How E-Pharmacies are Evolving India’s Over-the-Counter (OTC) Market?

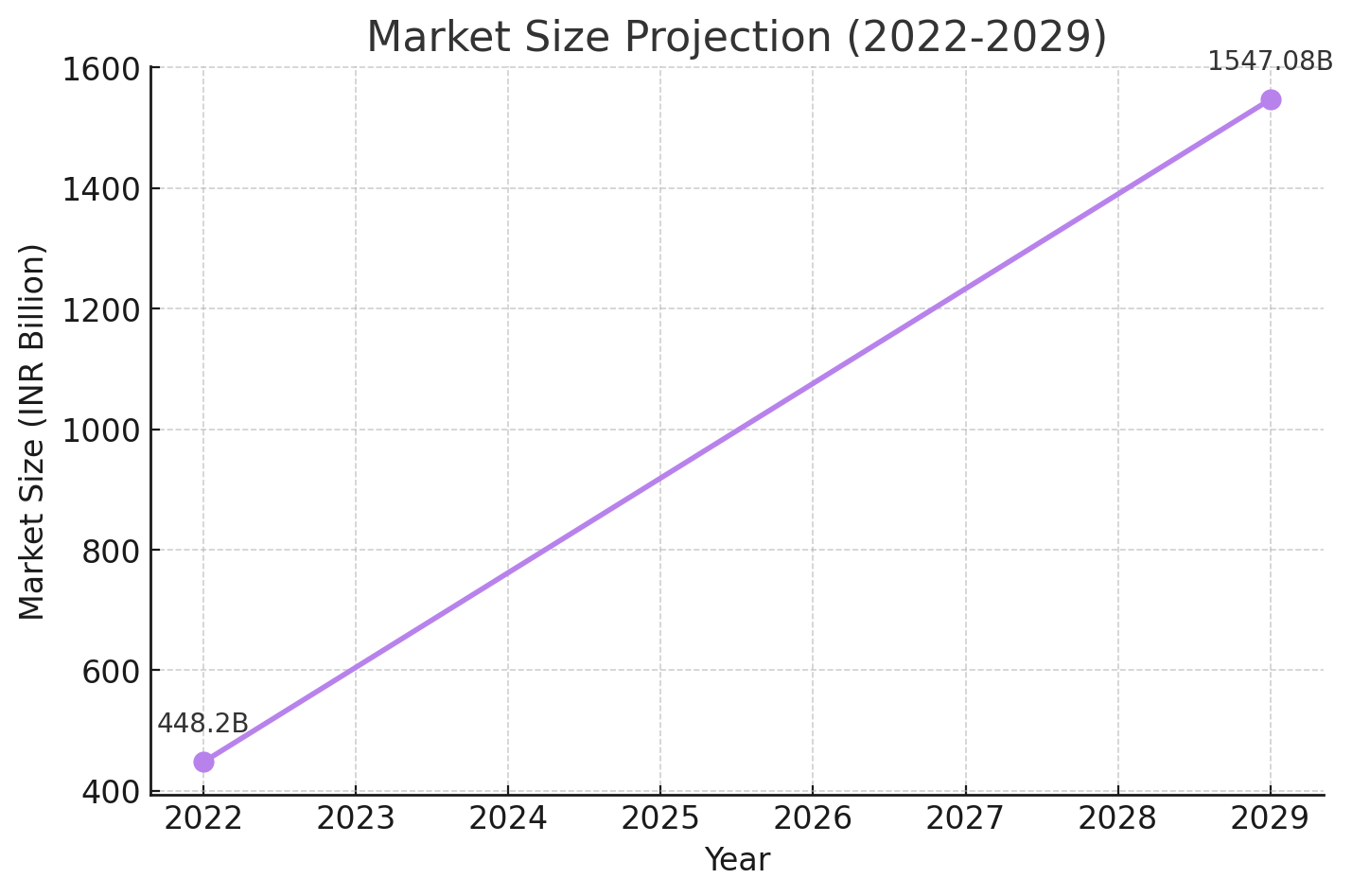

India’s over-the-counter (OTC) pharmaceutical market is at an inflexion point, poised for transformative growth. With a market size of INR 448.2 billion in 2022, projections indicate a remarkable surge to INR 1,547.08 billion by 2029, reflecting a CAGR of 19.1%. This acceleration is fuelled by rising consumer awareness, a shift towards self-medication, and the disruptive power of digital commerce. As e-pharmacies reshape traditional retail models, OTC drug distribution is experiencing a paradigm shift, offering unparalleled convenience, accessibility, and price transparency.

The Digital Disruption of India’s OTC Market

- India's e-commerce ecosystem is reshaping how consumers access OTC drugs, with leading e-pharmacies platforms such as 1mg, CareOnGo, Netmeds, Apollo Pharmacy, Medlife, and PharmEasy redefining distribution networks. Additionally, E-pharmacies in India currently serve customers across more than 20,000 PIN codes.

- Digital pharmacies have disrupted the conventional retail model, making medications available on demand, often at competitive prices, with doorstep delivery. According to Ken's research analysis, 32% of urban Indians now prefer online healthcare platforms, demonstrating a definitive behavioural shift.

- India's digital health transformation reaches beyond urban centres, fuelled by greater internet access, affordable smartphones, and government initiatives like Digital India and Ayushman Bharat Digital Mission. As of September 12, 2024, over 66.70 crore (667 million) Ayushman Bharat Health Accounts have been created, with 42.01 crore (420.1 million) Health Records linked to them.

- Telemedicine integration has further strengthened this ecosystem, offering real-time consultations and AI-driven recommendations for personalised medication choices as 67% of Indians are comfortable seeking medical advice from their doctor through a health application on their phone, showing a high willingness to adopt telehealth.

Forces Powering Growth in the OTC Sector

- Increasing access to health information has empowered consumers to make proactive healthcare decisions. Self-medication trends are on the rise, particularly among Digitally Literate, middle-income consumers who rely on digital research before purchasing OTC products.

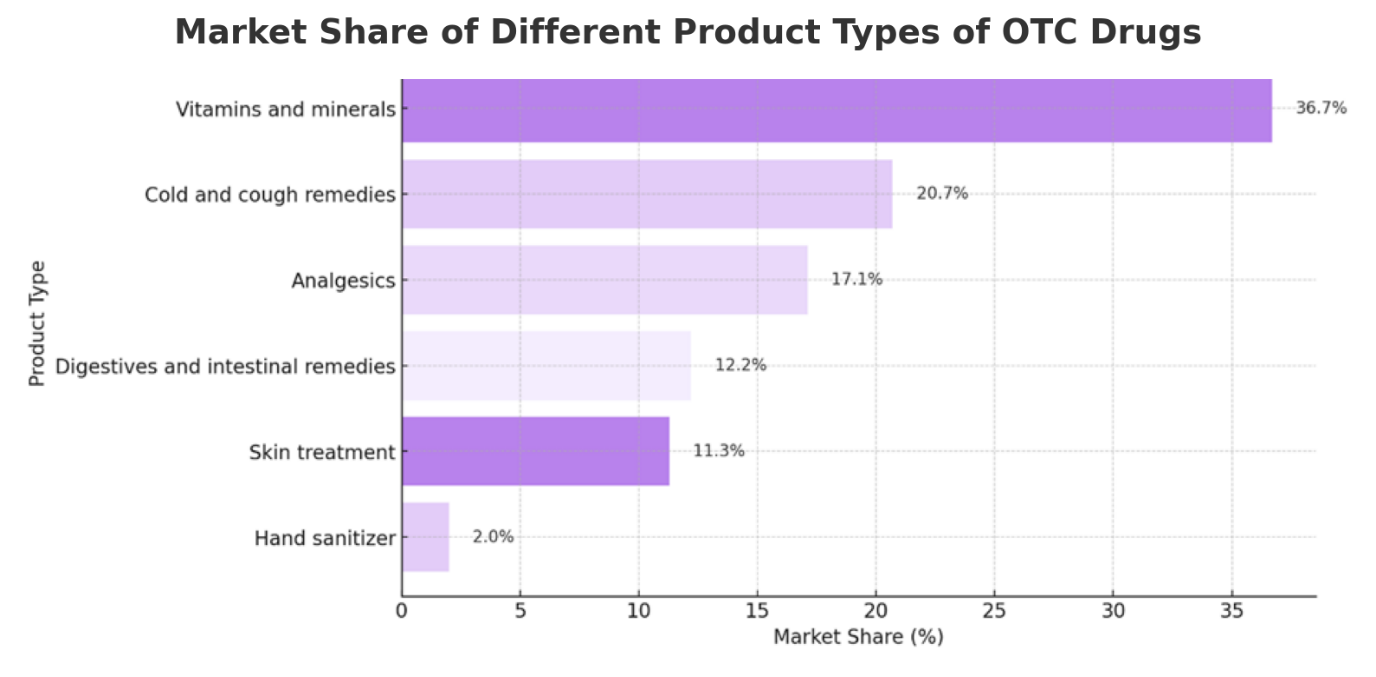

- A significant portion of the Indian population tends to use OTC drugs like vitamins and minerals, painkillers, and cough syrups to manage early disease symptoms, with approximately 52% engaging in self-medication, according to Ken research analysis.

- Progressive policy shifts, including the Production Linked Incentive (PLI) scheme, are enabling prescription-to-OTC switches, expanding the market for easily accessible medications. Additionally, the introduction of herbal and nutraceutical OTC products has diversified the sector, aligning with the growing preference for natural healthcare solutions.

- AI and big data analytics are enhancing digital pharmacies' ability to predict demand, personalize recommendations, and ensure seamless last-mile delivery. This has particularly benefited India’s underserved regions, making essential healthcare products more accessible than ever before.

India’s OTC market is undergoing an era of digital transformation, where e-commerce serves as the primary enabler of accessibility, efficiency, and growth. AI, big data, and telehealth are driving innovation, redefining how consumers interact with OTC products. As industry players align their strategies with this evolving landscape, India’s OTC market will continue its upward trajectory, offering a replicable model for global healthcare digitization. Those who invest in digital capabilities, regulatory alignment, and consumer-centric experiences will be best positioned to lead this next phase of growth.