Revolutionizing Fitness Culture in MENA, a Journey of Tradition to Transformation

The MENA fitness equipment market is booming, driven by rising health awareness, government initiatives, and tech-driven trends. Expected to reach USD 780M by 2029, the market thrives on gym expansions, digital fitness, and evolving consumer preferences. Explore key trends shaping its future.

The Middle East and Africa region is entering a health-conscious path towards a better future. An eagerness to fight health conditions caused by fitness-ignorant lifestyle choices, the need for easy access to fitness and support by health-focused government initiatives fuels this rise.

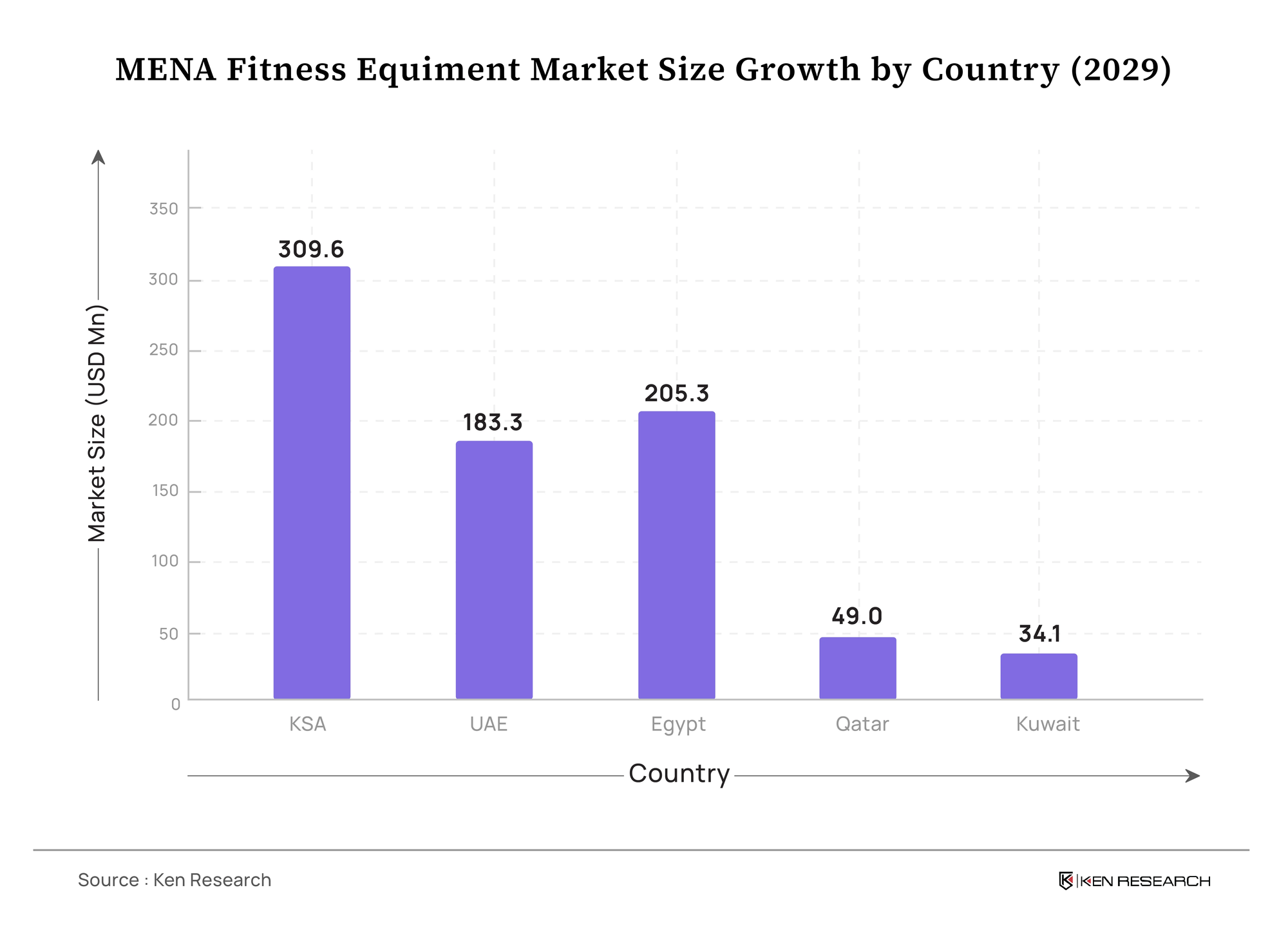

As a result, the MENA Fitness Equipment Market is expected to reach USD 780 Million by 2029. Countries like the UAE and Saudi Arabia are already ahead on the racetrack, while Qatar, Kuwait, and Egypt are close behind in presenting growth opportunities for the market. This article will explore how the fitness equipment market was propelled to its heights and what the future has in store for the market.

Sparking Health Awareness

- Over the last decade, middle eastern countries saw health concerns associated with lifestyle choices like obesity and diabetes grow significantly. Countries in the Gulf Cooperation Council (GCC), saw obesity rates exceeding 40% among adults in 2022. As a result, governments across the region launched multiple awareness campaigns, namely the Dubai Fitness Challenge and “Your Home, Your Gym” by Saudi Arabia, encouraging its people to engage in more physical activities.

- These efforts, coupled with the rising health-conscious Millennials and Gen Zs, who now add up to almost 80% of fitness memberships, drive the demand for fitness centers with up-to-date equipment. According to the World Obesity Federation, by 2025, approximately 10.5% of adolescents aged 5-18 will be bound by obesity. Along with this, the youth actively seek personalized experiences, hyping up gyms that offer services like personal training, Zumba, and yoga among other fitness amenities.

- Rapidly growing in number, the MENA urban population is projected to reach nearly 80% by 2050. This severe growth also opens the door to space constraints and lifestyle changes, causing fitness centres and gyms to be more famous than home gyms, leading to increased investment in fitness infrastructure. As a result, over 14,000 fitness facilities, comprising mostly economical and premium fitness centers are dominating the market.

Governments Leveling the Field

- Significant government support has been pivotal in promoting fitness across this region. Initiatives like Saudi Arabia's Vision 2030, the UAE's National Strategy for Wellbeing 2031, and Qatar's National Sports Day have stimulated investments in fitness facilities and associated infrastructure.

- These thoughtful policies have also encouraged the private organizations to expand their services which in turn boosted gym memberships and subscriptions to workout programs.

Glimpse into the Future

- Taking a peek into the future, the Fitness equipment market in the MENA region is being reshaped by technology, preparing it for the future. VR/AR workouts, AI-powered trainers, and hybrid memberships combining virtual and physical training are becoming extremely popular. Not just this, flexible membership plans, such as pay-per-class and monthly subscriptions, are taking the spotlight for their adaptability and accessibility.

- Additionally, corporate wellness programs are on the rise as companies prioritize the health of their employees, boosting demand for gym facilities and fitness equipment in office areas. These gyms also include wellness services like physiotherapy, nutrition counseling, and genetic testing in their plans.

The MENA fitness equipment market has grown significantly in recent years and is expected to grow at a CAGR of ~9%, fueled by rising health consciousness, supportive government initiatives as well as technologically advanced users. Affordable gyms are the star performers, providing high-quality services at affordable prices, while premium gyms expand rapidly to cater to the more affluent population. As the fitness culture continues to evolve, businesses lean to include digital training, flexible membership plans, and all-inclusive wellness services to remain competitive and seize opportunities in this growing market.