How Can India Establish Itself as a Semiconductor Hub by 2035?

India's semiconductor market is on the rise, projected to reach $64 billion by 2026. With significant investments and a focus on self-reliance, the future looks promising for decision-makers.

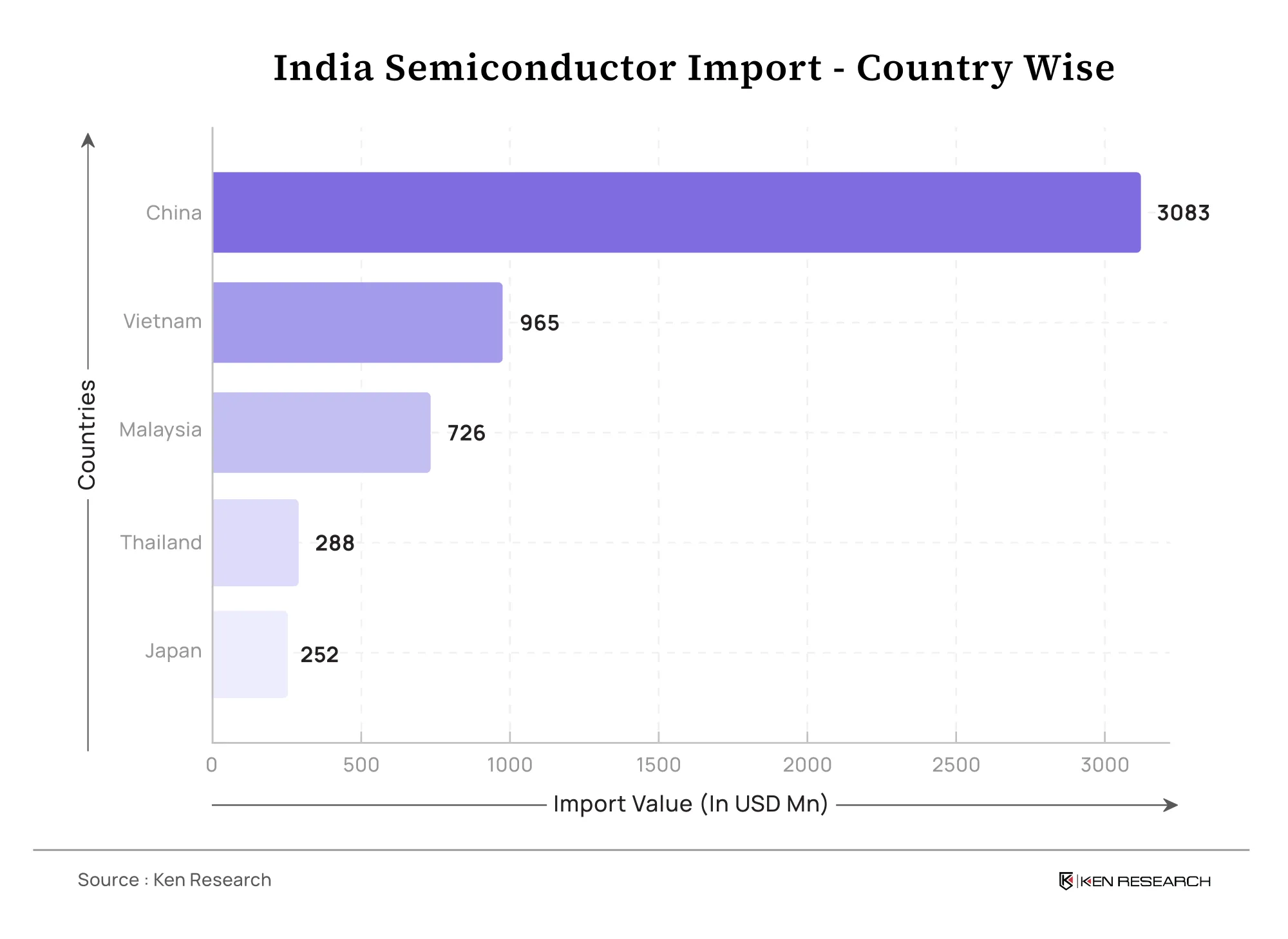

India has come a long way in the global semiconductor market, achieving remarkable feats in recent years. However, it still imports 90-95% of its semiconductor chips to meet its growing domestic demand. In 2023 alone, India imported semiconductors worth USD 18.40 billion from countries such as China, Vietnam, and Malaysia, making it the fifth-largest semiconductor importer globally.

Despite its reliance on imports, India is making rapid progress in developing a domestic semiconductor industry. Under the "Make in India" initiative, the government aims to position the country as a semiconductor hub by 2035. This vision is already witnessing results as India, while still a major importer, emerged as the 14th largest exporter of semiconductor devices in 2023, worth USD 6.70 Bn.

With continued investments, infrastructure development, and policy support, India semiconductor market has the potential to shift from an importer to a global semiconductor powerhouse.

Building a Self-Sustaining Semiconductor Market

- The Indian government has launched strategic initiatives to establish a strong semiconductor ecosystem. Among them, the Semicon India Program, introduced in December 2021 with a total allocation of USD 8.79 billion, is designed to develop semiconductor and display manufacturing capabilities. The program aims to attract global semiconductor firms, encourage local manufacturing, and enhance supply chain flexibility.

- Additionally, India's first domestically produced semiconductor chip is expected to be rolled out in 2024, marking a remarkable milestone in the country’s self-reliance journey. The sector is also projected to generate over 1 million jobs by 2026, further driving economic growth and technological advancements.

Foreign Investments Driving Growth

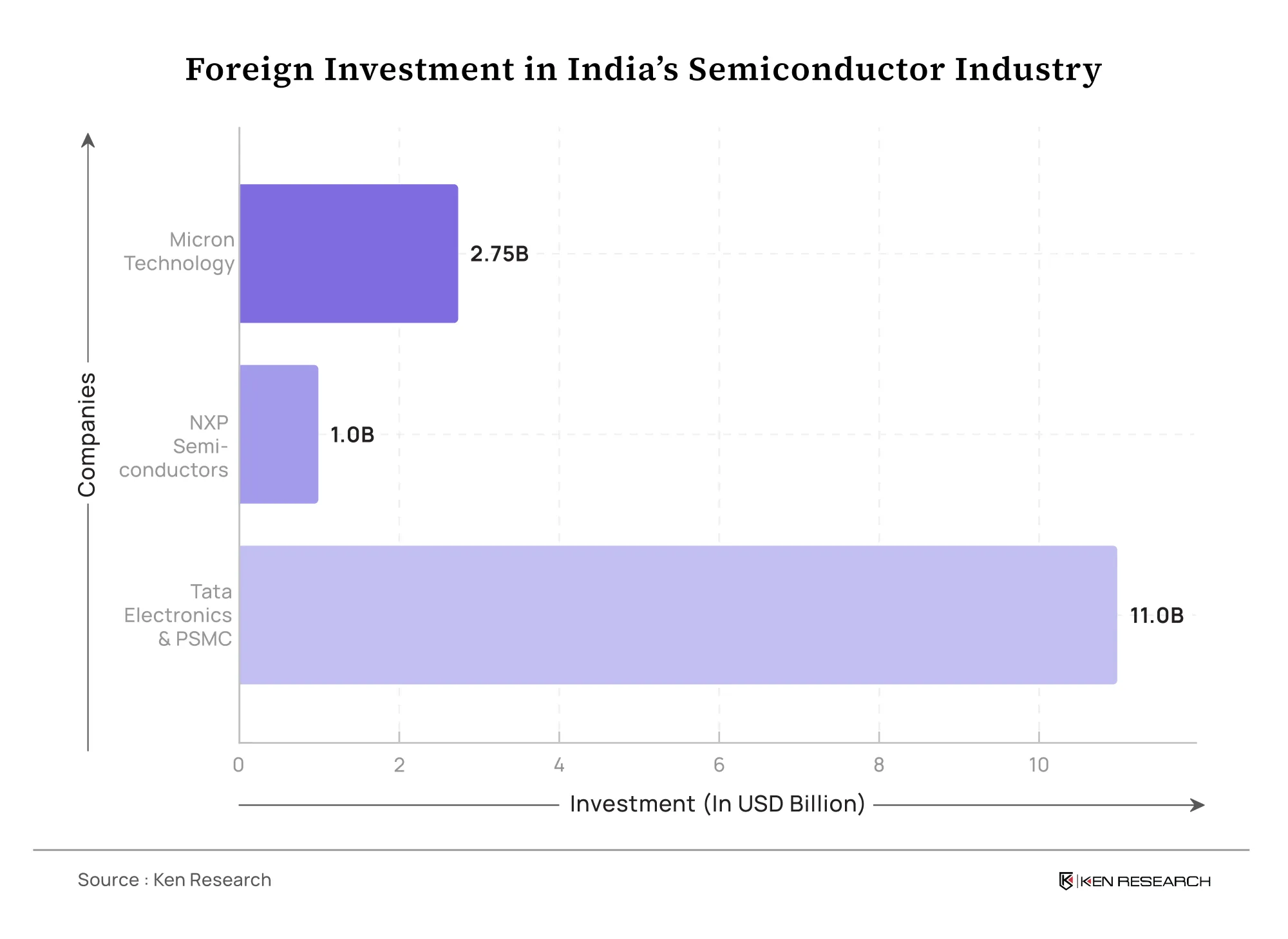

India’s semiconductor industry is attracting substantial foreign direct investment, reinforcing its position in the global market.

- Micron Technology’s Semiconductor Plant: In 2023, the U.S.-based Micron Technology announced an investment of USD 825 million to establish India's first chip production and testing plant in Gujarat.

- The project, valued at USD 2.75 billion, is being developed in partnership with the central and state governments, which will contribute 50% and 20% of the funding, respectively.

- NXP Semiconductors’ Research & Development Expansion: The Dutch semiconductor firm plans to invest USD 1 billion in research and development, along with micron technology for an assembly and testing plant in Gujarat. This investment will further develop India’s capabilities in high-value semiconductor production.

- Tata Electronics and Powerchip Semiconductor’s Fab Plant: Tata Electronics, in collaboration with Taiwan’s Powerchip Semiconductor (PSMC) has announced an USD 11 billion semiconductor fabrication plant in Dholera, Gujarat. This mega project is expected to create approximately 20,000 skilled jobs and substantially reduce India’s reliance on imported chips.

Advancing Research & Development for Long-Term Competitiveness

- In order to develop a domestic semiconductor ecosystem that goes beyond manufacturing, it requires innovation in chip design and R&D capabilities. The Indian government has launched the National Chip Design Infrastructure (NCDI) initiative, providing semiconductor designers with essential resources and infrastructure to foster local chip innovation. This initiative aims to bridge the gap between global semiconductor leaders and India’s domestic industry.

- Private sector players are also driving innovation in the sector. TCS (Tata Consultancy Services), in partnership with Tata Electronics, is set to manufacture India’s first homegrown semiconductor chips by 2026. The company is actively investing in semiconductor design and engineering to ensure India’s competitiveness in the global supply chain.

Eliminating Infrastructure Gaps for a Robust Supply Chain

While India has made commendable progress, challenges remain in building a world-class semiconductor infrastructure.

- Supply Chain Efficiency: India needs to develop a robust semiconductor supply chain, including raw material sourcing, packaging, and assembly. To address these challenges, in 2024, the Indian government allocated USD 15.2 Bn for three semiconductor manufacturing plants under the “Development of Semiconductors and Display of the Manufacturing Ecosystem”.

- Additionally, establishing dedicated semiconductor clusters and logistics hubs will be crucial to ensuring uninterrupted production.

- Skilled Workforce Development: The semiconductor industry requires a highly skilled workforce. Expanding specialized training programs and university partnerships will be essential to producing the next generation of semiconductor engineers.

- Subsequently, 70% of engineering colleges now partner with semiconductor firms for internships and co-op programs to overcome this workforce crisis.

- Policy Incentives & Financial Support: Government-led incentives such as tax benefits, subsidies, and relaxed regulatory norms, will further attract global semiconductor firms and encourage domestic innovation. The union government has already initiated the Semicon India Programme and other incentive programs to develop the domestic semiconductor industry.

The Promising Future Ahead

India semiconductor industry is still in its initial stage but is experiencing unprecedented growth due to supportive government policies and increasing foreign investments. With the first fully domestically manufactured semiconductor chip expected by 2026, India is poised to strengthen its role in the global semiconductor supply chain.

To capitalize on this momentum, India must prioritize investment in research and development, establish strategic partnerships with global semiconductor leaders and develop a strong supply chain ecosystem. By focusing on innovation and expanding local manufacturing capabilities, India can position itself as a key player in the global semiconductor landscape by 2035.