How is India Soy-Protein Market Creating a Breakthrough in Plant-Based Nutrition?

India's soy-protein market is driving a plant-based nutrition revolution, fueled by health trends, rising veganism, and demand for sustainable protein alternatives in food, beverages, and supplements.

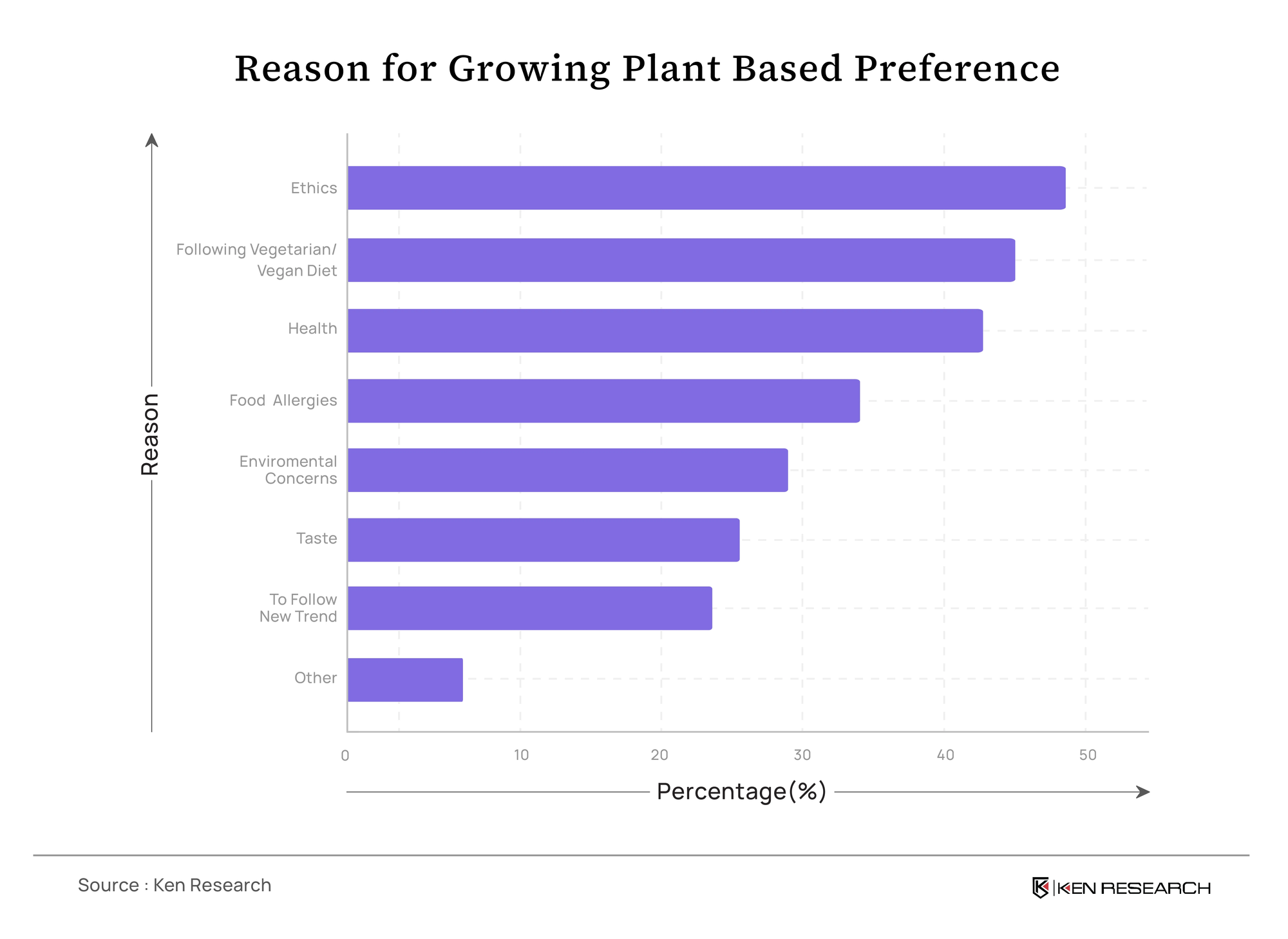

India’s dietary landscape is undergoing a transformation with 24% of its population now identifying as vegetarians and 9% of the population as vegan. This change is primarily caused by the rising need and awareness to reduce animal deaths for human consumption.

As a result, India Soy- Protein market saw a stunning rise in revenue reaching a market size of USD 525 million in 2023. Simultaneously, the market has become a compelling space for investment due to more people turning vegetarian or vegan, accompanied by government initiatives.

Let’s look deeply into what caused the propulsion and made the Indian soy protein market a promising destination for inquisitors and investors alike.

Resilience Through Rough Tides

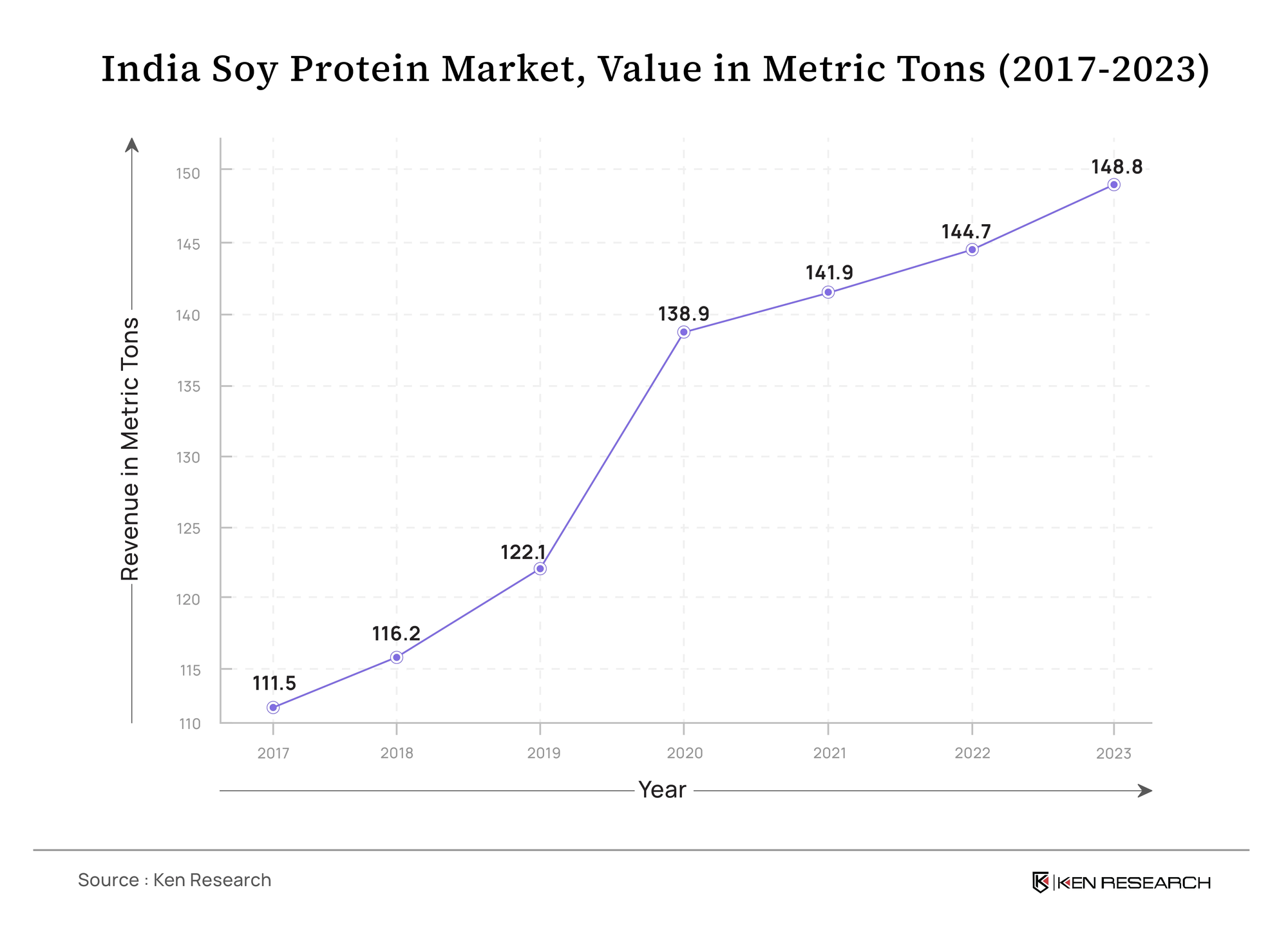

- The market has demonstrated resilience even during the most challenging time any nation has undergone, i.e. the COVID-19 pandemic. In 2020, the soy protein market went through a remarkable growth of 14.09% amidst the pandemic.

- This surge was a result of an increased focus on health and immunity, showing how plant-based protein will constantly be in demand due to its health benefits.

Highlighted Benefits of Health

- As soy protein is a complete protein powerhouse addressing issues related to heart health, cancer risk, digestive health, and overall nutritional needs, nearly 70% of Indians are willing to make dietary adjustments for its health benefits.

- These benefits highlight a huge consumer base eager to adopt soy protein products, driven by ethical, environmental, and health-conscious choices.

How the Market is Looking at the Present

- By 2023, The Indian soy protein market has produced nearly 148 metric tons, out of which protein isolates are the most popular.

- Under segmentation by form type, isolates hold a share of 57.4% because of their ability to mix well and dissolve easily, making them a great choice for dairy and meat alternatives.

- However, forecasts show that hydrolysates are expected to gain much more momentum in the coming years growing at a 4.1% CAGR.

- India’s lactose-intolerant population of 60% fuels the transition to plant-based dairy substitutes like soy milk and tofu. Under the segmentation of end-users, the food and beverages segment owns 57% of the share, as the demand for lactose-free and nutrient-rich alternatives is significantly growing.

Along with these opportunities, government initiatives like 100% FDI in food processing and 100% income tax exemptions for new food processing units for the first five years, create an inviting environment for investments.

Why Invest in India’s Soy Protein Market?

India’s soy protein market is a clear reflection of evolving user preferences and sustainable living. Factors like Shifting dietary habits combined with rising health consciousness create a need for ethical and eco-friendly product lines gaining momentum in the future.

In short, the opportunities for investors lie in aligning with these trends and developing innovative solutions to gain traction in the market. Whether it’s through product differentiation, infrastructure investments, or leveraging government policies, the soy protein market in India is creating a new dawn for plant-based alternatives.