Why Fast Growth and Digital Loyalty Are Driving Beauty Deals in India?

India’s beauty market is booming as FMCG giants race to acquire digital-first brands, unlocking consumer loyalty, agility, and future-ready distribution in a $33B industry by 2027.

Global and Indian FMCG majors are acquiring digital-first beauty brands. What they’re buying isn’t just product it’s agility, insight, and future market access.

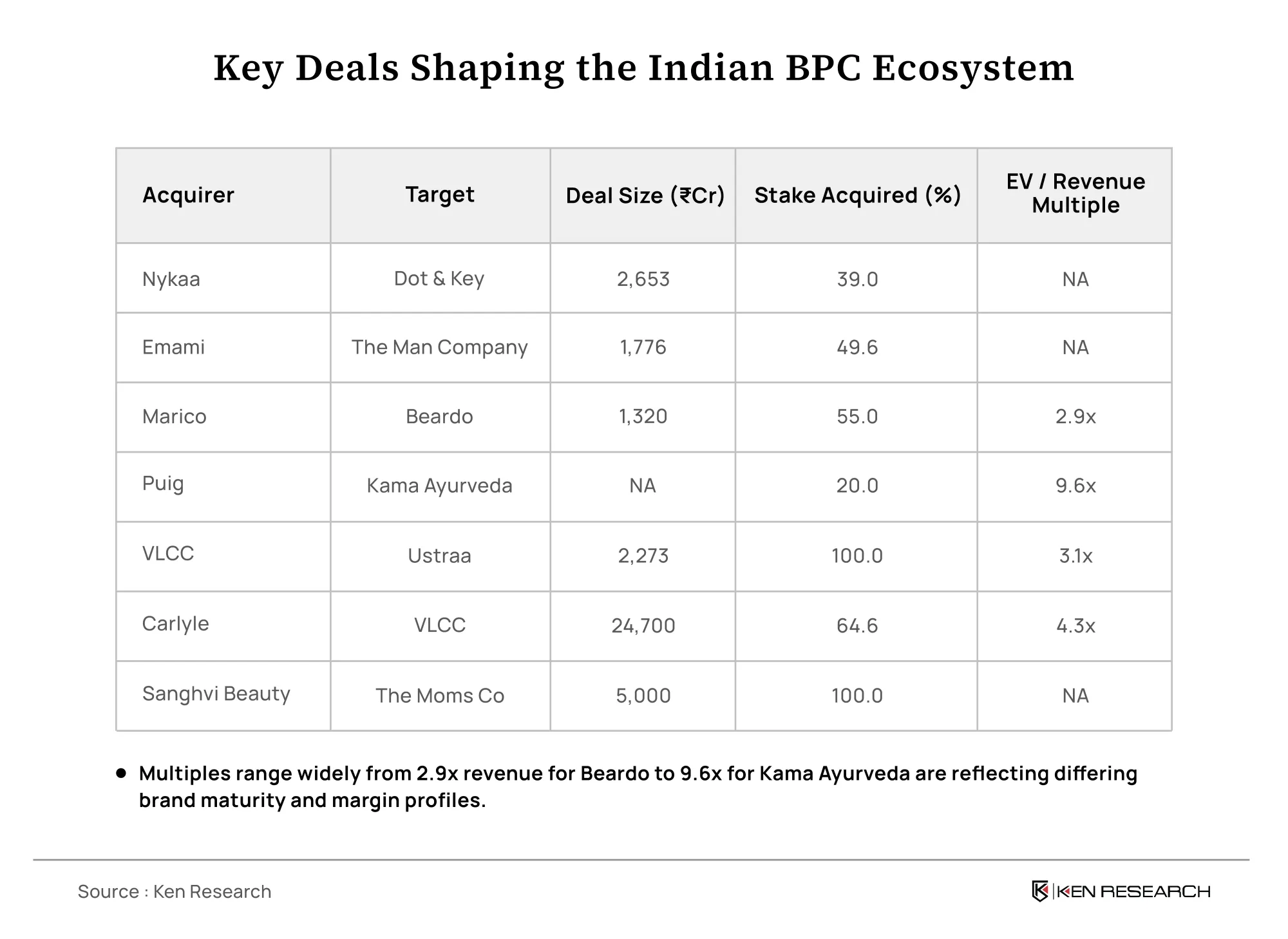

In early 2024, Sanghvi Beauty made headlines. The company, known for its roots in professional beauty services, acquired The Moms Co for ₹5,000 crore. Just months earlier, it had bought 100% of St. Botanica for ₹1,400 crore.

These transactions weren’t isolated. From Nykaa and Emami to Marico and L’Oréal, legacy players are on a steady acquisition spree in India’s beauty and personal care (BPC) sector. Their targets are high-growth, digitally native brands with loyal online audiences.

India BPC market, expected to reach USD 33 billion by 2027, is no longer just about creams and soaps. It’s about control over a younger consumer base, distribution innovation, and digital fluency.

Why incumbents are acquiring, not building?

- India’s BPC sector is highly fragmented. The top 20 brands account for just 32% of market share. In a space defined by fragmentation and fast-changing preferences, acquisitions are often faster and cheaper than building in-house.

- Launching a new brand internally can take 18–24 months. An acquisition gives companies access to products, formulations, and market-tested packaging within weeks. For instance, when Nykaa acquired Dot & Key for ₹2,653 crore, it immediately expanded its skincare portfolio with a ready-made suite of products.

- Legacy brands often struggle with product experimentation. New-age startups, on the other hand, iterate rapidly using D2C feedback loops. By acquiring them, acquirers avoid the R&D risk while benefiting from data-backed traction. Marico’s investment in Just Herbs, a clean beauty brand, gave it access to a segment it hadn’t entered before without building from scratch.

- D2C brands typically acquire customers via Instagram, beauty marketplaces, and email, which model legacy brands rarely optimize. These acquisitions provide not just products but modern marketing capabilities and access to high-LTV consumer cohorts.

What acquirers are buying beyond the product?

- In most cases, it’s not just about buying SKUs. The value lies in the strategic assets these brands bring to the table. Beardo, acquired by Marico for ₹1,320 crore, had built strong brand equity in male grooming. Its shaving oils and beard balms were category leaders. Investors paid for those anchor SKUs, which consistently drove retention.

- Digital-first brands typically operate on lean supply chains. They use contract manufacturing and low fixed overheads. Ustraa, acquired by VLCC for ₹2,273 crore, maintained digital gross margins over 60% attractive even in a tightening funding climate.

- Many brands acquired had penetrated Tier II and diaspora markets early. Kama Ayurveda, now 20% owned by Puig, gained traction not just in Indian metros but in global clean beauty circles. This makes them attractive for global companies seeking to expand their reach without starting local operations from scratch.

What gets harder after the deal?

- While acquisitions provide access, they also come with friction. Several acquirers have faced operational and strategic challenges.

- Start-ups operate lean and fast. Post-acquisition, bureaucratic decision-making slows innovation cycles. In some cases, founders exit early, taking institutional knowledge with them. Investors then struggle to maintain growth rates without the original team.

- Moving a digital-first brand into offline retail creates pricing, inventory, and visibility conflicts with legacy SKUs. Supermarket buyers often hesitate to allocate shelf space to brands that aren’t fully integrated or don’t yet justify their margins in retail.

- Clean beauty and performance-led skincare brands often lose authenticity when rebranded or expanded too quickly. A consumer that trusts minimalist packaging and science-first messaging may turn away if the brand begins acting like an FMCG portfolio play.

“Buying is easy. Scaling without breaking brand equity—that’s the hard part,” says a former senior brand lead at a multinational beauty house.

What’s next for beauty M&A in India?

The next phase of acquisitions will likely focus on three fast-moving verticals:

- Nutricosmetics are supplements that promote skin, hair, and nail health. Consumers are shifting toward beauty-from-within, and new-age brands with plant-based offerings are ripe for acquisition.

- Clinical beauty and derma cosmetics Brands like Minimalist (which recently raised from Unilever Ventures) sit at the intersection of skincare and science. This segment appeals to both functional buyers and export-driven expansion strategies.

- Localised Ayurveda and ritual-based beauty Ayurveda-led brands with sharp positioning like Kama or Forest Essentials are becoming acquisition targets for global wellness players seeking authenticity and Indian heritage in their product lines.

Final takeaway

India’s beauty and personal care sector is undergoing a strategic transformation, where legacy giants are accelerating growth through the acquisition of digitally native, high-engagement brands. These aren’t just product buys, they’re strategic bets on consumer insight, modern marketing capabilities, and rapid go-to-market agility.

For investors, this signals a shift in value creation away from legacy distribution and toward digital proximity, data-driven innovation, and brand communities built on trust. As the market expands at a projected 11% CAGR, the highest returns will likely come not from scale alone, but from platforms that can seamlessly integrate and scale niche brands without eroding their authenticity.

M&A is no longer just an expansion tactic, it's becoming the most efficient route to future-proofing relevance in a fragmented, youth-led beauty economy.