How Swiggy & Zomato Are Reshaping India's Food-Tech and Logistics Innovation?

India’s Commercial Two-Wheeler industry has experienced exponential growth, largely fuelled by platforms like Swiggy and Zomato. These companies have disrupted traditional food logistics, setting benchmarks in fleet management, operational efficiency, and sustainability. Their innovations are meeting consumer demand and reshaping India’s gig economy and urban mobility ecosystem.

Monopoly of Zomato & Swiggy

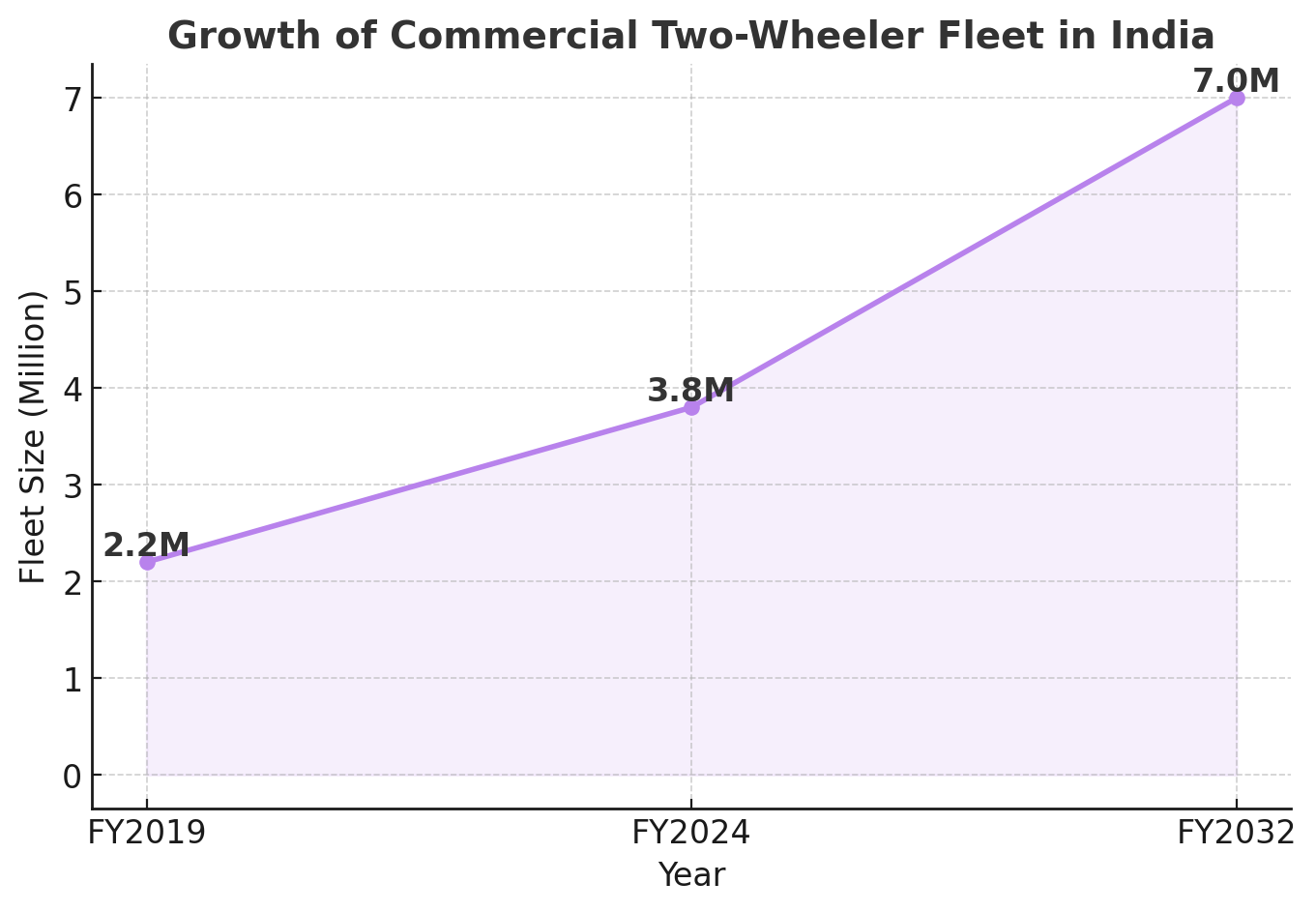

- The rapid expansion of India’s food delivery sector is evident in its growing two-wheeler fleet, which increased from 2.2 million in FY2019 to 3.8 million in FY2024, reflecting a CAGR of 11.6%. Projections estimate the fleet will grow to 7 million by FY2032 at a CAGR of 7.9%.

- Swiggy, Zomato, and Bunzo dominate this space, which controls 75% of the organized fleet market together, with Zomato accounting for a substantial 40% share. In addition to the organized sector, the unorganized segment contributes significantly, utilizing 2.7 million two-wheelers as of FY2024.

- This dual reliance on organized and unorganized operators allows the industry to serve diverse geographies, including Tier II and Tier III cities. These regions are becoming increasingly important as they drive new consumer demand and expand the reach of food delivery services stimulating the commercial two-wheeler market.

Fleet Ownership Models and Strategies

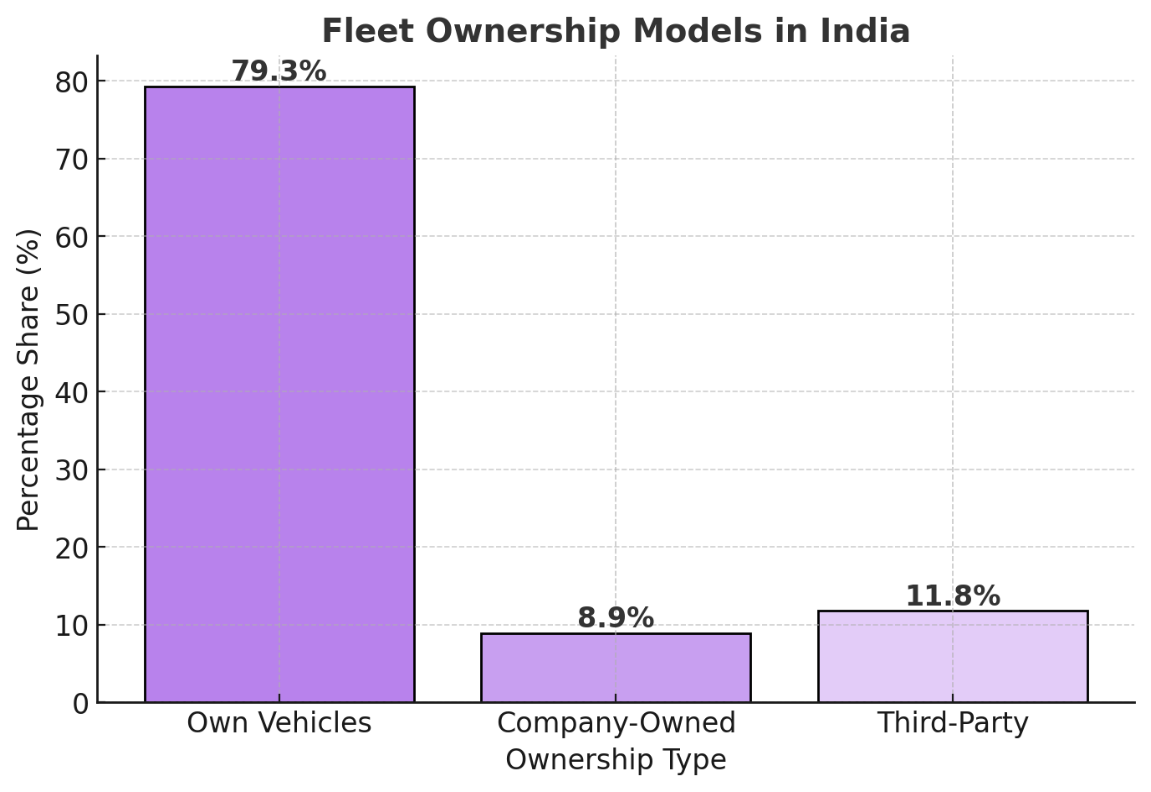

This dominant model, accounting for 79.3% of the fleet ownership with a fleet size of 844,592 units, allows delivery agents to use their own vehicles, significantly reducing operational costs for food delivery platforms. While this approach is economically advantageous for companies, it places a financial burden on agents, who must cover expenses related to fuel and vehicle maintenance adversely affecting their overall earnings.

- On the contrary, Brands such as Domino’s have adopted different model, which exert greater control over their delivery operations and ensure consistent service quality. This business model holds 8.9% of the fleet ownership encompassing a fleet size of 97,260 units. By employing riders with company-owned vehicles, these brands offer job stability and fixed salaries.

- Collaborations with third-party logistics providers like Zypp and Gogoro account for 11.8% of the fleet ownership in the industry. These partnerships facilitate the rapid integration of electric vehicles (EVs), which contribute to cost savings on fuel and support sustainability initiatives.

EV Adoption and Sustainability

- Sustainability and cost efficiency are at the core of the industry’s shift toward electric vehicles. As of FY2024, EVs account for 24.6% of the total fleet, with the figure expected to grow to 28.6% by FY2032. EVs offer up to 15% operational cost savings compared to traditional fuel vehicles, making them a strategic priority for Swiggy and Zomato.

- To accelerate this transition, these companies are forming partnerships with EV manufacturers for bulk procurement and investing in charging infrastructure.

- By FY2032, the majority of fleet expansions in urban areas are expected to be electric, aligning with India’s environmental objectives and reducing dependence on fossil fuels. This transition also positions Swiggy and Zomato as leaders in sustainable logistics innovation.

Swiggy and Zomato have redefined food-tech and logistics innovation in India, establishing themselves as leaders in efficiency and sustainability, and transforming the commercial two-wheeler market. By focusing on electric vehicles, technology integration, and tailored expansion into underserved markets, they are positioned to drive the next industry growth phase. Their commitment to operational excellence and green logistics ensures they remain at the forefront of reshaping India’s commercial two-wheeler landscape.