Exploring the Titans of KSA's Food Aggregator Market

The KSA food aggregator market is growing rapidly, driven by rising orders, smartphone penetration, and M&A activities, with key players like Hungerstation and Jahez leading the competition.

The KSA Food Aggregator Market is witnessing substantial growth backed by the rise in annual orders and increasing smartphone penetration and internet access. GMV (Gross Merchandise Value) is ready to scale simultaneously with a steady Average order value of 54-55 SAR. Additionally, M&A activities have transformed the market taking the sector to new heights of leadership and opportunities.

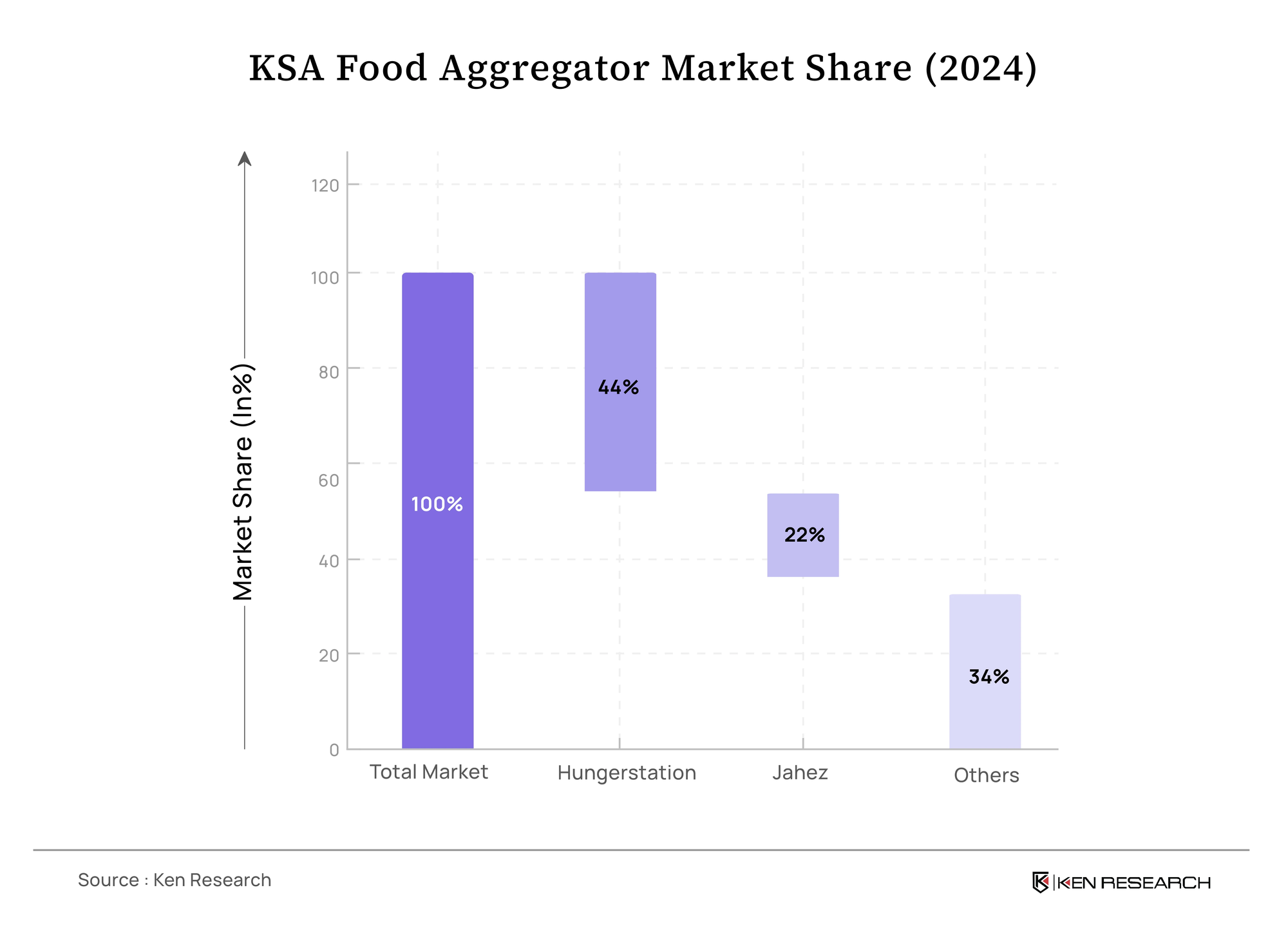

Subsequently, the market is highly consolidated witnessing dynamic competition from major players such as Hungerstation, Jahez, and others. Further, the paper will cover an in-depth competitive analysis of the market.

Market Rivalry of Top Two Giants

- Hungerstation and Jahez are ruling the KSA food aggregator market with a combined market share of 65%.

- In the first half of 2024 (H1 2024), Jahez reported a 31 % year-on-year increase in Gross Merchandise Volume (GMV), with total orders reaching 50.1 million, indicating the company’s expanding customer base and operational efficiency.

- Furthermore, the market is set to reach 1 million daily touchpoints in 2024, indicating significant consumer engagement and opportunities for service expansion, including q-commerce and dark kitchen models.

Hungerstation famous for its delivery of groceries in 20 minutes initially started as a food delivery app. At the moment, the company has a presence in 102 cities of KSA along with UAE and Bahrain.

Recent Mergers & Acquisitions Impacting Market

- Delivery Hero’s acquisition of HungerStation in 2023 for SAR 1116 Mn and unified its command in the KSA market leveraging HungerStation’s strong local brand and operational capabilities.

- Additionally, Uber’s 100 % acquisition of Careem in 2019 expanded regional opportunities by integrating services and securing its footprint across the Middle East.

- While, Noon’s acquisition of Namshi (2024) worked in the diversification of its offerings into fashion e-commerce, going beyond its portfolio of food delivery to enhance market reach and customer engagement.

Why HungerStation Emerged as the Market Leader?

- HungerStation is leading in coverage with operations scaling in over 100+ cities across KSA, making it the most popular and accessible platform for food delivery services in the region.

- On the other hand, 20,000+ restaurant partnerships have given an edge to HungerStation making sure that company’s diverse cuisine options and extensive choices reach every customer.

How Online Delivery is Dominating?

The pandemic has not only boosted the food aggregator market but has also encouraged businesses to enter e-commerce, as it offers convenience. In particular, the young population is driving the demand for online food delivery services.

- While affordability and value-for-money offerings remain critical factors for attracting and retaining customers when the majority of users earn less than SAR 15,000.

What's Next in the Market?

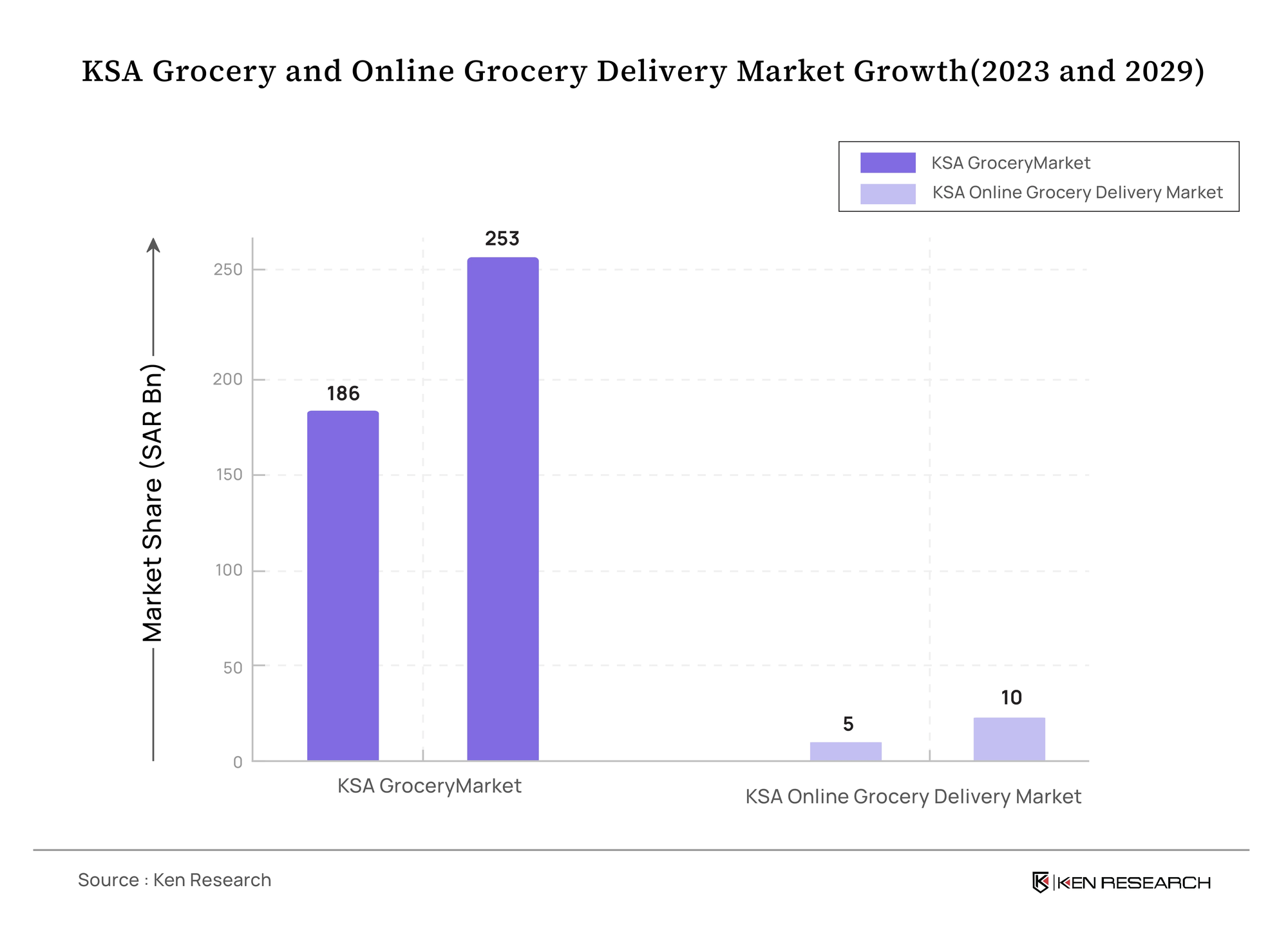

- Major competitors in the market are already adapting to the quick delivery market to promote an online presence for groceries. In support of it GMV share is expected to grow from 15% to 80% in the coming years.

- Plus, E-commerce will help cloud kitchens like HungerStation, Noon Food etc, witness a twofold growth of SAR 50 Bn by 2025 majorly because of Online shopping and digital accessibility.

The KSA food aggregator market is experiencing growth trends never seen before, supported by increasing annual orders, rising GMV, and a stable AOV of SAR 54-55. M&A activities, such as Delivery Hero’s acquisition of HungerStation and Uber’s acquisition of Careem, have transformed the competitive landscape, enhancing leadership and regional opportunities.

Popular cuisines like fast food and healthy options are gaining traction, with young professionals and families driving demand. HungerStation leads with extensive coverage, restaurant partnerships, and app popularity, while quick delivery trends and e-commerce growth reshape the online grocery segment. The market is full of whitespace, creating opportunities for existing firms and new startups to explore untapped areas.