Why Record-breaking Investments are the Next Phase of India’s Real Estate Expansion?

India real estate sector is booming, driven by strong investments, infrastructure growth, and rising demand for premium properties, shaping a dynamic future.

The Indian real estate industry is witnessing significant growth trends and transformation, backed by strong economic fundamentals, evolving buyer preferences, and favourable policy outlooks. With major investments in smart cities, metro rail networks, highways, and commercial hubs, India is shaping up to be one of the best-performing economies globally.

Moreover, Experts predict that average home prices in India will rise steadily due to demand for premium properties. This paper aims to analyse the major investment and its impact on the real estate industry in India.

How Government is Uplifting the Industry?

- In the annual budget FY23, the Indian government allocated INR 10,00,961 Cr for capital investment in the country. Out of which, the highest spending is allotted to the Ministry of Road Transport and Highways with an allocation of INR 2,70,435 Cr, followed by railways, which received its highest-ever budget of Rs 2.4 lakh crore in 2023.

- Moreover, the Indian government also launched several initiatives and Schemes like the Pradhan Mantri Awas Yojana (PMAY) to further support the real estate industry in the country, which has already sanctioned over 12 million houses, with more than 6.4 million completed by 2023.

- Additionally, in the 2023 budget, PMAY increased its expenditure by 66% over INR 79,000 Cr. Now, the budget 2024-25 is aiming to provide 3 Cr more houses in rural and urban areas under the PM Awas Yojana further solidifying the real estate sector in untapped regions.

What is the Role of the Private Sector in Growing Workspace Infrastructure?

- In June 2024, Onward Workspaces announced an expansion in Delhi-NCR, adding 150,000 square feet to its portfolio with a hold of investment of Rs. 18 crores. This expansion includes four new centers in Sector 126, Noida; Okhla Phase 3, Delhi; and Connaught Place (CP), Delhi.

- Additionally, 12.4 Mn sq feet of office space has been sold between April and June 2023 across the country, a 6% Q-o-Q increase compared to last year. Further, Investment inflows in the office sector rose 53% YoY during 2023, reaching USD 3.0 billion.

All-Time High FDI in the Industry

- Bolstered by PLI incentives, FDI in Indian manufacturing hit USD 165.1 billion, marking a 69% increase over the past decade. The last five years saw total FDI inflows of USD 383.5 billion into India.

- Further, increased capital deployment in the July-September quarter has led to a record high of USD 8.9 Bn of equity inflows in the first 9 months of 2024, accounting for 46% year-on-year growth.

- Delhi-NCR has emerged as the epicentre by accounting for 32% of the land deals nationwide, while Gurugram leads the race with a 65% share. Additionally, around 23,500 residential units were launched in Delhi NCR in the first half of 2024, exceeding the total launches of 2023, which stood at 22,707 units.

Where is the Money Flowing?

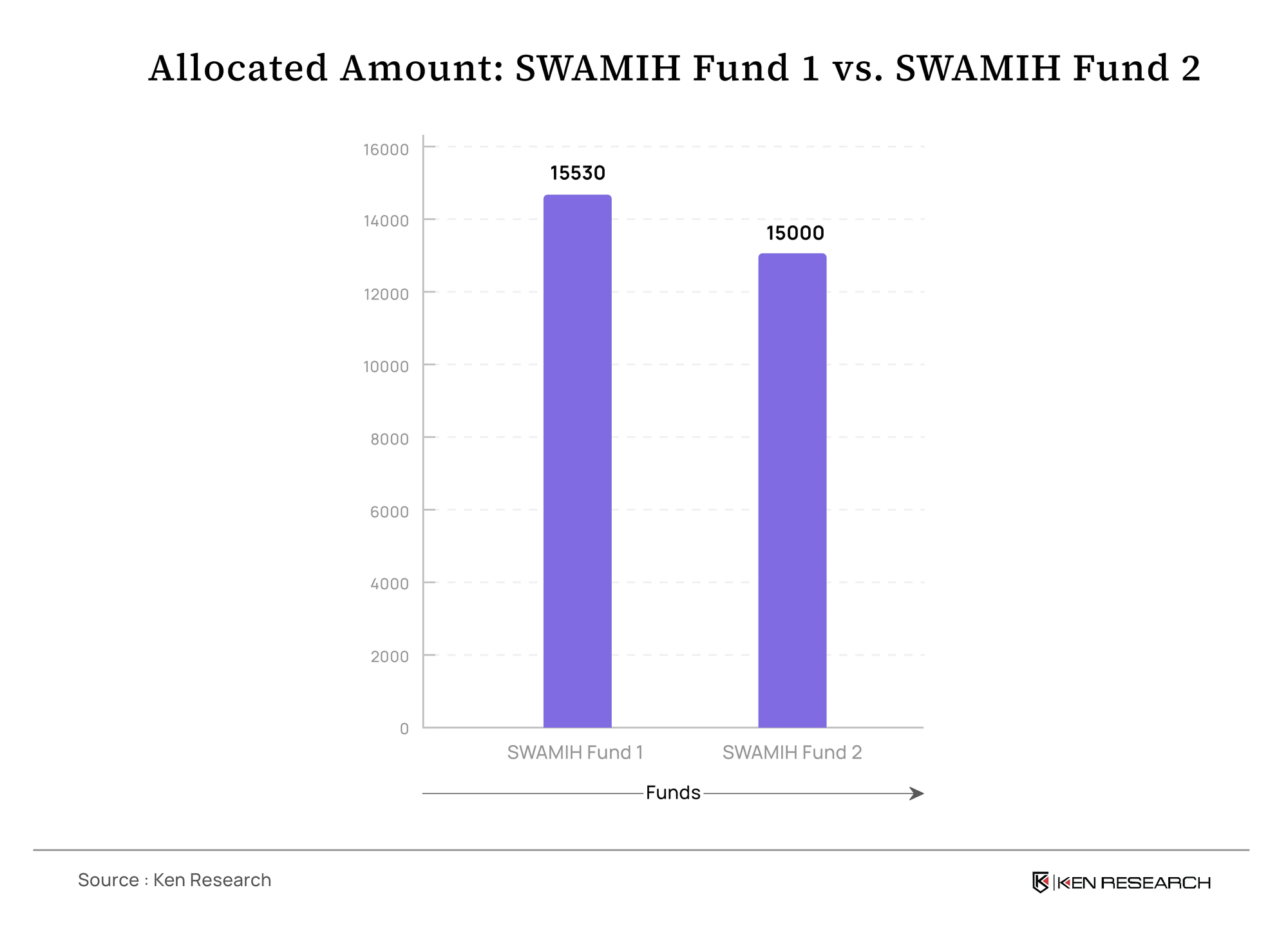

- SWAMIH (Special Window for Affordable and Mid-Income Housing) Fund 2, which will operate as a blended finance facility, has been allocated INR 15,000 Cr in the Union Budget 2025 to fast-track the completion of 1 lakh stalled housing units.

- Previously, with a capital commitment of ₹15,530 crore, SWAMIH 1 has already facilitated the completion of over 50,000 homes and aims to deliver 60,000 more in the next three years.

- The Budget 2025-26 has even prioritised urban development as one of the six transformative reform sectors with an allocation of INR 96,777 Cr to the Ministry of Housing and Urban Affairs (MoHUA).

India’s real estate market is undergoing a remarkable transformation, indicated by record-breaking infrastructure investments, policy-driven housing initiatives, and soaring workspace expansions. With capital allocations for highways and railways in the FY23 budget—India’s urban landscape is changing. Government initiatives like PMAY are set to expand further, targeting three crore more homes in the coming years.

Delhi-NCR are emerging as investment hotspots, driving record-high land deals and FDI inflows. Meanwhile, the SWAMIH Fund 2 allocation aims to fast-track 1 lakh stalled housing units, further strengthening India’s residential market. With urban development now a national priority, India stands on the brink of a real estate revolution, set to redefine, accelerate infrastructure growth, and unlock new opportunities in the sector.