How Did Minimalist Disrupted Skincare Industry to Build a ₹2,955 Crore Clean Beauty Brand?

Minimalist’s acquisition by HUL marks a pivotal shift in India’s D2C skincare market. Explore key strategies, market trends, and what this deal signals for beauty industry M&As.

Four years ago, two brothers in a cramped Jaipur room turned a failed beauty venture into a ₹2,955 crore skincare empire, proving that transparency and efficacy can outpace legacy giants in India’s booming beauty market. India beauty and personal care sector is set to hit USD 34 billion by 2028, growing at a 10-11% CAGR, the fastest globally.

Yet, the skincare segment was ripe for disruption, long dominated by established brands peddling vague claims, murky ingredient lists, and premium pricing over substance. Then Minimalist entered a market that has taken advantage of science-backed formulations, ingredient clarity, and a direct-to-consumer (D2C) model to reshape the landscape.

Acquired by Hindustan Unilever Limited (HUL) in March 2025 for ₹2,955 crore with 90.5% stake, Minimalist scaled to profitability and market leadership. This article dissects the strategies behind its rapid rise.

The Call for Transparency

Skincare consumers in India faced a persistent challenge, legacy brands pushed products with inflated promises, often unbacked by science, cloaked in ambiguous details, and priced for prestige.

Minimalist positioned itself as the “truthful” alternative, delivering full ingredient transparency via minimalist packaging that lists actives and concentrations. Inspired by The Ordinary’s 2014 success in North America, Minimalist tailored this model for India with gentler formulas suited to local needs.

Against rivals like Pilgrim and Deconstruct, its clarity-first approach achieved a 65% repeat purchase rate, outpacing norms, building trust with a science-driven consumer base, and cracking an oligopolistic market.

Strategy 1: Science-Backed Product Innovation

Minimalist anchored its offerings in efficacy, not trends. Using clinically validated ingredients like niacinamide and salicylic acid, it ensured measurable outcomes, its 2% salicylic acid cleanser became a top e-commerce seller.

Investing in R&D to meet global standards, Minimalist backed claims with studies, a stark contrast to legacy players’ marketing heft. Born from the Yadav brothers’ Freewill flop, this science-first ethos earned credibility with consumers and dermatologists.

HUL’s post-acquisition R&D, potentially in biotech actives, could amplify this edge, a synergy investor should watch.

Strategy 2: Owning the Supply Chain with a D2C Model

Minimalist took control where others outsourced. In-house manufacturing in India cut costs by 20-30% versus imports, dodging tariffs that hit rivals like The Ordinary. Paired with a D2C model via Amazon and Nykaa, it bypassed retail markups, driving margins of 40-50%.

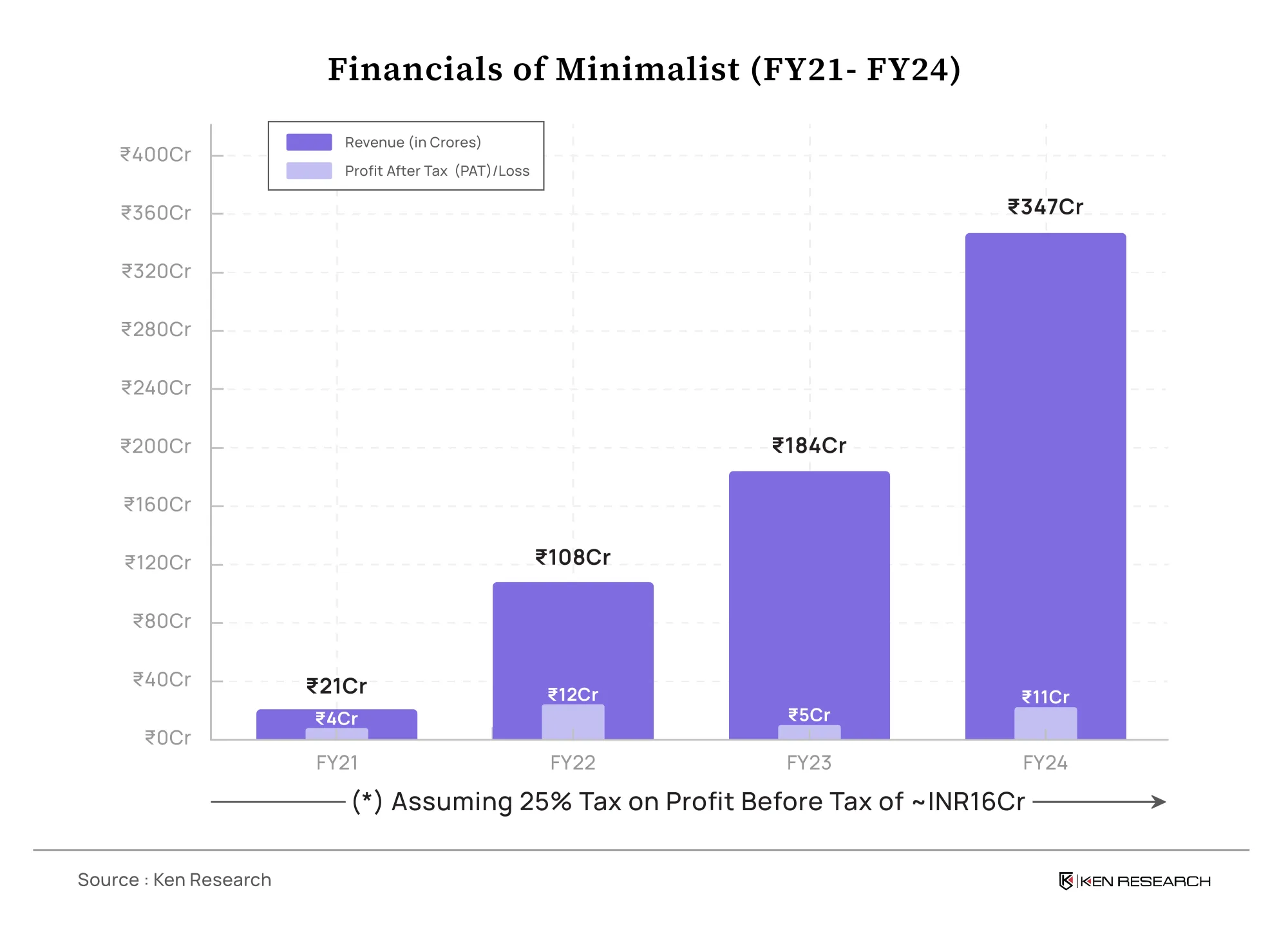

This lean operation scaled revenue from ₹184 crore in FY23 to ₹347 crore in FY24, with profits doubling to ₹10.83 crore, hitting a ₹500 crore annual revenue run rate by 2025. The brand maintained its Cost of Goods Sold (COGS) at approximately 35% of revenue by developing products in its own laboratory. This approach eliminated third-party markups and enabled rapid innovation.

Strategy 3: Pricing and Consumer Trust

Meanwhile, Minimalist rewrote pricing by cutting branding excess, no celebrity ads here. At ₹599 (USD 7), it penetrated over 15,000 pin codes and According to the company's data, a significant majority of Minimalist users 83% report noticeable improvements in their skin conditions within just four to six weeks of using the products.

Organic advocacy fueled trust, sustaining repeat purchases and growing a 500,000+ customer base. Unlike cash-burning peers, its profitability from day one and “India-first” gentler formulas gave it a local edge, now poised for HUL’s offline push to 2000-20,000 stores.

Strategy 4: Data-Driven Consumer Engagement

Minimalist educated its audience via website and social media, offering insights on formulations and benefits. With 2.5 million followers, ties to 1,000+ dermatologists, and analytics refining offerings, it built credibility and reach.

Unlike other beauty brands, minimalist is not limited to metro cities the company has conquered about 50% of consumers from Tier 2 cities and beyond, and nearly 30% of them are male.

This dialogue, sustained by consumer feedback, kept loyalty high, a factor in HUL’s ₹2,955 crore bet, approved by the Competition Commission of India CCI on March 17, 2025. Founders Mohit and Rahul Yadav, who were retained for two years, ensure this connection holds against corporate risks.

Lessons from Minimalist’s Success

Minimalist's meteoric rise to a valuation of ₹2,955 crore, marking a 5x leap from its ₹572 crore Series A funding in 2021, is rooted in its commitment to authenticity, innovation, and consumer trust. This growth story underscores the potential of India's D2C beauty sector, as evidenced by Peak XV's ₹777 crore exit from its 27.9% stake, delivering returns of 5-10x, a testament to the lucrative opportunities in this growing market.

Moreover, Minimalist demonstrated remarkable agility by launching over 50 SKUs in just four years, surpassing competitors with its tailored, science-driven offerings like the 2% Alpha Arbutin Serum. This strategy not only captured the evolving skincare preferences of Indian consumers but also positioned the brand as an attractive acquisition for HUL’s innovation-focused portfolio.

Hindustan Unilever Limited (HUL)'s acquisition of Minimalist aligns with global M&A trends in the beauty industry. By integrating Minimalist into its portfolio, HUL aims to bolster its beauty segment revenues by 21%, targeting ₹1,000 crore by 2020. This strategic move highlights the growing preference for digital-first models with localized supply chains that outperform traditional legacy structures. Minimalist serves as a blueprint for taking advantage of innovation and operational efficiency in the USD 38 billion Indian beauty frontier.