Revolutionized EV Industry of SEA

In 2023, Singapore emerged as the leading destination for FDI in the EV sector, attracting investments totaling USD 141 million.

South East Asia’s Electronic Vehicle industry has been a global outperformer in demand growth and shareholder wealth creation for a long time now. Its strong starting point could make it the next EV manufacturing hub.

Southeast Asia is experiencing a notable transformation in its automotive landscape, particularly with the increasing adoption of electric vehicles (EVs). As of 2023, the collective GDP of Southeast Asia reached approximately USD 10.7 trillion, reflecting the region's economic growth and its potential as a burgeoning market for EVs. The shift towards electric mobility is not only a response to global environmental challenges but also a strategic move to enhance economic resilience and sustainability. In 2023, Singapore emerged as the leading destination for FDI in the EV sector, attracting investments totaling USD 141 million. This was followed by Indonesia and Vietnam, which received USD 22 million and USD 18 million, respectively.

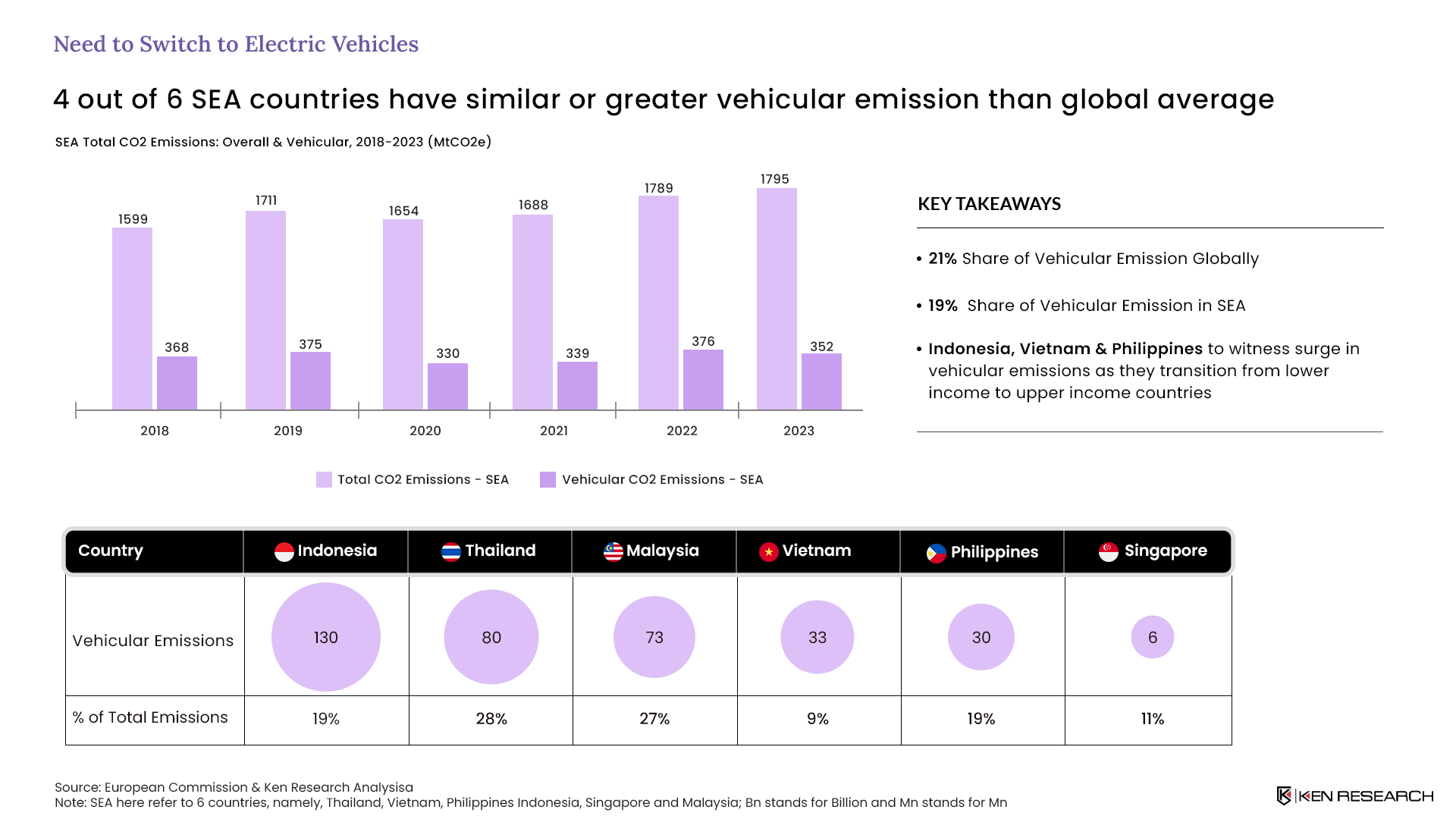

The sector is projected to grow by 18% to 19 % during 2023–30 increasing its global market share by 2030 majorly in Vietnam, Indonesia, and the Philippines. This growth is expected to be driven by a range of factors:

- Government Support through OECD and ERIA: With collective exports totaling USD 1,900 billion and imports reaching USD 1,800 billion, the government is supporting the Southeast Asian (SEA) region through various policies including tax breaks, import duty exemptions, and tax incentives for R&D. Singapore outshined with export accounting for USD 514 Bn. The ASEAN SME Policy Index, developed by the OECD and ERIA, serves as a benchmarking tool for ASEAN member states to evaluate and enhance policies supporting small and medium-sized enterprises (SMEs).

- Charging Infrastructure through public-private partnerships: With plans to establish 10,000 stations by 2025 and 12,000 by 2030, charging structures in Southeast Asia have advanced due to increased private sector involvement and public-private partnerships. By leveraging public-private partnerships and government incentives, the region is positioning itself to meet the rising demand for electric vehicles while addressing environmental concerns and enhancing energy security.

- Technology Development with tax deductions and increased R&D: With tax deductions of up to 300% on R&D costs, Indonesia is actively supporting domestic players investing in EV-based research and development. The Philippines has also enhanced its support through 'Special Corporate Tax' deductions provided by the Green Jobs Act to have 500,000 EVs on its roads by 2030. Vietnam has set a production capacity target of 350,000 EVs by 2026, with 250,000 at Vietnam-based Vinfast and 100,000 in a Hyundai factory.

An analysis of SEA’s competitiveness

This section analyzes SEA’s competitiveness in EV across three categories— Infrastructural parameters, Consumer participation, and Competition.

Infrastructural parameters: SEA has a well-planned theory to establish maximum charging stations but is lagging in the implementation. As of 2023, the Philippines has 181 charging stations in Metro Manila and 110 in Calabarzon, while Singapore and Vietnam aim to establish 50,000-60,000 stations through public-private partnerships. The absence of standardized protocols and interoperability between charging networks is a significant barrier to the widespread adoption of EVs in Southeast Asia.

Consumer participation: SEA has seen a surge in the volume of EVs sold but is facing hindrances from the side of consumers. The sale of electric vehicles (EVs) in Southeast Asia has expanded, with a compound annual growth rate (CAGR) of 18% to 19% in Indonesia and Vietnam, where growth prospects are notably higher. In 2023, Thailand has emerged as a leader, contributing 12% of the automotive sector to its GDP. The broader Southeast Asian market is projected to see total EV sales volume reach approximately 8.5 million units by 2035, with Indonesia expected to lead in volume, followed by Thailand and Vietnam. Indonesia aims for 4.5 million units sold by 2035, while Thailand is projected to sell 2.5 million units.

Competition: Southeast Asia benefits from strong support from both domestic and international players, but entering the market remains challenging for new entrants. In 2022, Indonesia attracted only 22 out of 217 foreign direct investments (FDI), reflecting the dominance and intense competition among established Internal Combustion Engine (ICE) players. Meanwhile, the Philippines recorded minimal FDI inflow of just 9 due to a lack of local EV production capabilities.

Regulatory Bottlenecks

Southeast Asia's automotive market is hindered by uncertainty surrounding battery swapping policies, with Indonesia, Vietnam, and Malaysia contributing only 3-4% to overall GDP in this sector. Even the regulations are still nascent in Vietnam with other SEA countries.

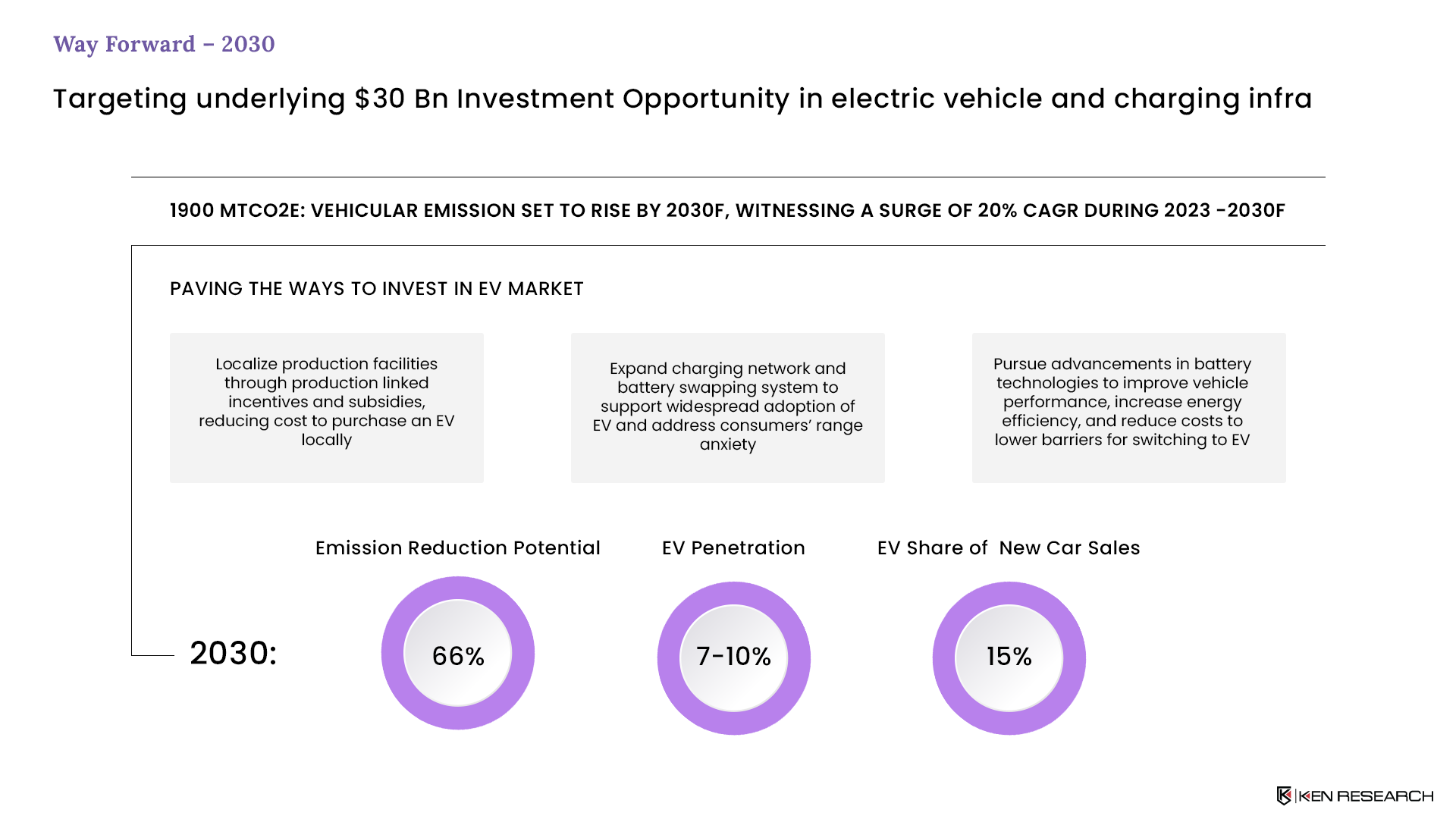

By 2030, Southeast Asia is expected to see a $30 billion investment opportunity in the electric vehicle (EV) market, driven by the emergence of local manufacturers and international partnerships. In addition, the expansion of infrastructure through an increased number of EV charging stations is anticipated to support this growth.

Out of the four main segments of the sector— Passenger Electric Vehicles, Electric Two-Wheelers, Electric Commercial Vehicles, and Battery Production and Supply Chain. Among the four main segments of the electric vehicle (EV) market in Southeast Asia, the Electric Two-Wheelers segment is expected to develop by and large by 2030.

Benchmarking SEA’s manufacturing competitiveness in EV

While Southeast Asia's electric vehicle (EV) sector is poised for potential growth, the outlook for shared mobility remains uncertain. Benchmarking the sector against six global chemicals clusters—China, Germany, US, Japan, South Korea, and France—across number of variables shows that though SEA is more or equally competitive on most counts, other countries have a competitive edge over SEA in a few crucial respects.

Potential winning opportunities in SEA’s EV sector

Southeast Asia's electric vehicle (EV) market presents significant growth potential, driven by supportive government initiatives, rising consumer interest, and the participation of major automotive manufacturers. However, overcoming infrastructure challenges and lowering costs will be essential to fully harness this potential. As the market evolves, opportunities will emerge throughout the entire EV value chain, positioning it as an appealing sector for investment and development.

- Deployment Target with $30 Bn investment: According to the deployment target, the implementation of electric EVs and charging infrastructure will offer $30 Bn investment opportunity in SEA by 2030. Indonesia aims to deploy 15.2 Mn (Cars+2W) by volume, and Singapore aiming for 100% EVs by 2031. While Indonesia and Singapore lead the way in EV deployment, other Southeast Asian countries like the Philippines, Vietnam, Thailand, and Malaysia also make strides in promoting electric mobility.

- Charging Infrastructure in terms of DC fast-charging stations: Singapore aims to have 60,000 charging points by 2030, focusing on public-private partnerships to drive implementation. The country has already made significant strides, with 61 DC fast-charging stations as of 2023. Thailand plans for 12,000 charging points and 1450 battery swapping stations by 2030. Singapore and Thailand have made significant progress in their charging infrastructure plans, with Singapore leading in DC fast-charging stations and Thailand focusing on a mix of AC and DC chargers.

Implications for SEA and global companies to reflect on

SEA has the potential to become the consumption and manufacturing engine of the global EV industry with 66% emission reduction potential, 7-10% of EV penetration and 15% of EV share of new car sales. As the market matures, the potential for localized manufacturing and a comprehensive EV ecosystem will further enhance Southeast Asia's attractiveness as a key player in the global EV landscape, making it a promising area for stakeholders across the entire value chain.

Questions to be addressed

Global Automotive companies interested in entering or scaling up their businesses in SEA should, however, strategically ponder upon several questions, such as: What is the current state of the EV market in SEA? Which countries present the most significant opportunities for EV penetration? What are the local regulations and policies regarding EVs? Are there specific environmental regulations that need to be considered?

Similarly, domestic automotive companies need to reflect upon numerous questions, such as: What is the current size and growth potential of the EV market in the target SEA country? Who are the key customer segments and what are their preferences and needs? Are there any local content requirements or restrictions that need to be considered?