Are Indian Banks Stepping Away from Credit Card Expansion?

This report explores the inflection point in 2025, the strategic pivots by banks and fintechs, and the shift toward UPI-linked and embedded credit models that are reshaping the lending landscape.

Exploring the slowdown, the reasons behind it, and what’s next for lenders and investors

After nearly a decade of double-digit growth, India credit card market is showing clear signs of fatigue. In January 2025, total credit card spending stood at ₹1.84 trillion, a 2% decline from ₹1.88 trillion in December 2024. The number of outstanding credit cards also shrank by 1.2 million, bringing the total to 109 million.

Although spending slightly recovered in February 2025 to ₹1.67 trillion, it still marked a seven-month low driven by declines in both point-of-sale (₹62,124.91 crore) and e-commerce (₹1.05 trillion) transactions. These signals mark a strategic inflexion point for banks and FinTechs, who are now shifting from volume-led expansion to profitability-focused refinement.

What Fueled the Frenzy and Why It’s Losing Steam

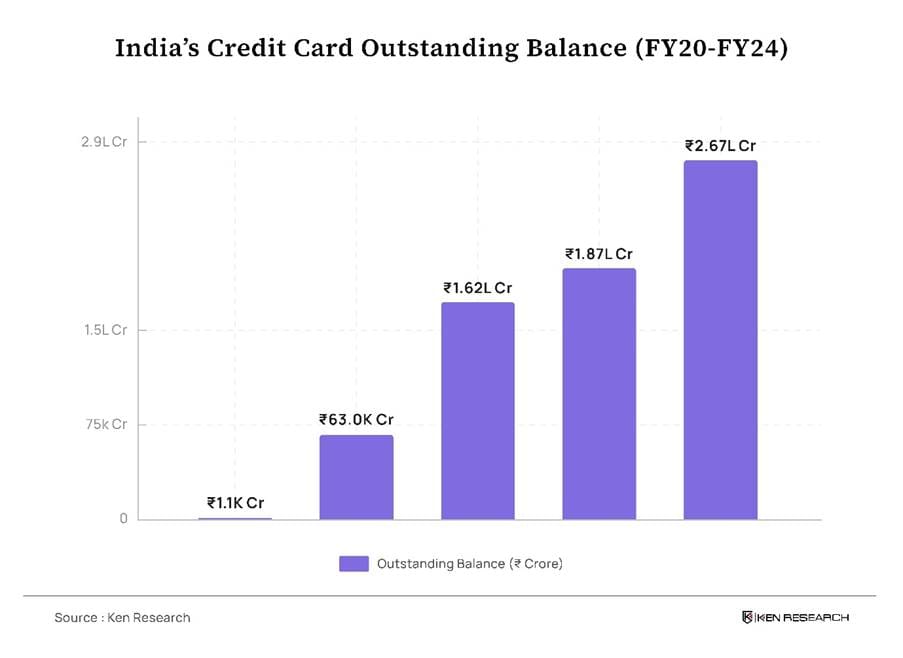

From 2016 to FY2024, India’s credit card transaction value tripled, reaching INR 28 trillion. This surge was powered by aggressive product rollouts, aspirational urban consumption, and digital adoption. At its peak, monthly new issuances touched 820,000 cards in January 2025.

Yet cracks are now visible. Over 60% of cards are still concentrated in the top 10 cities, limiting room for incremental growth. Tier 2 and Tier 3 markets remain underpenetrated due to income irregularities and credit invisibility.

Meanwhile, CAC has increased significantly, typically by ₹1,500 to ₹2,500 per customer, but per-card spending is plateauing. In January 2025, the average spending per card dropped to ₹16,911, a 1% decline from the previous month. This is compressing lifetime value, with some fintechs reporting LTV (Lifetime Value to Customer): CAC (Acquisition Cost) ratios falling below 3:1.

Delinquency is rising, particularly in subprime and new-to-credit cohorts. As of June 2024, delinquency in the 91–180 days past due (DPD) category stood at 7.6%, up from 6.5% a year earlier. Average balances per card also surged from ₹28,919 to ₹32,233 in the same period.

Simultaneously, regulatory headwinds have intensified. The RBI has cracked down on unsolicited cards, increased disclosure norms, and placed minimum limits to prevent exploitation, increasing compliance costs and dampening fee-based income.

How Banks Are Repositioning

In response, India’s top lenders are shifting from mass issuance to selective, profitability-driven playbooks. Banks such as HDFC, ICICI, and Axis are targeting high-income, urban users with strong repayment histories and high credit utilization.

Premium cards bundled with travel, insurance, and investment perks are gaining traction. Meanwhile, banks are rationalizing portfolios by retiring low-margin co-branded cards and halting launches that lack segment differentiation.

Risk frameworks are being overhauled. AI-enabled underwriting, real-time behavioural scoring, and dynamic credit lines are becoming standard.

What’s Rising Instead

As traditional growth flattens, banks and FinTechs are building out new rails. UPI-linked credit approved by the RBI in 2023 allows pre-sanctioned lines to be accessed without physical cards. This model enables seamless disbursal at a lower operational cost.

BNPL firms like Slice and ZestMoney are evolving into credit infrastructure providers, embedding lending into partner ecosystems rather than offering direct-to-consumer loans. These models help control risk while increasing product stickiness.

Even co-branded cards are changing. The focus is now on ecosystem monetization, such as Flipkart Axis Bank cards, driving repeat e-commerce usage rather than pure volume.

New credit issuance is also slowing. According to CRIF High Mark, Q1 FY25 saw only 4.4 million new cards issued, a 34.4% YoY drop. Defaults, meanwhile, have surged. Credit card NPAS rose 28% to ₹6,742 crore by the end of 2024.

The broader direction is clear that consumer credit in India is moving toward embedded, invisible models powered by data, integrated APIs, and customer lifecycle analytics.

What This Means for the Future of Lending?

The credit card frenzy may be slowing, but the consumer credit opportunity in India is far from over. What’s ending is the old playbook mass issuance, generic rewards, and thin underwriting.

Banks must now optimize for resilience, higher-quality acquisition, deeper monetization, and regulatory alignment. Fintechs are shifting toward infrastructure, powering embedded credit within platforms. For investors, metrics like NPA trends, repayment behaviour, and LTV-to-CAC ratios will matter more than user counts.

The next wave of India’s credit economy will be defined not by plastic in wallets, but by intelligent, embedded credit experiences woven into the digital fabric of everyday life.