Biosensors 2030: Strategic Roadmap to Capture Value in a $44.9 Billion Market

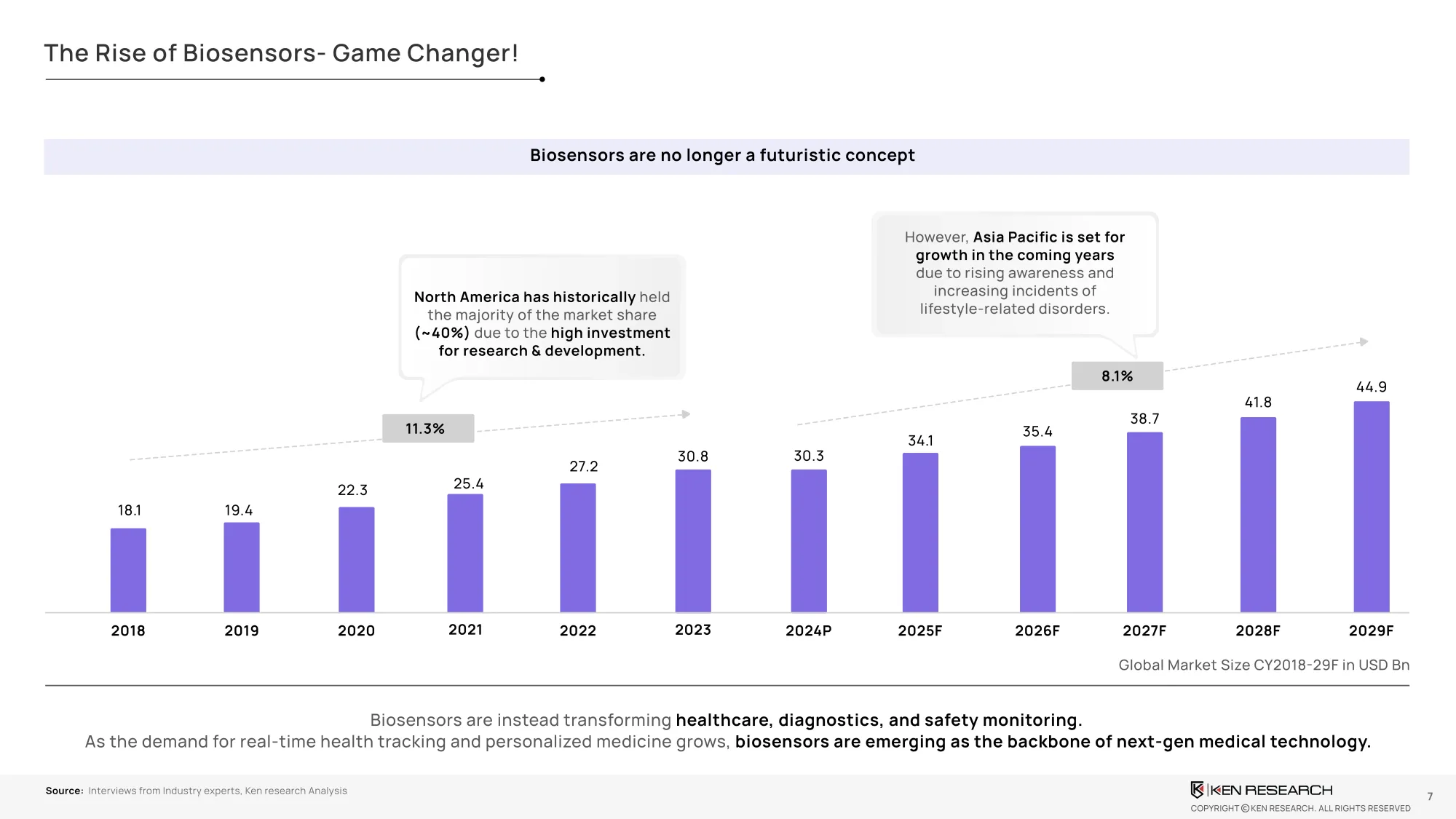

The global biosensors market is set to hit USD 44.9 Bn by 2029, driven by real-time diagnostics, AI integration, and cross-sector applications. This POV outlines key trends, platform strategies, and tech shifts shaping the future of sensing ecosystems.

Biosensors are evolving from narrow diagnostic tools to foundational elements of real-time, data-driven healthcare and industrial ecosystems. With global market value projected to reach USD 44.9 billion by 2029, organizations must shift from device-first thinking to platform-based strategies that prioritize interoperability, continuous sensing, and decision-centric integration.

15 Slides | Use-Case Frameworks | Technology Benchmarking | Decision Roadmaps

WHO THIS POV IS FOR

This report is built for:

- Diagnostic and healthtech product leaders seeking scalable sensing strategies

- Platform and R&D heads exploring real-time, AI-integrated devices

- Investors evaluating biosensing use cases across healthcare, agriculture, and environment

- Policymakers and digital health regulators preparing for convergence of medical and consumer-grade sensing

EXECUTIVE SUMMARY

The global biosensor market is projected to grow from USD 30.8 billion in 2024 to USD 44.9 billion by 2029, signaling an urgent need for platform thinking, interoperability standards, and regulatory foresight. The market is shifting toward multifunctional, connected biosensors that deliver actionable data—not just diagnostics.

What’s changing:

- Use cases are expanding beyond glucose monitoring to metabolic, infectious, and environmental tracking

- Integration with cloud, AI, and edge computing is redefining the value proposition

- Hardware innovation is being outpaced by the need for analytics, interoperability, and modularity

MARKET SNAPSHOT – GLOBAL GROWTH DRIVERS AND SEGMENTAL INSIGHTS

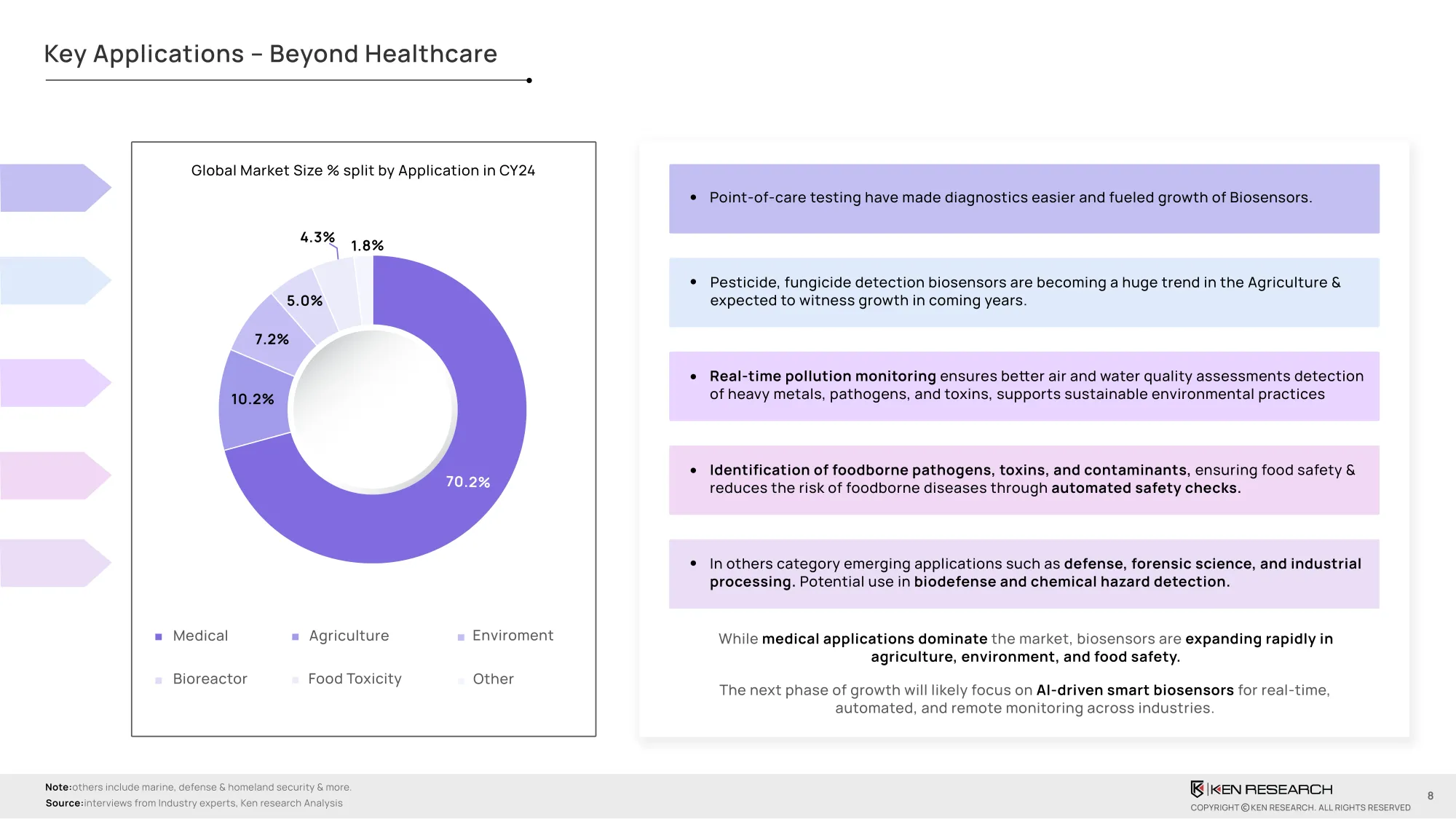

The biosensor market will grow at an 8.1% CAGR, reaching USD 44.9 billion by 2029, driven by demand for non-invasive, real-time data in:

- Healthcare (70.2%): CGMs, metabolic trackers, and POC diagnostics

- Agriculture (10.2%): Soil quality, pesticide residue, and crop-level sensing

- Environmental Monitoring (7.2%): Pollution, air/water quality tracking

- Food Safety (5%): Pathogen and spoilage detection

TECHNOLOGY LANDSCAPE – SCALING FROM SENSOR TO SYSTEM

Innovation is moving from sensor precision to system-level architecture:

- Zinc oxide nanostructures and aptamer-based sensors are pushing limits on sensitivity and specificity

- Optical and electrochemical sensing formats are being miniaturized and embedded in wearables

- AI-enhanced analytics and edge processing are enabling real-time decision-making

- The next wave of biosensors will not just detect—they will predict, contextualize, and trigger interventions.

COMPETITIVE ADVANTAGE – MOVING FROM HARDWARE TO SENSING-AS-A-SERVICE

Leaders like Abbott (Lingo) and Medtronic are bundling sensing with real-time feedback, platform APIs, and behavioral interventions. The shift is from diagnostic event to continuous wellness insight.

To remain competitive:

- Companies must integrate sensors with cloud platforms, APIs, and analytics

- Proprietary algorithms will drive IP, not just hardware

- Real-time data loops will shape engagement, not static test results

POLICY & REGULATORY DYNAMICS – NAVIGATING COMPLEX CLASSIFICATION ZONES

Biosensors now operate across clinical, consumer, and industrial domains, creating friction in regulatory clarity:

- Hybrid CGM-wellness devices require dual-track approval workflows

- AI diagnostics require documented transparency and validation trails

To de-risk:

- Organizations must model for region-specific classifications and prepare for evolving MDR/FDA digital health standards

APPLICATIONS – WHERE BIOSENSORS ARE DELIVERING OUTCOME IMPACT

- Healthcare: CGMs, sepsis detection, and multi-analyte trackers are driving personalized care

- Agriculture: Real-time soil and nutrient sensing supports smart farming at scale

- Food Safety: Embedded pathogen sensors increase packaging intelligence

- Environmental: Air and water biosensors enable on-site incident response

- Bioreactors: Industrial-scale biosensors improve production yield and energy efficiency

STRATEGIC IMPERATIVES – ORGANIZATIONAL SHIFTS REQUIRED TO COMPETE

- Redesign product portfolios for modular biosensor platforms—not isolated devices

- Develop software and cloud analytics capabilities in parallel with sensor hardware

- Establish strategic partnerships across care delivery, agtech, and smart infrastructure

- Invest in regulatory and compliance foresight, particularly around AI-enabled diagnostics and hybrid classification

WHAT LEADERS MUST ANTICIPATE NEXT

The biosensor market is no longer defined by test strips or diagnostic kits. It is now a real-time intelligence platform with implications across public health, agriculture, and consumer well-being. Those who invest in end-to-end sensing ecosystems—backed by analytics, regulation readiness, and multi-sector alignment—will define the next era of diagnostics.