Which Gym Types are Most Popular in the KSA Fitness Industry?

Discover how Saudi Arabia's fitness industry is evolving with boutique gyms, hybrid fitness centers, and women-only facilities. Gym memberships are surging, growing at a CAGR of 16.8% from 2020-2023, driving demand for smart fitness solutions.

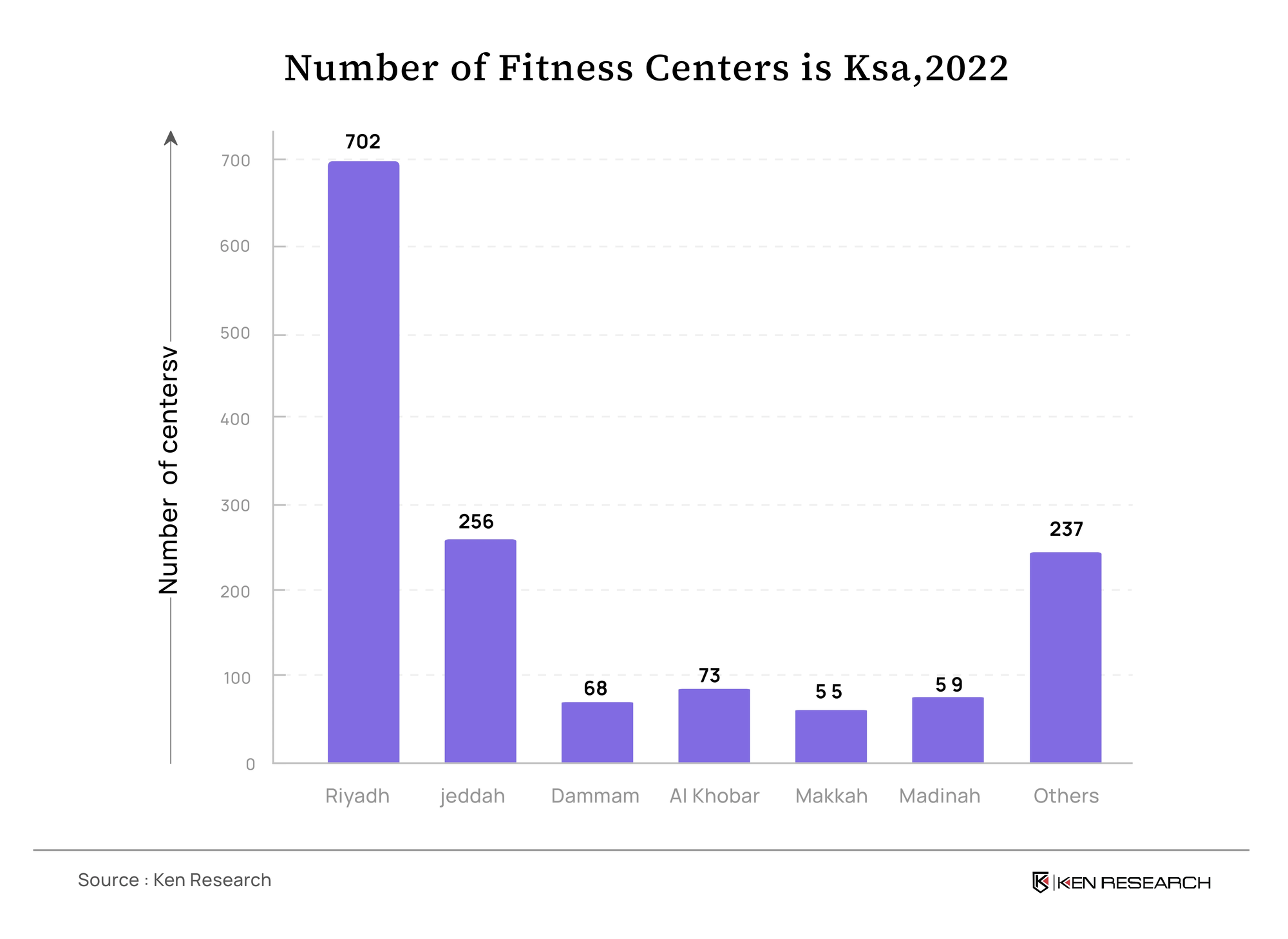

In recent years, the fitness Industry in Saudi Arabia has brought a revolution with tech advancements and facility modernisation owing to increased obesity cases and health-related concerns rising among the population. It has further created more demand for personalised training, and memberships with fitness centers have reached 1440 and 2230 in 2022 and 2027, respectively.

The country is experiencing an increase in gym user penetration, growing at a CAGR of 16.8% from 2020 to 2023—the fastest rate globally. The fitness industry is booming, and with it, a new wave of specialised fitness centres is emerging. Boutique studios, hybrid gyms, and woman-centric facilities are rapidly gaining traction as consumers seek more tailored and engaging workout experiences.

Evolution of Fitness Centers

- Boutique fitness centres are making an impact by being specialised in workouts like CrossFit, HIIT, functional training, and Pilates. They offer a personalised experience and cultivate a community-driven environment.

- In 2022, the virtual fitness market in Saudi Arabia generated revenue of USD 105 million and is projected to reach USD 530 million by 2030. Additionally, hybrid gyms come into the picture to integrate smart fitness equipment, virtual coaching, online booking systems, and on-demand workout classes.

- Further, the emergence of women-only fitness centres has changed the entire scenario of the Saudi fitness industry. Leading brands such as NuYu and Lava Fitness are at the forefront, providing inclusive environments that empower women through fitness.

Boutique Gyms- Most Preferred Type

- Boutique gyms are gaining momentum, rising demand for personalised experiences, specialised workouts, and a strong sense of community are the reasons why they are getting popular.

- These gyms are known for unique, tailored workouts that differentiate themselves from traditional gyms. In 2018, NuYu Fitness invested USD 67 million to open more than 20 new boutique gyms in the kingdom. Moreover, the growth of personal training studios, boutique fitness centres, and innovative gym models will drive the rapid expansion of the commercial gym industry.

Hybrid Gyms- Need of the Hour

- In the past 12 months, 56% of people in Saudi Arabia did not hold a gym membership, indicating significant untapped potential for hybrid gyms in the country.

- As the fitness landscape evolves, smart fitness equipment, advanced cardio machines, and innovative strength training apparatus are essential tools that can enhance member experience and operational efficiency. By integrating these technologies, hybrid gyms can attract new users who are currently not engaged in gym memberships.

- It even extends to mobile applications, online booking systems, and virtual training platforms, creating an integrated fitness ecosystem for tech-savvy consumers.

Women-Centric Fitness Centers- Completely Untapped

- The female market has been historically underserved, with female-only gyms often priced higher than male-only equivalents. In KSA, Female participation in sports has increased significantly, nearly 150% since 2015, according to the Saudi Ministry of Sports.

- Despite this, the female fitness segment in Saudi Arabia is considered entirely untapped, with a low penetration rate, but the revenue per member globally can rise to higher bars. Indicating a ripe opportunity for innovative and fairly-priced fitness solutions tailored to women's needs and preferences in the Kingdom.

What is the Future of Fitness Services in the Kingdom?

The Saudi Arabian fitness industry is undergoing a revolution supported by tech advancements, facility modernisation, and rising health concerns. The demand for personalised training and memberships has skyrocketed. Boutique fitness centers are making a strong impact by offering specialised workouts and community-driven environments. Meanwhile, the hybrid gym model is transforming the market, integrating smart fitness equipment, virtual coaching, and digital platforms, catering to an evolving audience.

Women-centric fitness centres are also reshaping the industry, addressing a historically underserved female market, and contributing to the 150% increase in female sports participation since 2015. With rising competition and evolving consumer preferences, fitness centres continue to innovate and stay ahead in this rapidly growing market.