Why Did India Fail to Build a Global Makhana Brand Despite Being the Largest Producer?

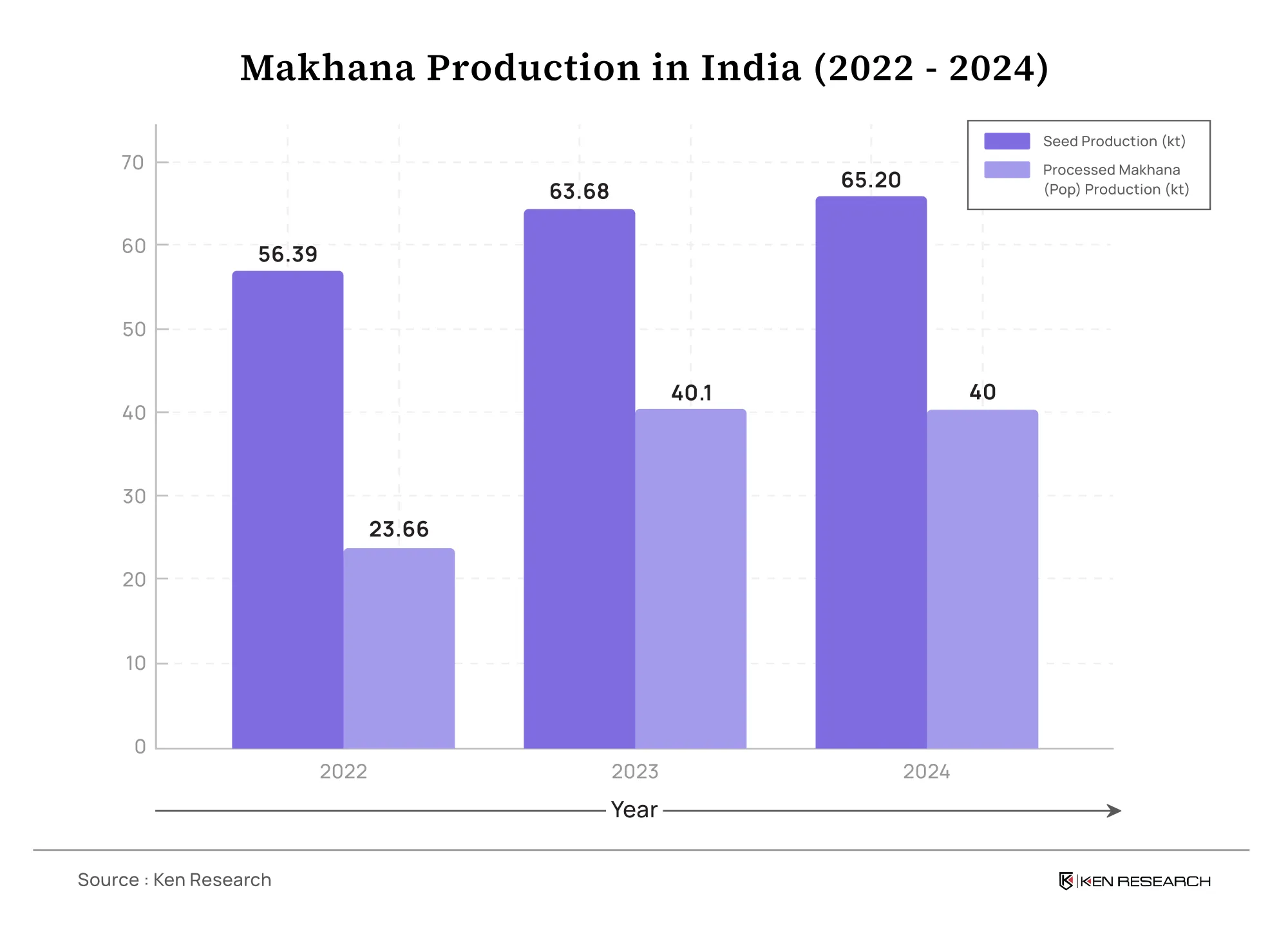

India is the world’s largest producer of makhana (fox nuts), with Bihar and Assam leading the cultivation due to ideal climatic conditions. In 2023, India produced approximately 120,000 metric tons of makhana seeds.

However, only 40,000 metric tons undergo processing, generating a farm-level value of INR 250 Cr and a trade-level revenue of INR 550 Cr. Despite this, India has failed to create a globally recognized makhana brand comparable to Lays or Haldiram in the potato product segment. What has hindered India’s rise in the global makhana market, and how can the industry overcome these challenges?

Limited Branding Efforts

- A strong brand presence is essential to capturing global market share. While Indian brands such as Farmley, Tata Sampann, Khetika, and Indian Foxnut operate domestically, their limited production capacity and the lack of commercialization restrict their global outreach.

- The absence of a solid branding strategy has resulted in fragmented market penetration, preventing makhana from being positioned as a mainstream snack on the global stage.

Labor-Intensive Processing Hindering Mass Production

- Makhana cultivation and processing remain highly labour-intensive, requiring skilled workers to navigate muddy pond beds using long bamboo poles. The post-harvest process involves multiple stages of cleaning, drying, and popping, further increasing dependency on manual labour.

- Additionally, traditional farming methods result in lower yields, with farmers achieving only 1.7–1.9 tonnes per hectare compared to the potential 3–3.5 tonnes per hectare using modern techniques.

- The absence of mechanization slows down scalability, limiting supply chain efficiency and increasing production costs. Without advancements in automation, India’s makhana industry struggles to compete with processed snack alternatives that are already popular among the masses.

High Price Sensitivity Discourages Mass Adoption

- Makhana's price range of INR 800-1800 per kg makes it a premium category compared to substitute snacks like popcorn and peanuts. The high cost restricts market penetration, particularly in price-sensitive consumer segments and regions like tier-2 and tier-3 cities.

- Unlike global brands that have successfully positioned premium snacks through targeted marketing and value-based branding, makhana lacks a well-defined premium positioning strategy. The absence of price simplification through cost-effective production techniques further complicates its acceptance among the masses.

Lack of Proper Infrastructure

- Despite Bihar accounting for 90% of India makhana production, the state lacks a well-established wholesale market. Instead, major wholesale hubs are located in Khari Baoli (New Delhi), Nayaganj (Kanpur), and Varanasi, creating logistical inefficiencies for farmers and producers.

- Further, the price of makhana in distant markets is generally 60-70% higher than in local markets, largely due to transportation costs.

- Additionally, inadequate cold storage facilities, inconsistent quality control measures, and the absence of direct export-oriented infrastructure limit India's ability to scale global distribution.

Limited Product Innovation

- One of the critical challenges in Makhana's global expansion is the lack of product innovation. Unlike potato chips, which have been adapted into various flavours and forms, makhana remains largely confined to traditional roasted or lightly salted varieties. The absence of flavoured, spiced versions such as caramel-coated, cheese-flavoured, or masala-seasoned options restricts its appeal to international markets.

- In contrast, snack brands have successfully diversified their offerings to cater to changing consumer preferences. Further, investment in R&D for new makhana-based products, including protein bars, flavoured crisps, and fusion snacks, could significantly expand its consumer base.

How India Can Build a Global Makhana Brand

1. Establishing a Centralized Makhana Board

- A government-backed Makhana Board will provide structured policy support, ensuring streamlined production, market regulation, and price stability. The 2025 Budget allocated INR 1 billion (Rs. 100 crore) for a Makhana Board in Bihar, marking a critical step in organizing the sector.

- Similar to commodity boards for tea and spices, this initiative will introduce Minimum Support Prices (MSP), R&D funding, and financial incentives for exporters in the near future.

2. Strengthening Supply Chain and Infrastructure

- Building dedicated processing hubs, modernized storage facilities, and export-oriented airports in Bihar and Odisha will enhance makhana’s commercial viability. Encouraging private sector participation in supply chain automation and packaging innovations can further elevate product standardization.

- Subsequently, post-production value chain employment is expected to increase from 500,000 individuals to 700,000 individuals, given aggressive investment in the industry.

3. Brand Positioning and Global Expansion

- India must adopt an aggressive branding strategy, positioning makhana as a premium yet accessible superfood. Collaborating with global retailers, leveraging e-commerce platforms and investing in international marketing campaigns will help drive demand.

- Lessons from the success of brands like Lays and Kind Bars illustrate the potential of effective storytelling, informative packaging, and health-centric marketing.

4. Fostering Product Innovation and Market Adaptability

- In 2022, Bihar’s makhana gained Geographical Indication (GI) status, enhancing its appeal as a high-quality product both domestically and internationally.

- To further enhance Makhana’s global appeal, Indian producers need to focus on product diversification. Introducing innovative flavours and value-added variations such as chocolate-coated makhana, spicy blends, or energy-boosting makhana snacks will cater to a broader audience.

- Additionally, makhana-based cereal bars, trail mixes, and even plant-based dairy alternatives should be explored to align with current global food trends. Aligning makhana with the health-conscious movement will help position it as a natural, nutrient-dense alternative to processed snacks.

What is the Road Ahead?

With increasing consumer awareness around health-conscious snacking, makhana has the potential to disrupt the global snack food industry. Industry estimates project India makhana market to reach INR 6000 Cr with the right structural reforms. By addressing branding, infrastructure and cost challenges, India can transform its makhana industry from an unorganized sector into a globally recognized powerhouse.