Indian SMBs to grow and proliferate

Integrated project management solutions account for 2% of total digital spending and play a crucial role in centralizing customer information.

Indian SMBs have increasingly leveraged technology to enhance their global outreach. With improved internet access, affordable smartphones, and the proliferation of digital communication tools, these businesses can now connect with international customers more effectively.

In recent years, India's small and medium businesses (SMBs) have been on the rise contributing remarkably to the country's economic growth and employment. Technologies such as online meetings, cloud services, and digital payments have facilitated seamless interactions, allowing SMBs to market and sell their products globally without the need for physical presence.

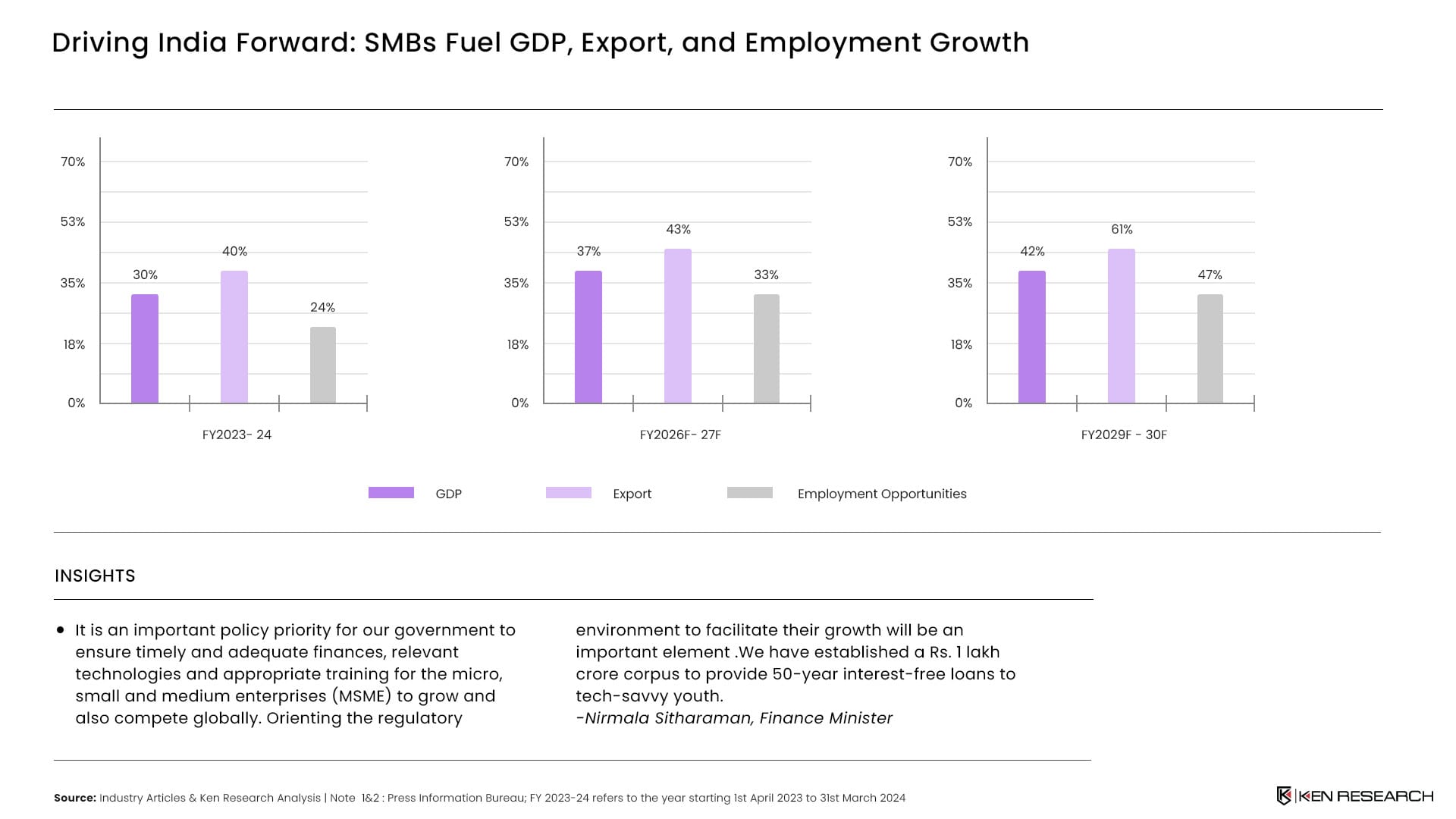

The sector is projected to grow by 1.8X by FY 2029-30 with GDP to grow from 30% in 2023 to 42% in 2029. This growth is expected to be driven by a range of factors:

- Brand Discoverability by going digital: About 51% of enterprises in India are based in rural areas, playing a crucial role in local and national economic growth. The transition to digital enables SMBs to operate 24/7, providing customers with the convenience of shopping at any time. Currently, approximately 62% of SMBs use websites, online stores, or e-commerce platforms as their main sales channels, and 83% of small businesses have embraced online selling in the last five years.

- Integrated Project Management in SMB ecosystem.: Integrated project management solutions account for 2% of total digital spending and play a crucial role in centralizing customer information. By 2025, the market size is expected to reach an impressive $1.5 trillion fueled by the accelerating pace of digitization and the impetus provided by government-led initiatives aimed at fostering the SMB ecosystem.

- Connected Cloud Services to reach $2,291.59 billion: The cloud services market for small and medium-sized businesses (SMBs) is prepared for advancing growth, projected to rise from $676.29 billion in 2024 to $2,291.59 billion by 2032, with a compound annual growth rate (CAGR) of 16.5%. The retail sector is expected to maintain its dominance, capturing 46% of the market share, while real estate is forecasted to hold 4%.

An analysis of India’s competitiveness

India's competitiveness in the chemicals sector can be analyzed through three interconnected categories: Compatible Connectivity, End-Point Security, and Connected Cloud Services. Each of these areas plays a crucial role in enhancing the overall efficiency and effectiveness of Indian small and medium-sized businesses (SMBs) in the chemical industry.

Compatible Connectivity: India is self-sufficient in technology adoption but it still lags digital skills. India demonstrates a strong commitment to technology adoption, particularly among its SMBs, which are leading globally in technology spending. Approximately 35% of these businesses allocate over 10% of their revenue to technology initiatives. However, a significant barrier remains the lack of a skilled workforce trained in digital technologies.

End-Point Security: India is increasingly focusing on self-reliance in Cybersecurity solutions but still relies on traditional security measures. The Indian cybersecurity market is set for impressive growth, expected to rise from USD 4.70 billion in 2024 to USD 10.90 billion by 2029. Nevertheless, many SMBs still depend on outdated security practices, which undermine their technological advancements and expose them to risks. 88% of Indian SMBs reported experiencing cybersecurity incidents in the past year, highlighting a critical vulnerability within this sector.

Connected Cloud Services: India is self-sufficient in Digital Transformation but still lags due to limited resources. The cloud is projected to play a major role in boosting India's economy, with estimates indicating that it could contribute between 5% and 8% to the country's GDP by 2026. In real terms, this means the cloud could add anywhere from $310 billion to $380 billion to the economy. However, the implementation and management of these cloud services are often hindered by a lack of dedicated IT resources and expertise.

Limited Access to Finance

Micro / Solopreneurs are only able to make digital spend less than 20 Lakhs followed by small business owners who are making digital spends of 0.2-1 Cr. One of the most significant challenges faced by Indian SMBs is limited access to finance. Many small businesses struggle to secure loans or adequate capital due to stringent eligibility criteria, high collateral demands, and complex application processes.

While exports are projected to reach $915 billion in FY 2029-30.

Out of the five main segments of the sector— Manufacturing, Service Industry, Food and Beverage, Beauty and Wellness, and MedTech— the Manufacturing sector is expected to dominate exports in the future. With a strong focus on "Make in India" initiatives and government support for manufacturing, this sector is poised to leverage its capabilities to meet both domestic and international demand, contributing significantly to India's overall export growth.

Benchmarking India’s financial competitiveness in SMBs

While it's evident that Indian SMBs are poised for potential growth, their financial competitiveness remains uncertain. Benchmarking the sector against five global chemicals clusters—China, USA, Germany, Singapore, and UK —across number of variables shows that though India is more or equally competitive on most counts, other countries have a competitive edge over India in a few crucial respects.

Potential winning opportunities in India’s SMBs sector

Today, the Indian SMBs offer several opportunities to build at-scale businesses across several specialty, and segments. Identifying these opportunities calls for the right balance between market attractiveness and cost competitiveness. While cost competitiveness is generally a function of Holistic Payment Solutions, Productivity and Collaboration, and Vertical Solutions is a composite of current market size, expected CAGR, and macrotrends.

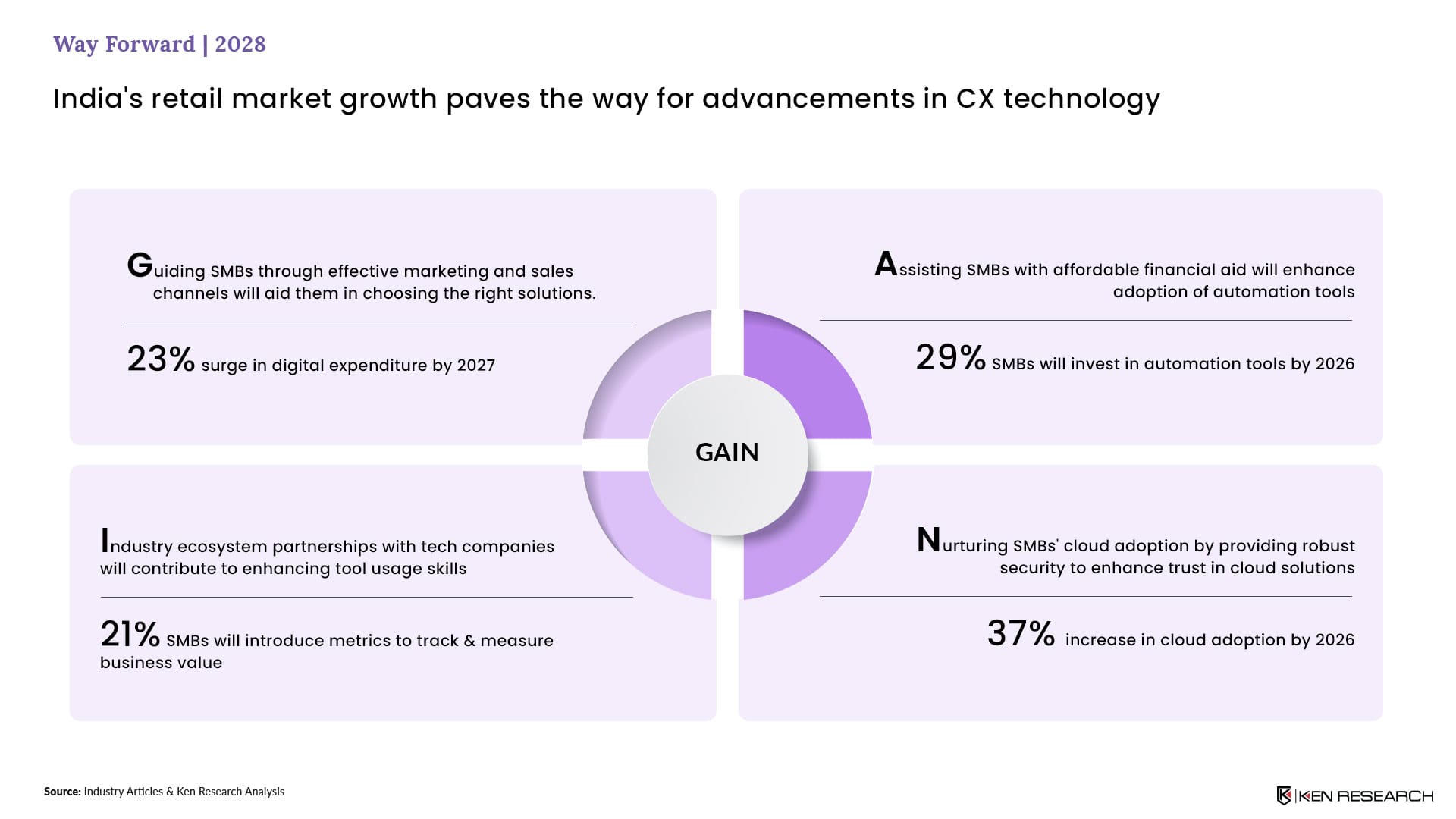

Holistic Payment Solutions with 23% rise: Holistic payment solutions, such as those offered by platforms like Easebuzz and Payoneer, provide a wide range of payment methods. This includes options for online transactions, mobile payments, and cross-border payments with a 23% surge in digital expenditure by 2027.

Productivity and Collaboration with increased automation: Collaboration tools are seen as enablers of growth for Indian SMBs, 21% of SMBs will introduce metrics to track & measure business value. Collaboration tools like Microsoft Teams enhance SMBs' productivity by streamlining communication, file sharing, and project management. 29% of SMBs will invest in automation tools by 2026

Vertical Solutions with increased cloud adoption: Vertical solutions are emerging as a significant opportunity for Indian small and medium-sized businesses (SMBs), providing tailored services that cater to specific industry needs. By leveraging vertical solutions, SMBs can differentiate themselves in the market with 37% increase in cloud adoption by 2026.

Implications for Indian and global companies to reflect on

Indian SMBs are also leading in technology investment, with many allocating over 10% of their revenue to tech, which enhances their operational efficiency and competitiveness. Government initiatives like Atmanirbhar Bharat provide essential support, enabling SMBs to innovate and expand globally.

Questions to be addressed

Global SMBs interested in entering or scaling up their businesses in India should, however, strategically ponder upon several questions, such as: What is the current market demand for our products/services in India? Who are our main competitors in the Indian market? What are the legal and regulatory requirements for foreign businesses in India? What are the costs associated with entering the Indian market?

Similarly, Indian SMBs need to reflect upon numerous questions, such as: How can SMBs leverage digital tools to enhance operational efficiency and customer engagement? How can Indian SMBs utilize e-commerce platforms to reach a global customer base? What funding options are available for SMBs looking to invest in technology and expansion?