How RTE Food Market is Transforming the Indian Food Industry?

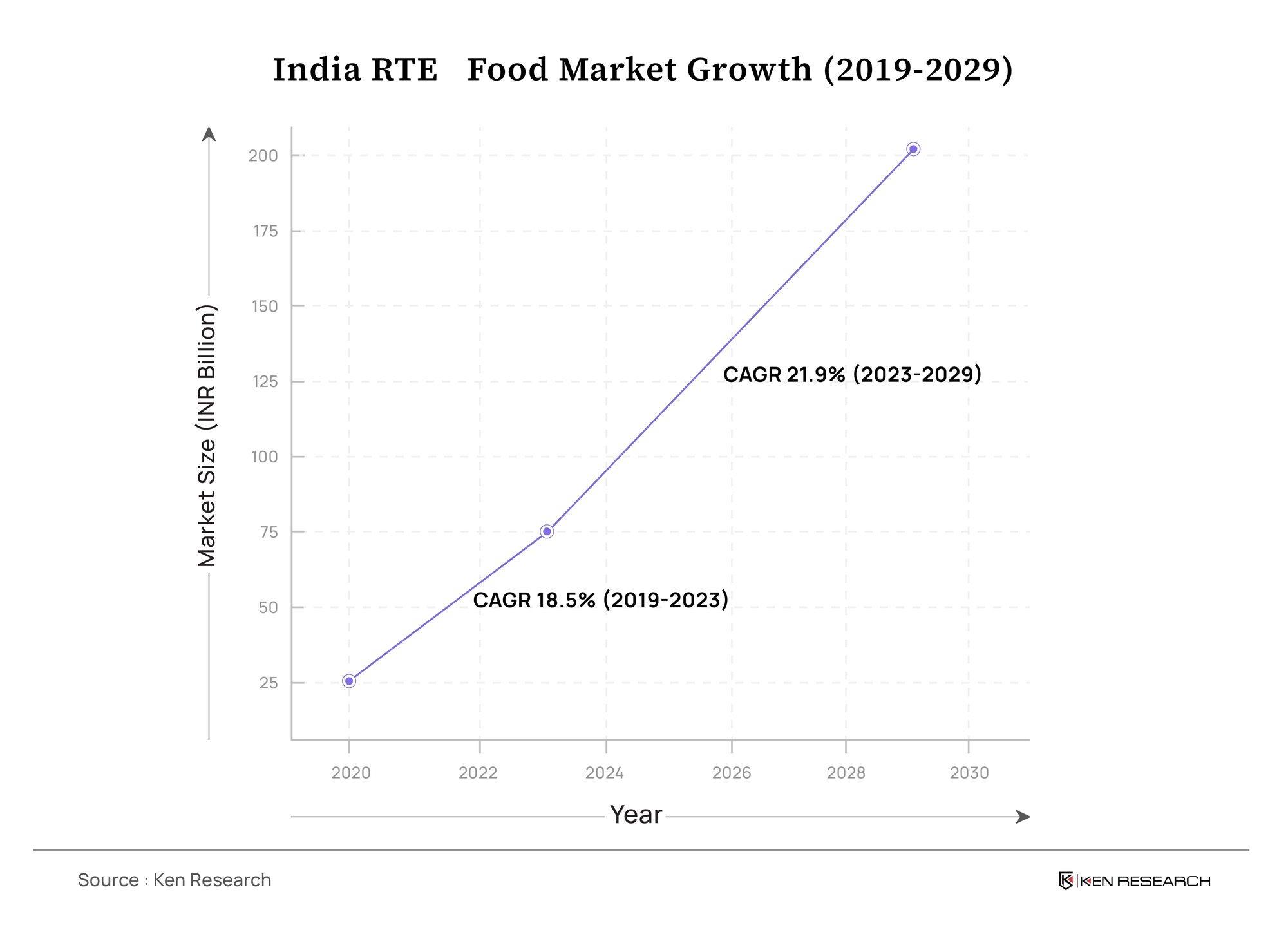

The Indian RTE food market is thriving, driven by frozen foods, e-commerce, and demand for healthier meals. With sustainable packaging innovations, the sector is set for major growth. Explore the trends shaping its future!

In recent years, India’s RTE (Ready to Eat) food market witnessed remarkable growth as the demand for frozen foods multiplied among Indians specifically in tier-1 and tier-2 cities. Prominent players in the market include Nestle, ITC, Haldiram, and McCain, offering a varied range of products across different segments like frozen foods, ready-to-heat meals, and ready-to-cook options.

With online platforms emerging as the preferred distribution channel, the market is unlocking new millstones along with the growing dominance of frozen foods. Additionally, Sustainable packaging and healthier ready-to-eat options are taking the spotlight further motivating the manufacturers to work on improving and innovating RTE options.

Monopoly of Frozen Foods

- In 2022, frozen foods dominated India Ready-to-Eat (RTE) food with a commanding market share of 53%, fueling the market to reach a valuation of INR 60 Bn in 2023.

- Moreover, the growing demand for quick, hassle-free, and nutritionally balanced meal options has highlighted the importance of frozen foods for a healthy and convenient lifestyle.

- Further, Upgrades in freezing mechanisms followed by the development of modern retail and e-commerce platforms have enhanced the accessibility of frozen food, stabilizing their leading position in the market.

Online Channels Driving Distribution

- Online platforms have been overpowering the distribution of Ready-to-Eat (RTE) foods in India, capturing 90.0 % of the market share in 2022.

- This shift was powered by digital transformation, and the growing preference for convenient, contactless shopping experiences, especially during the COVID-19 pandemic.

- With increasing internet penetration, smartphone usage, and the appeal of competitive pricing and doorstep delivery in the last decade, e-commerce has appeared as the preferred channel for RTE food purchases.

Healthier Ready-to-Eat Options

- The number of health-conscious consumers has grown rapidly post-covid era, a recent survey by a leading manufacturer shows that 58% of urban Indians prioritize nutritional benefits over taste.

- This number clarifies that Indian consumers look for healthier RTE options compared to traditional food products which contain several unhealthy ingredients resulting in obesity, diabetes, and high fat.

- As a result, Manufacturers are responding by introducing low-fat frozen meals, high-protein snacks, and trans-fat-free offerings. Subsequently, Clean labels, gluten-free products, and portion-controlled meals are setting a trend for fitness-focused consumers.

Advancements in Packaging

- Advancements and innovations in packaging, such as vacuum-sealed and microwave-friendly designs, have improved the shelf life, safety, and convenience of RTE foods, aligning with the busy lifestyles of the modern population.

- Progress in sustainable packaging, including biodegradable and recyclable materials, also resolves increasing environmental concerns. These solutions improve product appeal, support online distribution, and play an important role in expanding the market's reach.

The Promising Future

The India Ready-to-Eat (RTE) food market is witnessing new growth patterns which are being backed by demand for convenience, healthier meal options, and innovative packaging solutions. Frozen foods remain the favorite segment of the market, giving quick and balanced meal choices. On the other hand, online platforms have changed distribution by providing doorstep deliveries.

Manufacturers are taking notes to adopt health-conscious trends to remain firm in the market. In the near future, it will be interesting to see, how the arrival of new advancements such as vacuum-sealed and microwave-friendly designs will transform the operating cycle of the RTE food market in the country.