How the Jio-Starlink Alliance Could Redefine India’s Telecom Power Structure?

The Jio-Starlink alliance aims to bridge India's digital divide by combining satellite innovation with telecom reach, potentially reshaping the nation's connectivity landscape.

The Collaboration between two giants India’s Jio and USA’s Starlink has gained attention worldwide. In a bold move that could reshape the future of digital connectivity in India, Reliance Jio and Musk’s Starlink have formed an unexpected alliance, one that merges ground dominance with orbital reach.

With India’s broadband market projected to hit USD 1 trillion by 2030, the biggest gap isn’t technology but it’s access. Despite aggressive 5G and fiber rollouts, over 400 million Indians remain offline, most of them in rural areas. Enter Jio, the country’s telecom titan, and Starlink, a satellite disruptor backed by Musk’s global vision.

The recent partnership between Reliance Jio and Elon Musk’s Starlink aims to address this gap. Initially, Jio opposed Starlink’s entry, advocating for spectrum auctions that would maintain its control over the market. However, a regulatory shift in October 2024, favoring administrative spectrum allocation, forced a change in strategy. Now, with Jio’s scale and Starlink’s satellite network, this alliance has the potential to redefine India’s connectivity landscape.

Beyond expanding digital access, this collaboration carries strategic, financial, and competitive implications that could shape the future of India telecom industry.

Impact on India’s Telecom Power Structure

Jio and Airtel together command 80.9% of India’s broadband market, currently valued at USD 41.8 billion. However, the economic feasibility of expanding fiber and 5G into rural areas remains a challenge. BharatNet, India’s flagship government initiative, has connected only 35% of its target villages, leaving a significant gap.

Satellite broadband presents an alternative. Unlike Jio’s JioSpaceFiber (SES), which operates with just 70 satellites, Starlink’s 5,000+ satellite network offers broader coverage with lower latency. This makes satellite broadband a compelling option for regions where fiber and 5G are not economically viable.

For Jio, the partnership represents a strategic expansion rather than direct competition. Starlink outsources rural broadband infrastructure, reducing Jio’s capital expenditure (CapEx) while retaining control over distribution. With an extensive retail network of 100,000+ outlets, Jio is positioned to scale Starlink’s adoption faster than competitors.

This move also intensifies pressure on Vodafone Idea and BSNL, which together hold less than 5% of the broadband market and lack the satellite capabilities to compete. The result is a further consolidation of the market, reinforcing the Jio-Airtel duopoly.

How will this venture scale and fill the gap?

The success of this initiative depends on execution. While Starlink’s technology provides a coverage advantage, Jio’s distribution and local market understanding will determine adoption rates. The proposed hybrid model, fiber for urban areas, 5G fixed wireless access (FWA) for semi-urban regions, and satellite for rural connectivity, offers a practical solution for nationwide broadband expansion.

However, several challenges could impact scalability. Regulatory approvals from the Department of Telecommunications (DoT) are still pending, which could delay Starlink’s commercial rollout. Additionally, satellite broadband is vulnerable to weather disruptions, with an estimated 10-15% downtime in extreme conditions.

Despite these hurdles, as per Ken research analysis, it is projected that Starlink could onboard 5-10 million rural users by 2030, opening a multi-billion-dollar market opportunity.

Can Starlink Align with India’s Pricing Model?

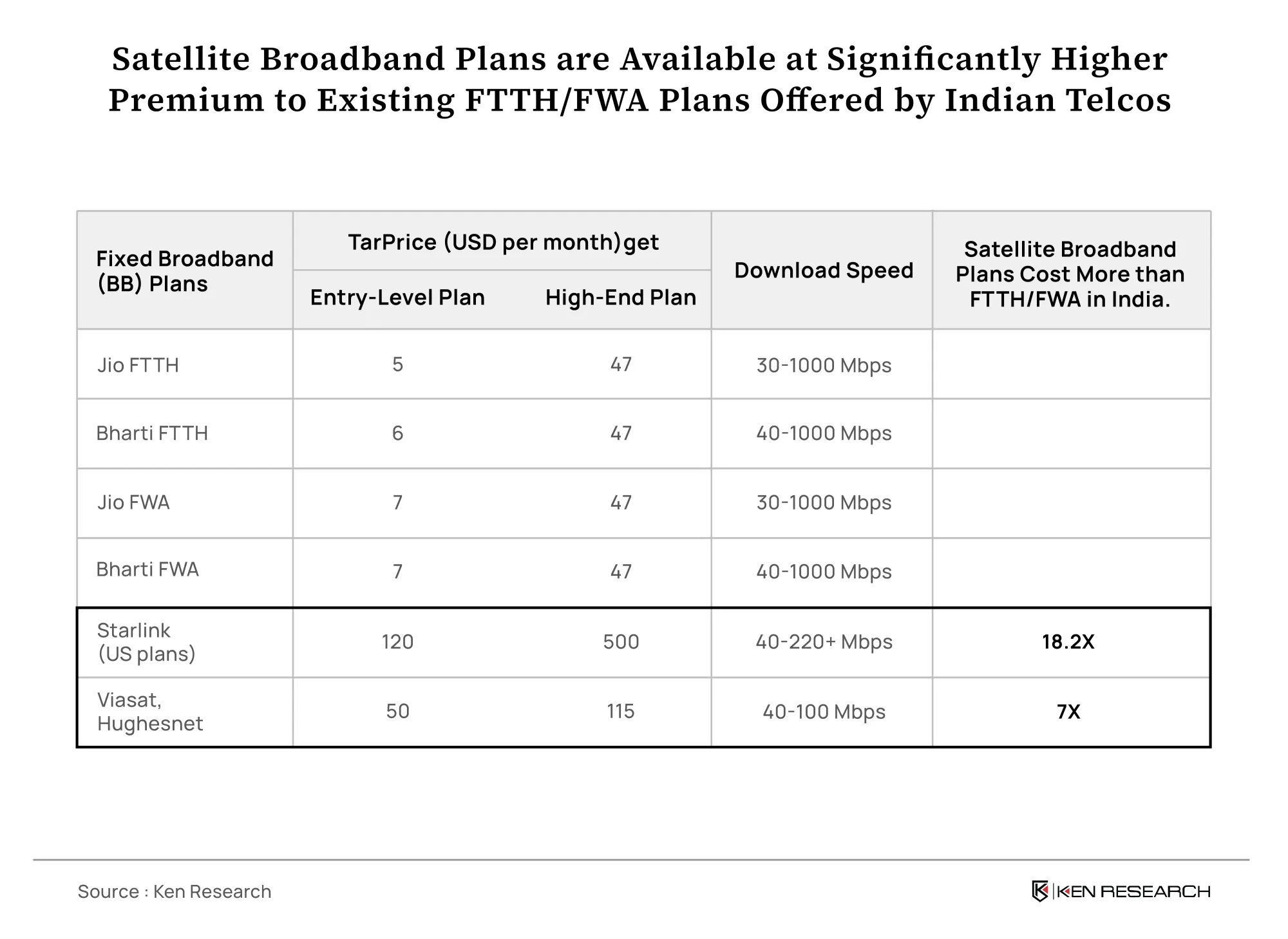

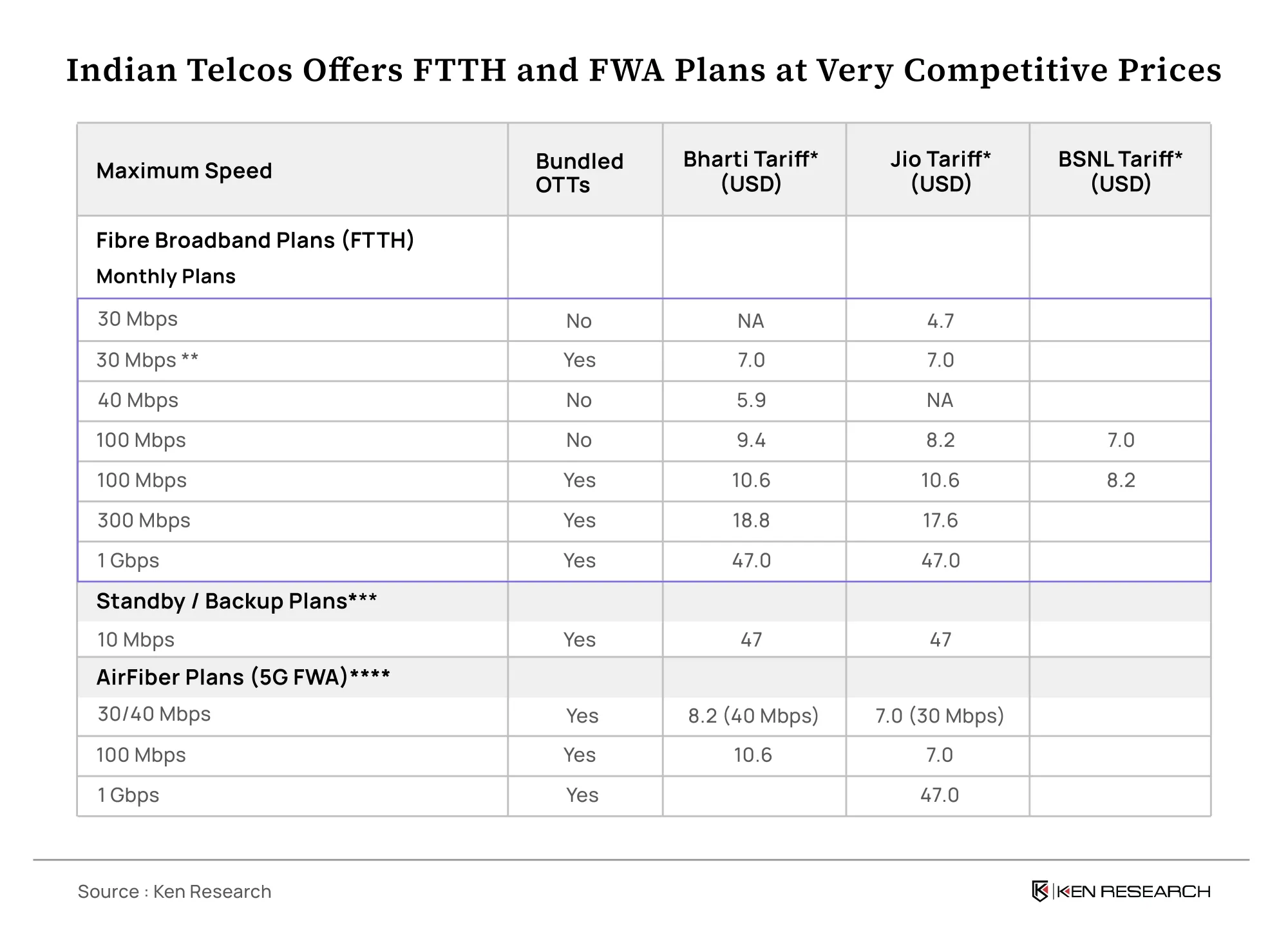

The biggest challenge for Starlink in India is affordability. Broadband pricing in India is among the lowest globally, with an average revenue per user (ARPU) between ₹400-₹1,000 (USD 5-USD 12). Starlink’s global pricing, however, ranges from USD 25-USD 35/month (₹2,100-₹2,900), making it 3-5x more expensive than traditional broadband options.

Jio’s approach to pricing will be critical. The most likely strategy is bundling Starlink terminals with JioFiber or 5G plans, reducing upfront costs for users. Other potential solutions include hardware subsidies (Starlink’s terminals currently cost ₹20,000-₹30,000 or USD 250-USD 380) and tiered pricing for different customer segments (households, SMEs, and enterprises).

Jio has already demonstrated its ability to drive mass adoption through affordability. Its 2016 4G expansion strategy reduced mobile data costs by over 90%, leading to a 45% increase in internet penetration. If Jio can apply a similar model to satellite broadband, rural ARPU could increase from ₹500 to ₹800, making Starlink’s India expansion commercially viable.

What is the Impact on Investments?

For investors, the Jio-Starlink partnership presents both significant upside and execution risks. If Starlink captures 10 million users, even at a conservative USD 25/month ARPU, it could generate USD 3 billion in annual revenue from India alone.

However, several uncertainties remain. Regulatory approvals, pricing adjustments, and infrastructure challenges could impact adoption rates. Starlink must also balance profitability with affordability, ensuring that its India operations align with its broader global strategy.

For Jio, the partnership offers an asset-light expansion model, allowing it to extend market control without heavy infrastructure investments. This could lead to stronger revenue diversification while reinforcing its leadership in rural connectivity.

For investors considering Reliance Jio, Starlink , or broader telecom sector investments, key factors to monitor include Government policy developments and potential incentives for satellite broadband. Jio’s pricing and bundling strategies to ensure affordability. Starlink’s capacity to meet regulatory and infrastructure challenges in India.

Conclusion

The Jio-Starlink partnership marks a pivotal shift in India’s broadband strategy, addressing the country’s rural connectivity gap while strengthening Jio’s market leadership. If executed effectively, this alliance could transform India’s satellite broadband market, expanding access to millions of previously unconnected users.

However, commercial success depends on execution. Jio must ensure affordable pricing and seamless integration with its existing services, while Starlink must adapt to India’s regulatory and operational landscape. Investors should closely watch government policies, pricing models, and user adoption trends as this partnership unfolds.

India’s next phase of digital expansion will not be defined by fiber alone, but by a hybrid connectivity model that integrates satellite technology. As Jio and Starlink take the lead, this could set a precedent for emerging markets globally, redefining the economics of broadband expansion.