How India’s Increasing Consumer Expenditure is Transforming India's Mid-Scale Hotel Sector

Discover how rising consumer expenditure in India is reshaping the mid-scale hotel sector, driving growth through increased domestic travel, evolving preferences, and demand for affordable yet quality hospitality experiences.

India’s Tourism and Hospitality Sector has shown exceptional growth in recent years and is expected to grow at a raging CAGR of 9.1% in the next decade. Along with this, a developing nation like India is expected to double its middle-class population by 2031, reaching 165 million households.

For Businesses operating in this field, the demanding growth of mid-scale hotels in India is directly proportional to this increasing middle-class population. Further, the industry is still in its initial stage in the country, anticipating conquering untapped regions as demand for affordable luxury pertains. This article is a tool for businesses looking to expand and explore the Mid-scale hotel market In India.

Growing Financial Condition of Mid-Sized Income Group

- The rising disposable income of India’s middle class is expected to surpass INR 317 million by the end of 2024, pointing out the substantial purchasing power of the middle class. This, in turn, fuels consumer demand for quality accommodations at an affordable room rate of INR 2500 – INR 9000, depending on the location, room type, and other amenities offered.

- In addition to this, urbanization is quickly reshaping the landscape, as 630 million Indians are expected to live in urban areas by 2030. On top of this, Tier-II and Tier-III cities are becoming major hubs for mid-scale hotels along with their rapid urbanization. As a result, leading names in the mid-scale hotels market are increasing their numbers at a rate like never before, adding over 2,000 rooms, particularly in smaller cities, within a year.

Embracing Government Assistance

- Government Initiated programs such as Swadesh Darshan, which was launched in 2014, aimed to enhance theme-based tourism circuits via developing world-class tourism infrastructure and promoting local tourism in 30 cities across 15 states.

- Furthermore, a cumulative FDI equity inflow of USD 5.44 billion in the tourism sector has also been an encouraging investment in the hospitality and tourism sector, which in turn positively impacts the mid-scale hotels market.

What the Future Holds

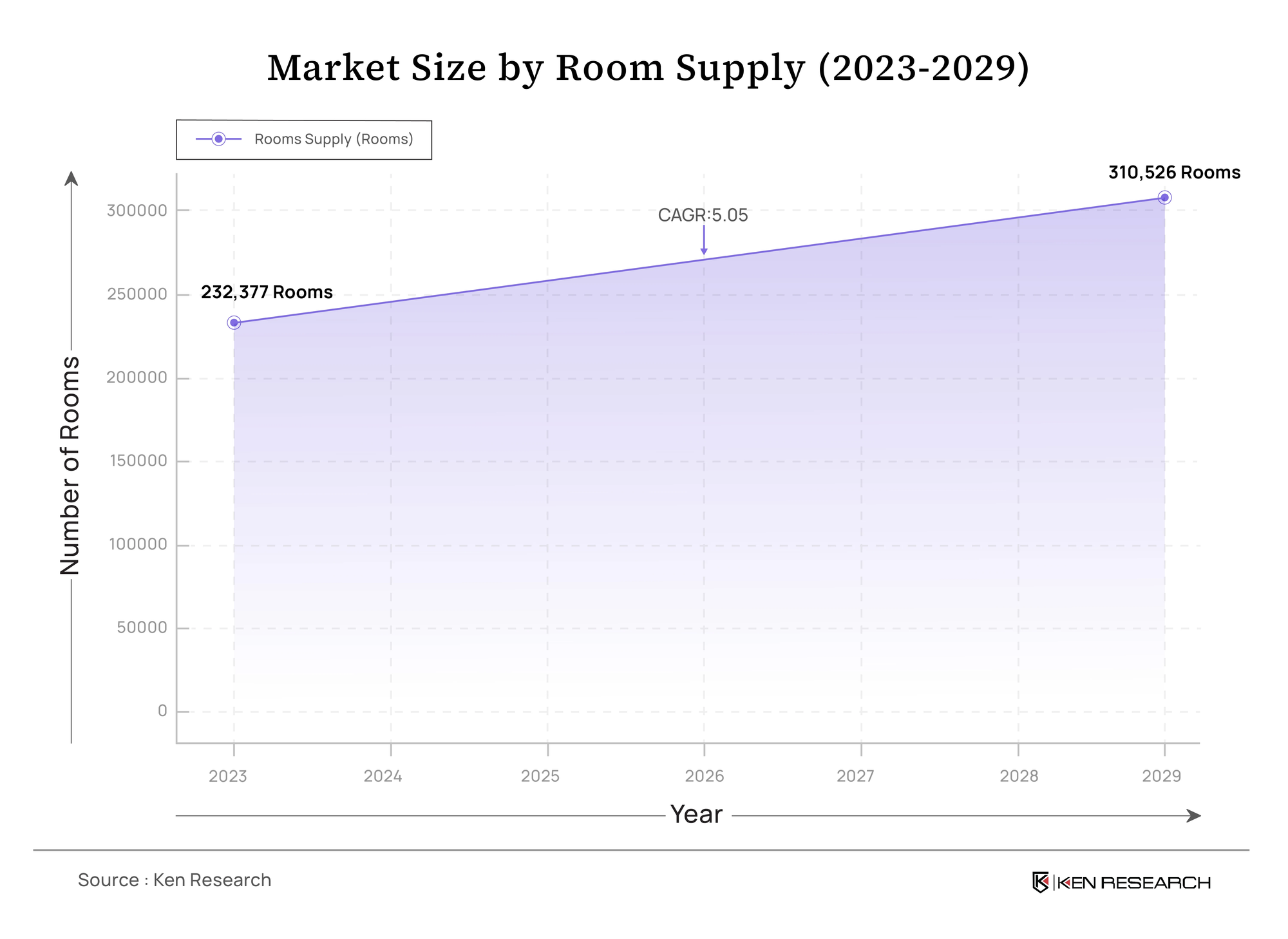

- From a glance at the recent reports, the nationwide branded hotel inventory reached approximately 180 thousand rooms in 2023, with mid-scale hotels contributing significantly to this total, and is expected to add about 94,000 keys by the year 2028.

- Some of the leading Hotel chains include Lemon Tree Hotels with the highest number of 88 properties and Ginger Hotels with a close second of 57 properties among other players in the market such as Fortune Park Hotels, Bloom Hotels, and many more.

- Based on the above-mentioned developments, it is safe to say that the future of India’s mid-scale hotel market is looking bright as revenues are expected to reach INR 530.1 billion by 2029.

The persistent growth of the mid-scale hotels market in India is expected to be fuelled by urbanization, an increase in disposable incomes of the middle class, government support, sustainable approaches, and many more factors.

The Mid-scale hotels in India are raising the standards to meet evolving traveller needs by prioritizing sustainability, leveraging technology, and focusing on customer experience now more than ever. The India mid-scale hotel market is not just growing; it has been setting the stage for a brand-new era of growth.