Revolutionizing APAC with Cutting-Edge Colocation Solutions

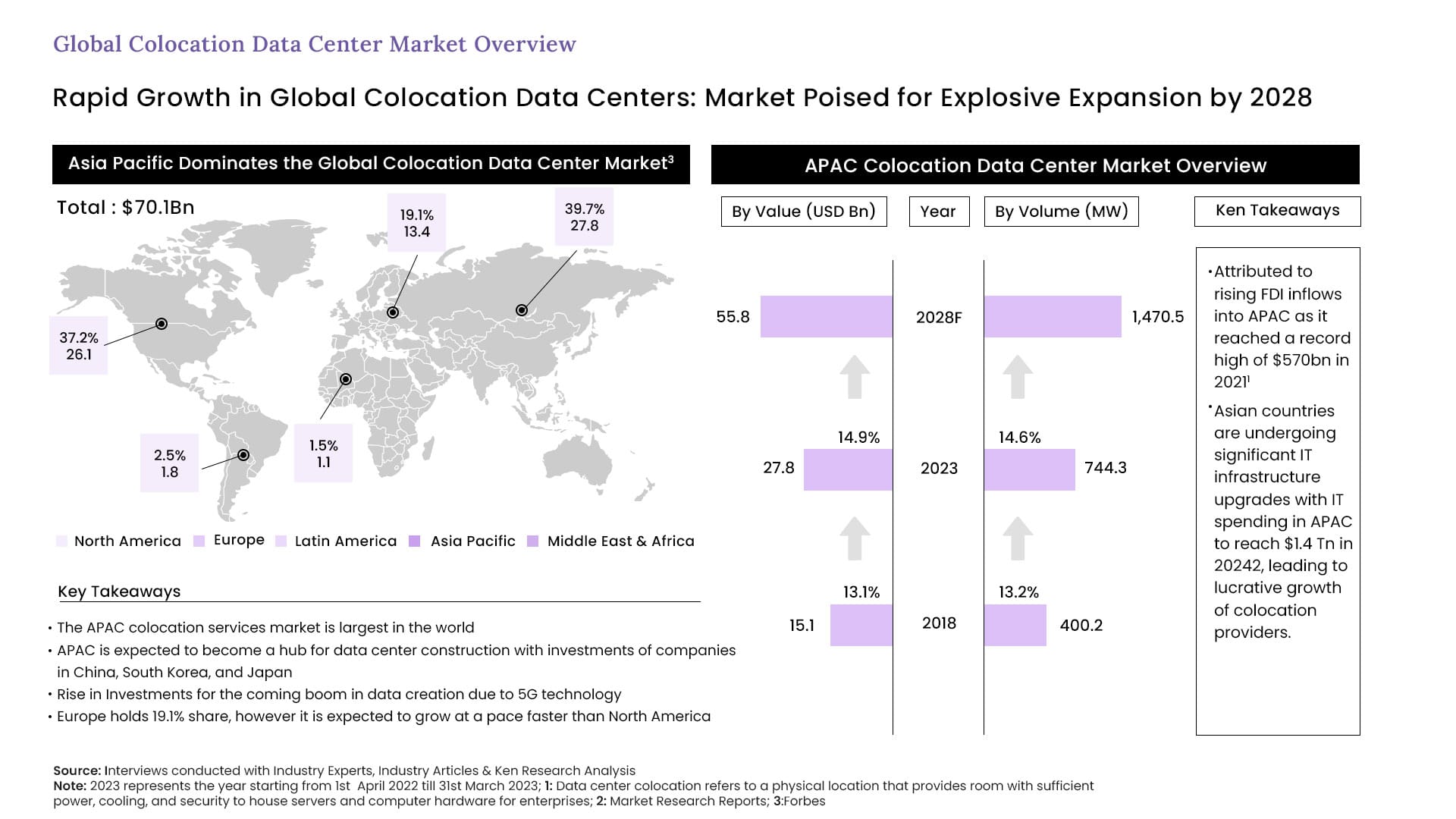

The Asia Pacific market was valued at USD 27.8 billion in 2023 with volume reaching a record time high of 744.3 MW. This is just a beginning the market is expected to rise exponentially in the coming years at the CAGR 14.9% potentially reaching at the valuation of USD 55.8 billion.

Asia Pacific is becoming a go to region for the businesses seeking lower capital costs and less hardware maintenance with colocation. With the continuous efforts of countries like China, South Korea, they are offering a secure & reliable data storage to ensure business continuity as 43% of them experienced a disruptive IT outage in 2023.

Over the past few years, Asia-Pacific is rapidly becoming a global leader in colocation services, with FDI inflows reaching a record high of $570bn in 2021, the South Asian land is witnessing a rise in Investments for the coming boom in data creation due to 5G technology as countries there are undergoing significant IT infrastructure upgrades with IT spending in APAC reaching $1.4 Tn in 2024, leading to lucrative growth of colocation providers.

The Colocation Industry is booming in the region, with 40 percent of the total market share dominated by Asia Pacific.

The Asia Pacific market is reaching its potential high in the colocation industry with the CAGR of 14.9%, it is expected to reach a valuation of USD 55.8 billion compared to USD 27.8 billion in 2023. This rise is influenced by budding growth drivers mentioned below-

The Asia Pacific market was valued at USD 27.8 billion in 2023 with volume reaching a record time high of 744.3 MW. This is just a beginning the market is expected to rise exponentially in the coming years at the CAGR 14.9% potentially reaching at the valuation of USD 55.8 billion. Let’s know what is driving the colocation market to rise in APAC-

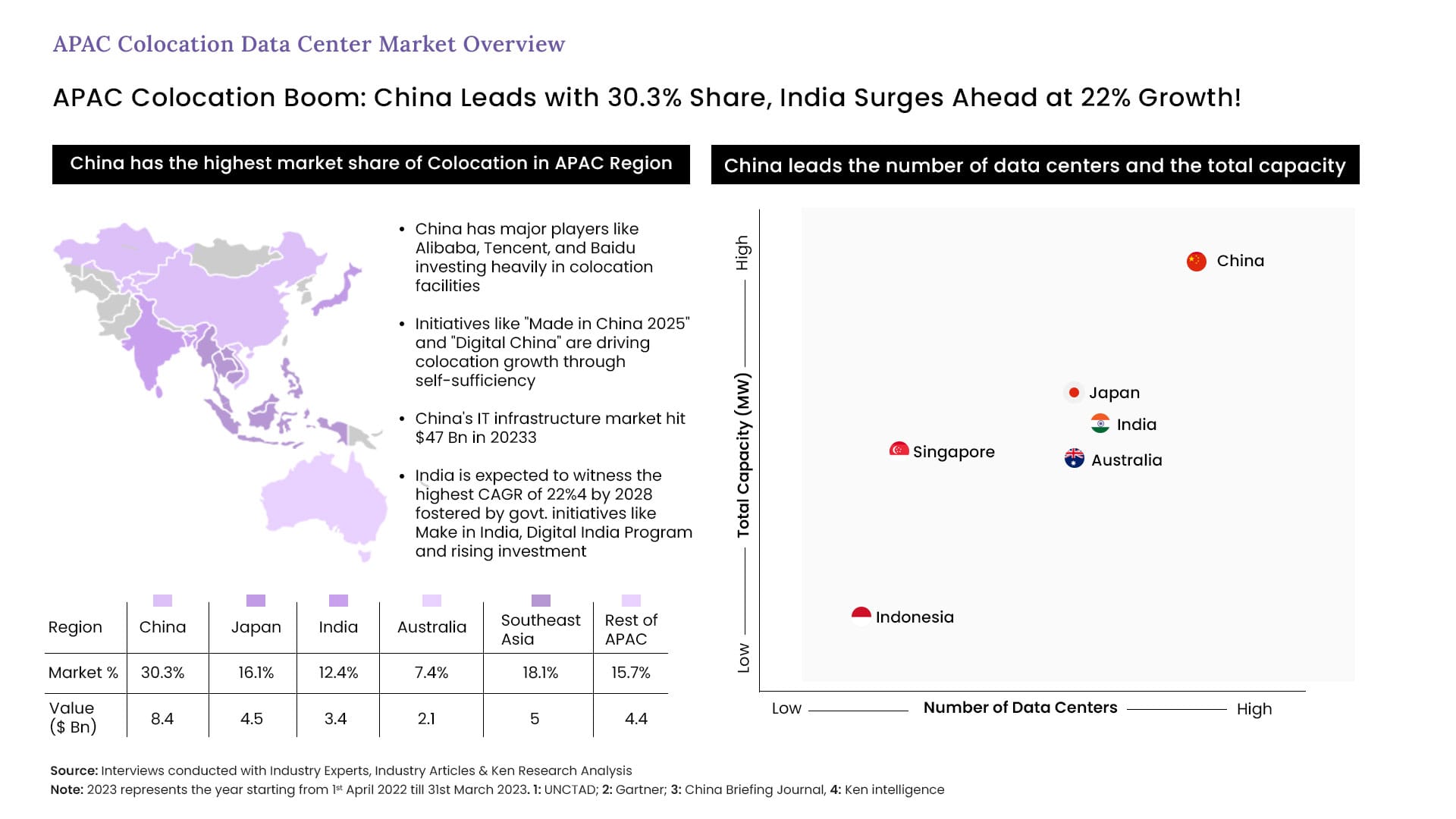

- Surge in Data Creation Due to 5G Technology: The deployment of 5G technology across the Asia Pacific (APAC) region is revolutionizing data generation. 5G networks promise faster speeds, lower latency, and the ability to connect a vast number of devices simultaneously. China's "Made in China 2025" and "Digital China" initiatives, for instance, aim to enhance the country's technological self-sufficiency, which includes significant investments in data center construction.

- Rising IT Infrastructure Investments: Enterprises can achieve up to 40% cost savings by using colocation services compared to building and operating their own data centers. Colocation centers benefit from this trend as they offer the necessary infrastructure for these global enterprises to operate efficiently in APAC. By providing cost-effective and scalable solutions, colocation providers enable companies to focus on their core business activities while ensuring their IT infrastructure.

- Foreign Direct Investment (FDI) Inflows: The APAC region has seen record-high Foreign Direct Investment (FDI) inflows, which have encouraged the colocation market. In 2021 alone, the region attracted $570 billion in FDI, a clear indication of global confidence in APAC's economic potential. This influx of capital is particularly directed toward sectors like IT and data centers, as multinational companies seek to establish or expand their presence in the region.

Key Factors Segmenting the Colocation Industry

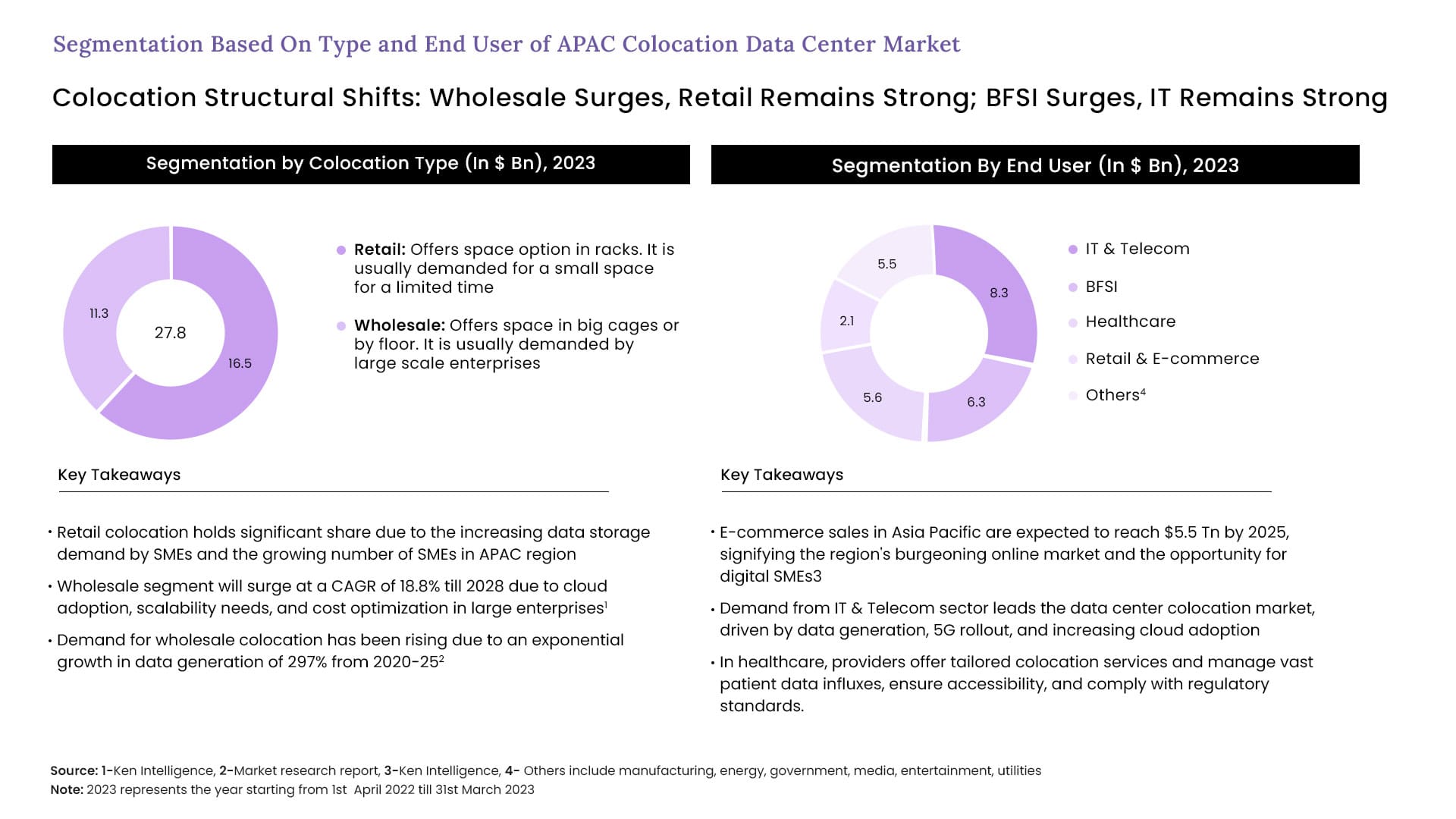

The Colocation Industry is segmented into Various factors and has been witnessing a cultural shift through the time as Wholesale surges, Retail stays strong and Intact at its position. In a similar manner while BFSI booms, IT is competing for its position as a leading End User.

By Type the Colocation Industry is segmented into Retail and Wholesale, Retail colocation holds substantial share due to the increasing data storage demand by SMEs and the growing number of SMEs in APAC region, Although the Wholesale segment will surge at a CAGR of 18.8% till 2028 due to cloud adoption, scalability needs, and cost optimization in large enterprises noting an exponential growth in data generation of 297% from 2020-25.

When categorized by end-user industries, the IT & Telecom sector dominates with $8.3 billion, driven by the high demand for data storage and management due to the explosion of 5G technology and cloud services. The BFSI sector follows as financial institutions increasingly rely on secure and scalable colocation services. Healthcare ($5.6 billion) and Retail & E-commerce ($2.1 billion) also contribute, reflecting the growing need for data management in these sectors. Other industries collectively account for $5.5 billion.

APAC Colocation Boom: China Leads with 30.3% Share, India Surges Ahead at 22% Growth!

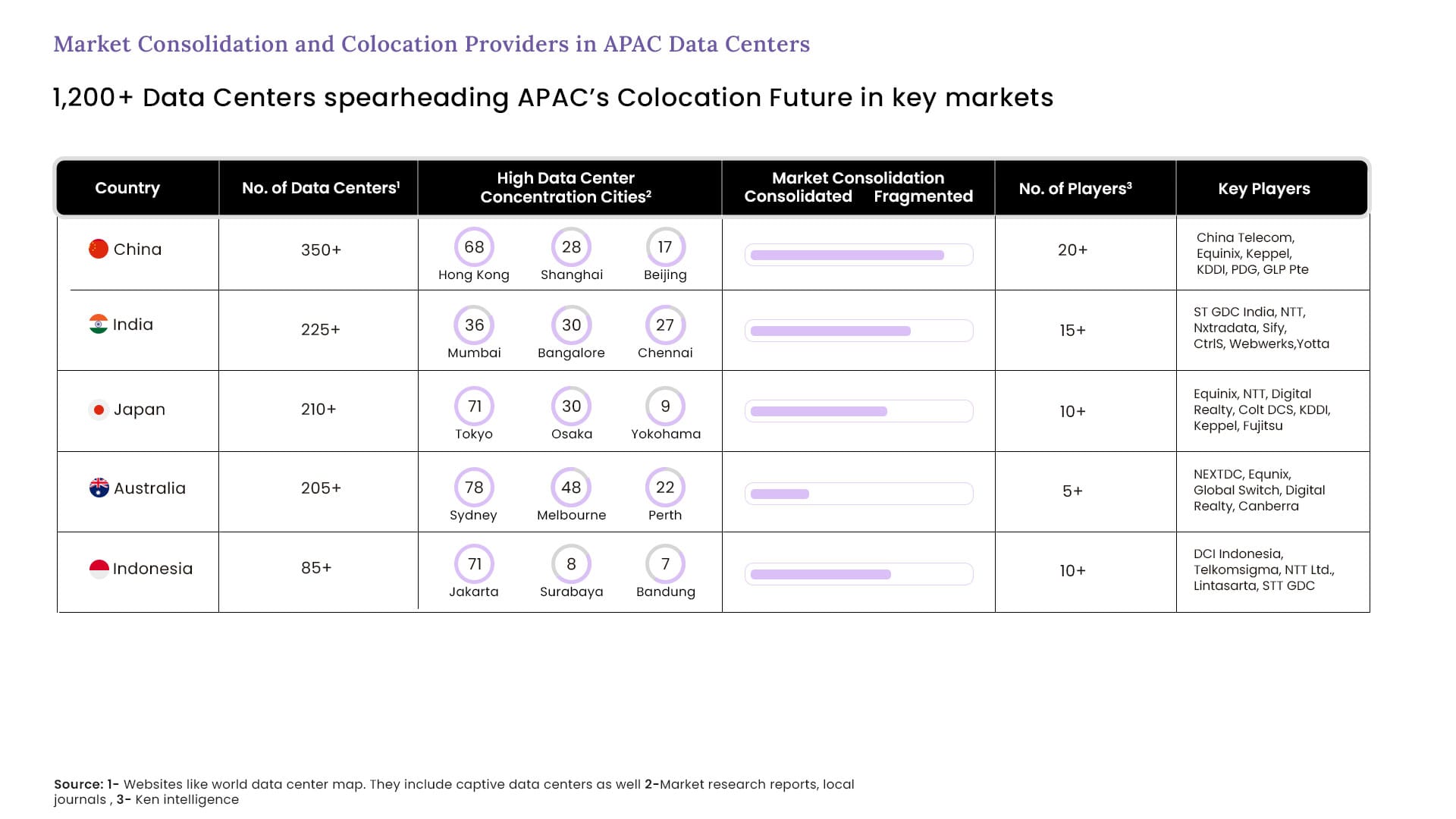

- China has a major contribution in the boom seen in the colocation market with Hong Kong alone house to 68 Data Centers

- India where Mumbai and Bangalore are emerging as major cities contributing to the Data Center hubs.

- Japan on the other hand is closely competing with India and have a major concentration of its data centers in Tokyo

- Australia and Indonesia are also in race with cities like Sydney, Melbourne and Jakarta making spaces in the colocation market.

Major Players in Colocation

Moving forward, here are some of the major players and their Strategic Investments fueling APAC Expansion and Innovation.

Equinix’s investments in Data Centers: Equinix plans to invest $40 million to open two new data centers in Malaysia in 2024. This strategic move aligns with the company's goal of expanding its presence in the rapidly growing APAC market, enhancing its ability to provide scalable, high-density colocation services to meet the increasing demand from global enterprises.

Digital Realty’s innovation ensuring efficiency: Digital Realty is enhancing its service offerings by adding Direct Liquid Cooling for High-Density Colocation in 170 of its data centers worldwide. This innovation is crucial for managing the growing demand for high-performance computing (HPC) applications, ensuring efficient cooling solutions that reduce energy consumption and improve sustainability across its facilities.

NTT Data’s Expansion in Malaysia: NTT Data is expanding its footprint in Malaysia with over a $50 million investment in 2024. This expansion is part of the company's broader strategy to strengthen its presence in the APAC region, capitalizing on the growing demand for colocation services driven by increased cloud adoption and digital transformation initiatives.

China Telecom in Global Tech Events: China Telecom has been actively participating in global tech events, including the Mobile World Congress (MWC) 2024, where it showcased advancements in cloud-network integration. This initiative highlights the company’s commitment to enhancing its digital infrastructure, enabling more robust and efficient connectivity solutions for its customers across APAC and beyond.

Rising Opportunity Markets in APAC Colocation Industry

There are country’s actively participating and making their way to become top players in the colocation Market, below mentioned are the opportunities and challenges they are facing in this race-

- India meeting the rising demand for storage: The country is thriving in the data center market with a momentous increase in demand from OTT, IT and Cloud Firms, even the government has intervened and launched Data Protection Bill supporting DCs as India based DCs also cater to the rising demand of data storage from Neighboring countries like Sri Lanka, Bangladesh, Bhutan. However, the hike in unit cost of power and competition among DC providers prove as a major challenge.

- Japan connecting borders with mobile data adoption: The colocation market in Japan is actively running in the race, driven by advanced infrastructure, key submarine cable connectivity linking the U.S., Asia, and Europe, and increasing mobile data adoption. However, challenges like power grid strain and limited land availability due to its island geography and natural disasters pose hurdles. Despite these, the market remains lucrative with an estimated growth rate of around 17.6%.

- Indonesia flourishing through the Tech startups: Even after facing major challenges in developing data center infrastructure and limited availability of reliable power and connectivity Indonesia’s digital economy is booming, with a heave in tech startups and government initiatives like "Making Indonesia 4.0" and tax incentives fueling demand for retail colocation.

In the same way there are countries with moderate but a potential market in the data centers, take a glimpse of the headwinds and tailwinds they are going through-

Singapore's colocation market thrives with a high occupancy rate, strengthened by new submarine cables and support from initiatives by the EDB and IMDA. But the land availability and energy constraints are constant problems which the country is overcoming as shown by its growth rate of 13.9%.

China benefits from its "Made in China 2025" plan and vast internet user base but faces high cooling costs due to heat and humidity, along with regulatory complexities, with a growth rate of 13.4%.

Australia’s colocation potential is enhanced by the ASC cable and government strategies, though high land and electricity costs slow progress, limiting growth to 8.5%.

Conclusion

The future will witness a major boom in the colocation industry as companies are investing in the energy efficient infrastructure and offering customizable colocation tiers by collaborating with telecom and cloud providers. Diverse customer needs are driven by key trends like strategic partnerships, sustainability, retail colocation, and geographical expansion. With expansion of new regions to optimize costs and increase revenue. These trends position APAC as a leading force in revolutionizing digital infrastructure for the next era.

Key Uncertainties

- High temperatures and humidity in regions like China will continue to drive up the costs of cooling data centers, making energy-efficient solutions a priority for sustainable growth.

- The steady flow of FDI into the APAC region may face disruptions due to geopolitical tensions and economic uncertainties, directly impacting future investments in the colocation market.

- The pace at which 5G and cloud technologies are adopted across the region will dramatically influence the demand for colocation services, driving infrastructure needs and investment.

- As major cities like Mumbai, Tokyo, and Sydney near saturation, emerging colocation hubs will be critical for future expansion. Wholesale colocation is dignified to outpace retail colocation, driven by scalability and cost-efficiency demands from large enterprises.

Big Questions about the future

How can we optimize costs of electricity prices and increasing cooling needs in high-temperature regions? What new geographic regions should be targeted for data center expansion without facing excessive land or power constraints? How can we ensure compliance with evolving data protection and regulatory standards across APAC while maintaining operational efficiency? What preparation should one do for the emerging technologies which will have the impact on colocation services in the next 5-10 years? How can we balance sustainability with efficiency, especially in energy-intensive regions where green technology adoption is still in early stages? What steps should we take to mitigate the risks posed by natural disasters, power shortages, or regulatory changes in key markets like Japan or Indonesia?