Customer Experience in Indian Retail – Strategic Roadmap for a ₹110 Cr Market Opportunity

India’s ₹110 Cr retail customer experience market is accelerating, driven by omnichannel strategies, AI-driven personalization, and tech-enabled in-store journeys. This POV outlines CX trends, ROI benchmarks, and strategic imperatives shaping India’s retail transformation.

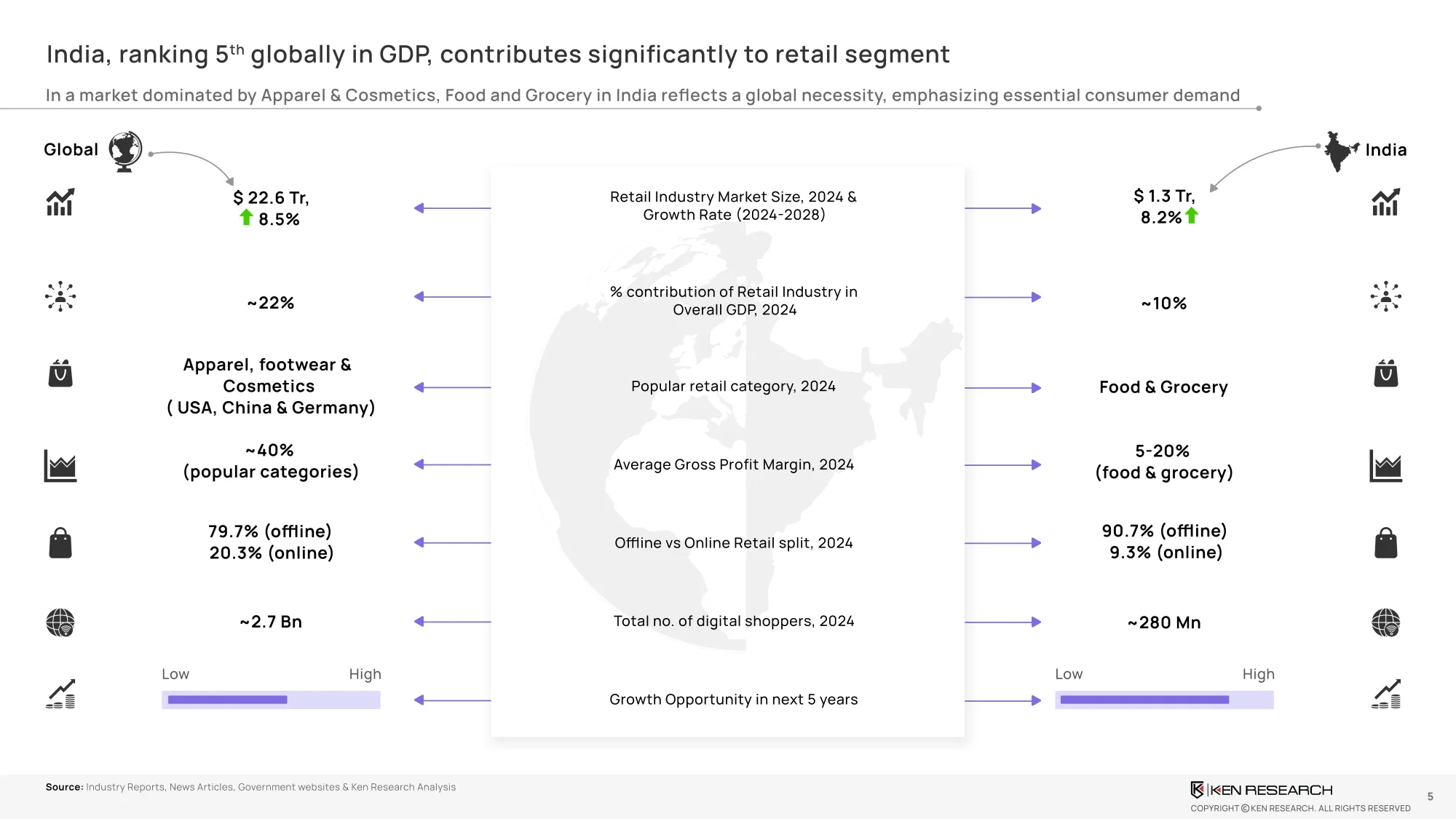

India’s retail sector, valued at over USD 1.3 trillion, is at an inflection point. Digital penetration is growing rapidly, yet most retailers are underinvested in scalable, ROI-driven customer experience (CX) strategies. This Point of View (POV) explores the evolution of CX in Indian retail, drawing from current data, case studies, and implementation frameworks to help leaders transform fragmented customer journeys into profitable, personalized experiences.

15 Slide Deck | Industry Benchmarks | High-Impact Use Cases | CX Technology Adoption Pathways

WHO THIS POV IS FOR

This strategic POV is intended for:

- Retail CXOs and Digital Heads tasked with driving omnichannel experience

- Retail technology partners building personalization, analytics, and AR-driven platforms

- Private equity and venture capital firms seeking high-growth CX transformation investments

- CX strategists and design leaders working on hybrid, Tier 1–Tier 3 retail deployment models

EXECUTIVE SUMMARY

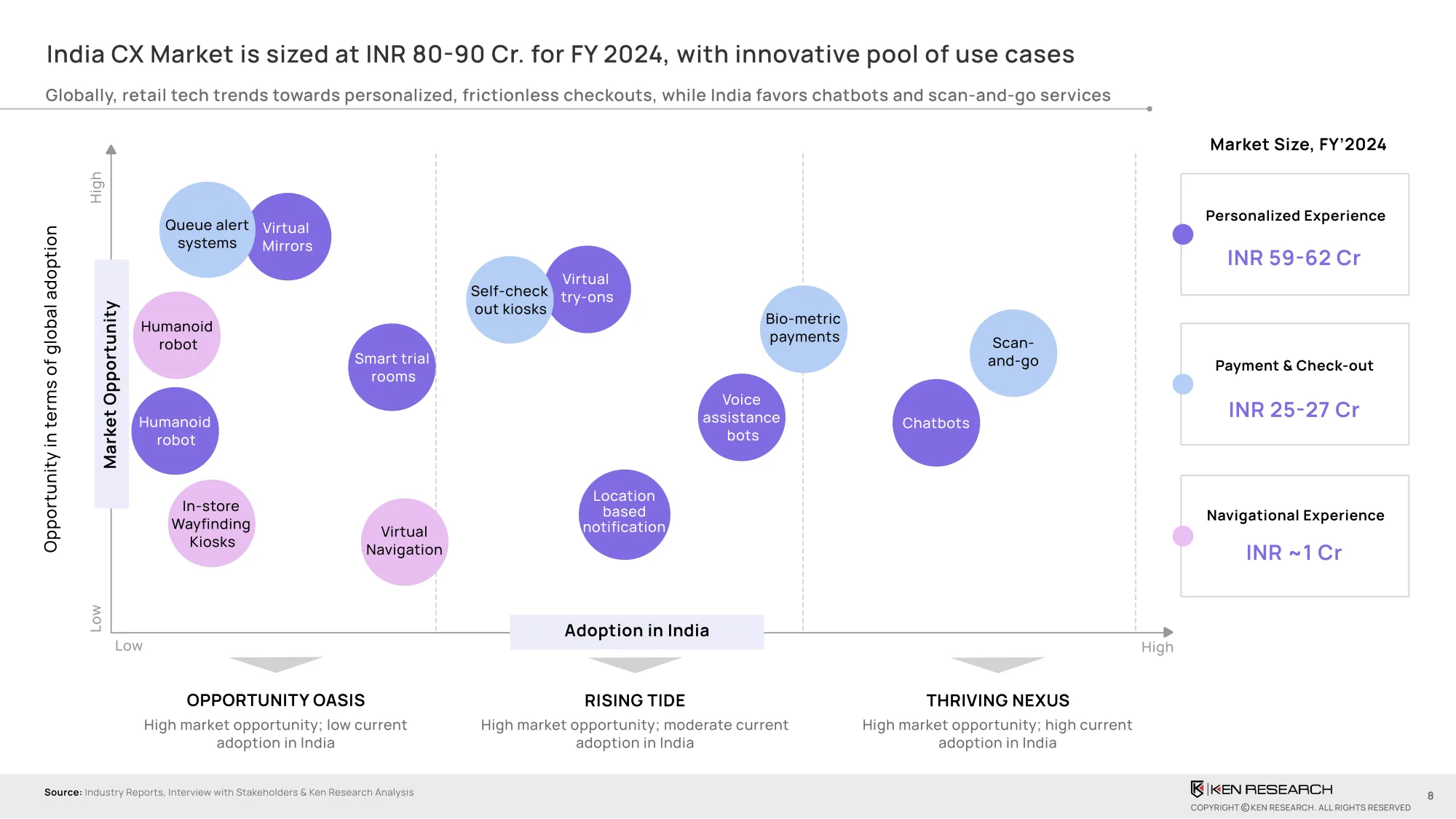

The current value of the Indian retail customer experience market is estimated between ₹80–90 crore in FY2024, with growth expected at a CAGR of 6.3% through FY2028. This growth is fueled by rising consumer expectations, increasing digital behavior, and tangible results from early-stage CX tech deployment.

Key Drivers of CX Investment:

- Over 280 million Indian shoppers now engage digitally, but offline still dominates (90.7%), exposing a delivery-expectation gap

- 75% of urban consumers express preference for integrated, omnichannel retail experiences

- Retailers piloting AI, AR, and personalized interfaces are seeing double-digit ROI uplift, but overall market penetration remains low

MARKET SNAPSHOT – CX INVESTMENT OUTLOOK

India’s organized and unorganized retail sector has undergone significant growth over the last decade. Yet the CX investment remains disproportionately low relative to customer expectations and revenue contribution.

Breakdown of CX Market in India (FY2024):

- ₹59–62 Cr – Personalization-driven CX investments (AI-based product recommendations, loyalty integrations)

- ₹25–27 Cr – Checkout and payment CX layers (scan-and-go, mobile payment optimization, queue alerts)

- ₹1 Cr – Navigation-based CX (in-store wayfinding, AR overlays, store-to-aisle guidance)

Digital commerce is expanding at 3x the rate of offline retail, but offline continues to deliver the majority of volume and remains the largest CX transformation opportunity.

TECHNOLOGY LANDSCAPE – EVOLVING CX TOOLSETS IN INDIAN RETAIL

CX technologies in India fall under three distinct maturity and adoption zones:

Opportunity Oasis (High impact, low penetration):

- Voice assistants and biometric-based payment kiosks

- Humanoid service bots and multilingual support tools

Rising Tide (Emerging use):

- Augmented reality mirrors and virtual try-ons

- Smart kiosks for scan-pay-go experiences

- Sensor-based customer flow tracking

Thriving Nexus (High adoption, measurable ROI):

- Chatbots and NLP-based conversational interfaces

- Queue optimization systems and push notifications

- Feedback collection tools integrated with loyalty systems

Retailers investing in multi-layered CX stacks—combining physical, digital, and mobile touchpoints—have consistently achieved higher revenue per square foot and customer retention.

COMPETITIVE ADVANTAGE – WHY CX IS A PROFIT STRATEGY, NOT JUST UX

Early adopters of CX innovation in India have demonstrated direct linkages between experience redesign and bottom-line improvement:

Benchmark Case 1 – Top 5 Indian Retailer:

- AI-led product mix personalization

- ₹33M margin improvement within one fiscal year

Benchmark Case 2 – Large Footwear Chain:

- Custom chatbot deployment + smart trial room A/B rollout

- 73% sales uplift attributed to ease of product discovery and mobile-first CX journey

Benchmark Case 3 – In-House Journey Mapping (2019 cohort):

- 2x increase in repeat customer revenue following CX redesign

POLICY LANDSCAPE – CX COMPLIANCE & ETHICAL PERSONALIZATION

CX strategies in India must operate within evolving privacy, consent, and data localization regulations. The Digital Personal Data Protection (DPDP) Act is already shaping how Indian retailers must:

- Deliver consent-based personalization at the point of interaction

- Store, process, and anonymize consumer feedback and biometric data

- Maintain CX continuity across systems while complying with interoperability requirements

Additionally, CX designs must ensure accessibility and inclusivity across India’s wide spectrum of tech literacy and regional language needs.

APPLICATION CASES – CX STRATEGY IN ACTION

Azorte (Reliance Retail):

- Implemented RFID-based smart trial rooms, self-checkout kiosks, and digital discovery terminals

- Results: Reduction in queue abandonment, improved conversion on high-margin SKUs, higher footfall in omnichannel zones

Senco Gold & Diamonds:

- Deployed “Sencoverse” – India's first virtual jewelry showroom in the metaverse

- Gamified product trials and remote walkthroughs enhanced conversion for Tier 2 city buyers

IKEA India:

- A/B testing of smart fitting rooms with mobile integrations

- Delivered a 73% boost in trial-to-purchase ratio

STRATEGIC IMPERATIVES – WHAT CX LEADERS IN INDIA MUST DO

To maximize CX ROI and long-term loyalty, Indian retail organizations should

- Anchor CX budgets to revenue-linked impact – prioritize investments that demonstrate ROI in customer retention, upsell, or cart value

- Start with deployable layers – chatbots, digital trial rooms, queue systems

- Bridge offline and online behaviors – unify loyalty systems, shopping journeys, and payment interfaces

- Enable insight loops – A/B test features, track feedback in real time, optimize journeys monthly

- Design for access and trust – build CX flows that account for language, literacy, and device compatibility

CX IS A P&L STRATEGY IN INDIA’S RETAIL FUTURE

CX is no longer a UX exercise—it is the next growth engine for Indian retailers across segments. With ₹110 Cr in measurable market opportunity, digital-savvy customers, and rising platform complexity, the next phase of competitive advantage will belong to retailers who act now, implement quickly, and personalize ethically.