute essential numbers. This sector is essential for driving economic growth and providing regional employment.

Projections suggest that the sector will see a compound annual growth rate (CAGR) ranging from 3.0% to 3.5% over the next decade, particularly in countries like Vietnam and Thailand, which are major agricultural exporters. The Parameters helping Vietnam and the other four countries are:

- Rising Exports by 2 million: As the third-largest exporter of cassava, Vietnam aims for export revenues of $2 billion by 2030, targeting a fresh cassava output of 11.5 to 12.5 million tons. Indonesia, the largest producer of paddy and maize, is also expected to grow at 6%, supported by investments in technology and sustainable practices. Meanwhile, Thailand, the leading cassava producer, is projected to grow at 4%, focusing on improving processing techniques and expanding export markets.

- Mechanization Scale of 1.68 HP/ha: Indonesia's agricultural mechanization level has steadily increased from 1.173 HP/ha in 1968 to 1.68 HP/ha, exhibiting the maximum acceptance of new technology in the region. This growth is driven by the rising global demand for large mechanized machinery, such as tractors, harvesters, and threshers, which are expected to enhance farming and storage efficiency. While Vietnam follows closely with ongoing efforts to improve mechanization, Thailand maintains the highest mechanization level in Southeast Asia.

- Increased Remuneration to $ 10,000: Thailand currently leads Southeast Asian countries in average farmer income, with data showing an average of $10,000 per farmer. Looking ahead, this figure is expected to rise further as Thailand continues to invest in agricultural mechanization and diversification. The Philippines follows with an average income of $3,600 per farmer, while Indonesia and Vietnam stand at $3,000 and $2,700 respectively.

An analysis of South-East Asian Countries competitiveness

This section analyzes competitiveness of South-East Asian Countries in agriculture across four categories— Economy, Human Resources, Technology, and Trade Capability.

Economy: South-East Asia is moving forward with integration of digital technology but high initial cost pose barriers to enter for small farmers. Southeast Asia's young, tech-savvy population and growing digital economy create a solid foundation for digital agriculture adoption. By 2025, the digital agriculture market in Southeast Asia is projected to grow to $10 billion, driven by increasing demand for efficiency and sustainability in farming practices. By taking proactive steps, the region can potentially outpace others in this domain, attracting foreign investments primarily in Indonesia, followed by Vietnam, Thailand, and the Philippines.

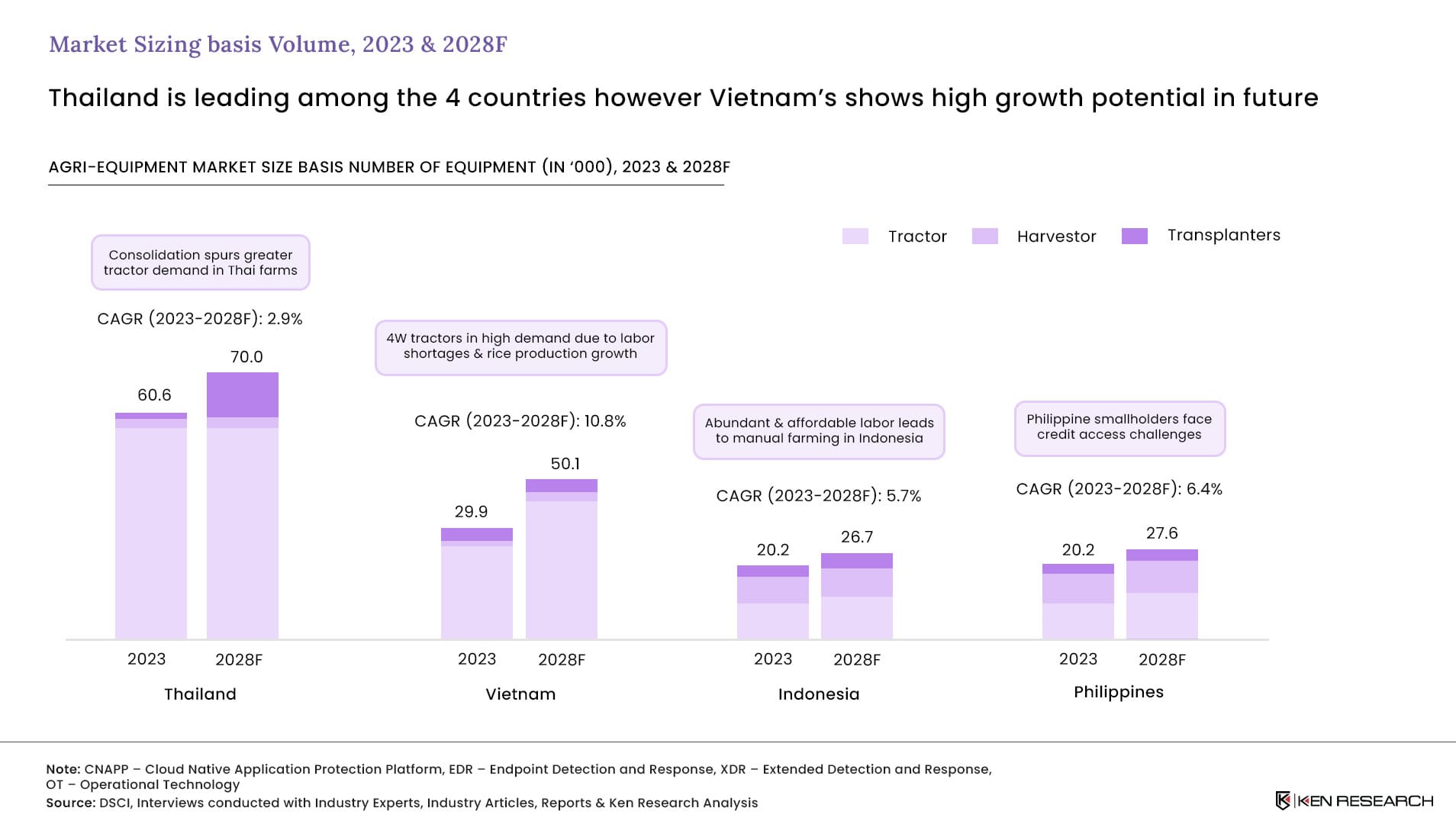

Human Resources and Technology: Southeast Asia exhibits scope of mechanized view in Primary sector but is facing labor shortages in agriculture due to rural-to-urban migration, particularly among the youth. Southeast Asia's agriculture sector faces challenges such as a lack of wage employment, informality, and seasonal labor, hindering worker organization. The region shows significant potential for mechanization, with Vietnam's demand for 4W tractors expected to grow at a CAGR of 10.8% by 2028, followed by the Philippines at 6.4%, Indonesia at 5.7%, and Thailand at 2.9%.

Trade Capability: Southeast Asian countries are significant exporters of agricultural products, but they rely heavily on imported agricultural equipment. Rice is a major export for Southeast Asia, with four countries among the top ten global exporters. The region supplies over 40% of the EU's rice imports and also exports significant volumes of palm oil, coffee, and wooden products. Meanwhile, the agricultural machinery market is dominated by John Deere, Kubota, and CNH Industrial, which together control more than 70% of sales in the region.

Widening trade deficit

Thailand experienced a record-high trade deficit of $36 billion with China in 2023, driven by a substantial imbalance in bilateral trade. Thailand imported $105 billion worth of goods from China, while its exports to China amounted to only $69 billion. This deficit is largely attributed to Thailand's reliance on Chinese imports of a diverse range of products, such as electronics, machinery, and chemicals, while Thailand's exports to China are primarily focused on agricultural commodities, including rubber, rice, and seafood.

Out of the three main segments of the sector—products, application and region—Product segment including Seedling, Planting, & Irrigation equipment is will grow significantly in the coming years. This indicates strong growth potential for this segment.

This report also notes that "Indonesia, Thailand, and Vietnam are also expected to be major markets for agriculture equipment due to the high adoption of advanced farming practices in these countries". The Vietnam agricultural machinery market analysis specifically highlights that "the increasing demand for low power under limited arable land, precision, handling, and efficiency has shaped the development of the modern planter tractor, and it continues to drive the development of these tractors". This points to rising demand for planting and seeding equipment in Vietnam.

Benchmarking Agri-Equipment Market in South-East Asian Countries

While the agricultural sector in Southeast Asia is poised for significant growth, its willingness to embrace new technology remains uncertain. Benchmarking the sector against six global Agri Equipment clusters— United States, China, India, Germany, Brazil, and Japan. The South-East Asia agricultural equipment market is characterized by a moderately competitive scenario due to the presence of many large and small global, regional, and local players. South East Asia agriculture equipment market is growing and attracting investment, it still faces competition from established players in U.S., Europe, and Japan. The market is characterized by the presence of large global players, making it challenging for smaller regional and local players to compete effectively.

Potential winning opportunities in Agri-Equipment Market in South-East Asian Countries

The Agri-Equipment Market in South-East Asia offers key opportunities in mechanization and automation, precision farming, government support, digitalization, and sustainability. Mechanization improves productivity and efficiency, especially in Indonesia. Precision farming techniques maximize yields and manage resources effectively. Governments support the agricultural machinery market, like Vietnam assisting farmers in acquiring equipments.

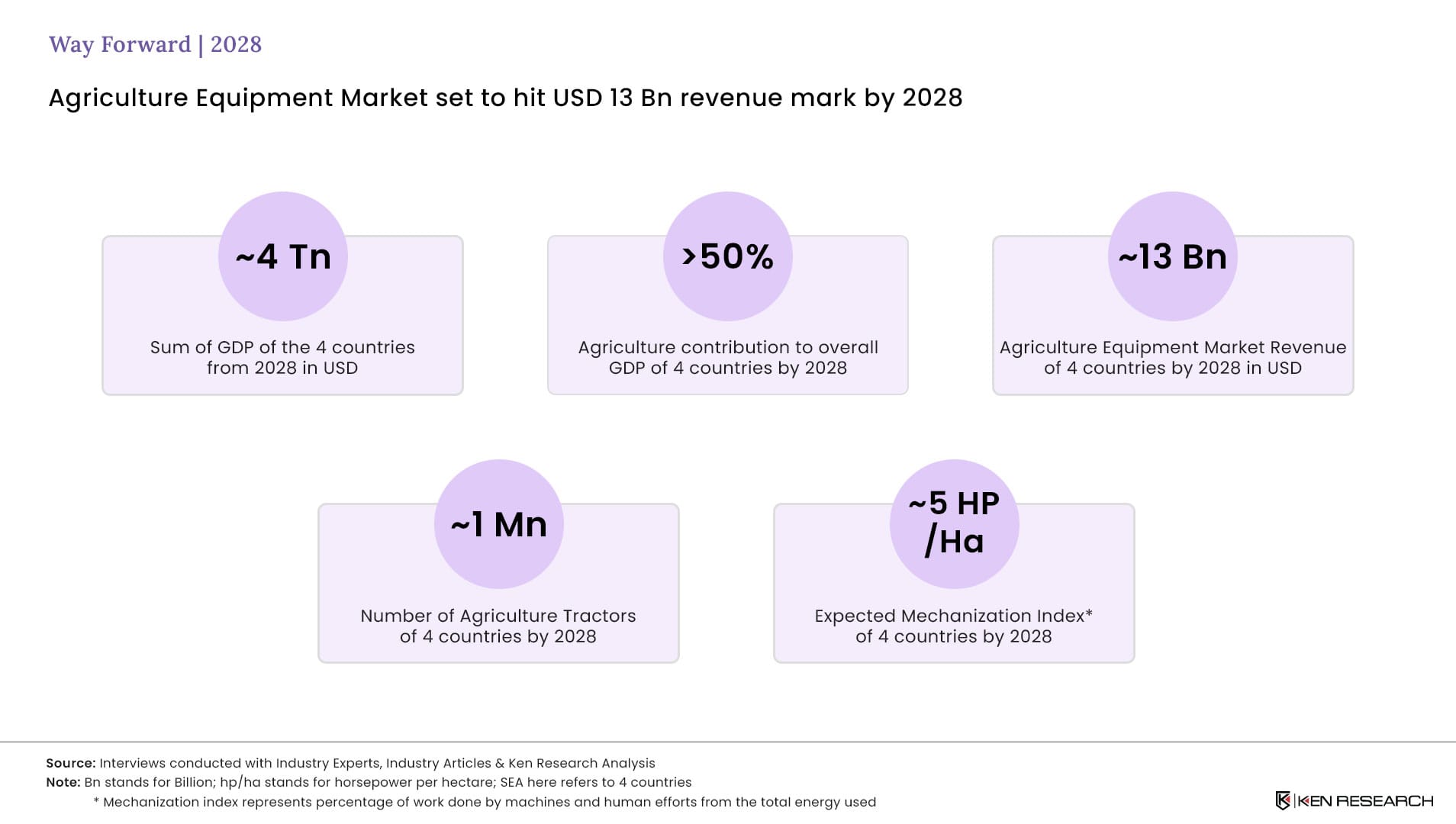

Digital Rental to reach 5 HP/ha: The digital rental market in Southeast Asia offers untapped collaboration opportunities with contractors, fostering innovation and growth in the agricultural sector. Looking ahead, digitalization and mechanization will advance together, with the Expected Mechanization Index for four countries projected to reach 5 HP/Ha by 2028, supported by an increase in the total number of tractors to 1 million.

Variants and upskilling by Kubota: Kubota could leverage the Agri Robo KVT's advanced autonomous capabilities to offer innovative rental, leasing, and lease-to-own products in the Thai market. By introducing new variants of the Agri Robo KVT and upskilling local technicians, Kubota can further enhance the appeal and accessibility of its autonomous tractor technology in the Thai market.

Advancements and Automation by AGCO: AGCO's precision farming platform, Fuse, and its new PTx brand are well-positioned to meet Vietnam's demand for advanced farming technologies. Vietnam aims for 70% mechanization in crop cultivation and up to 95% in aquaculture and fisheries by 2030.

Implications for SEA and global companies to reflect on

Southeast Asian countries have significant potential in the agricultural equipment market due to factors such as large agricultural sectors with 4 Tn sum of GDP of four countries, increasing mechanization with 1 Mn tractors to be used by SEA by 2028, government support, and growing demand for advanced farming practices. Manufacturers and suppliers have opportunities to expand their presence in these markets.

Vietnam is a promising market for agricultural machinery and equipment manufacturers. It is known for widespread tractor use among Southeast Asian countries. Philippines is a growing market driven by advanced cultivation techniques and technologically advanced equipment. Indonesia's seedling, planting, and irrigation equipment market is expected to grow significantly. Thailand is shifting from rice transplanters to combine harvesters due to global demand for crops like corn and wheat.

Big Questions to be addressed

Global Agri equipment companies interested in entering or scaling up their businesses in Southeast Asia should, however, strategically ponder upon several questions, such as: What is the key opportunity area to focus on? Can we establish a market monopoly? To what product differentiation we should cater? Will the farmers be able to afford our machinery? Who are the existing players in the market?

Similarly, Domestic Agri equipment companies need to reflect upon numerous questions, such as: What type of business is suitable to enter and what is the best mode of entry? Where does the business stand across the feasibility variables (technical, economic, and social) to enter a subsegment? Can we leverage the existing supply chain, if possible?