Biofuels 2030: Strategic Roadmap to Unlock a $276 Billion Opportunity

Biofuels are stepping into the global spotlight as a long-term clean energy solution. This strategic POV decodes market shifts, revenue forecasts, and key insights.

Biofuels have entered the spotlight, with production topping 40 billion gallons in 2023 and revenues projected to hit USD 276 billion by 2031.

14 Slides | Market Forecast & Industry Trajectory | Application Areas |Technology Innovation |Policy Landscape & Regulatory Influence

Built for Leaders Across

This strategic report is designed for:

- CXOs, Strategy, and Sustainability Heads in energy and transport firms

- Venture funds, institutional investors, and PE firms targeting clean fuel portfolios

- Policy advisors crafting national renewable fuel mandates

- Leaders in supply chain, biofuel production, and agricultural innovation

Access Benchmark Frameworks and Investment Tools for Biofuel Strategy Leaders

Executive Summary

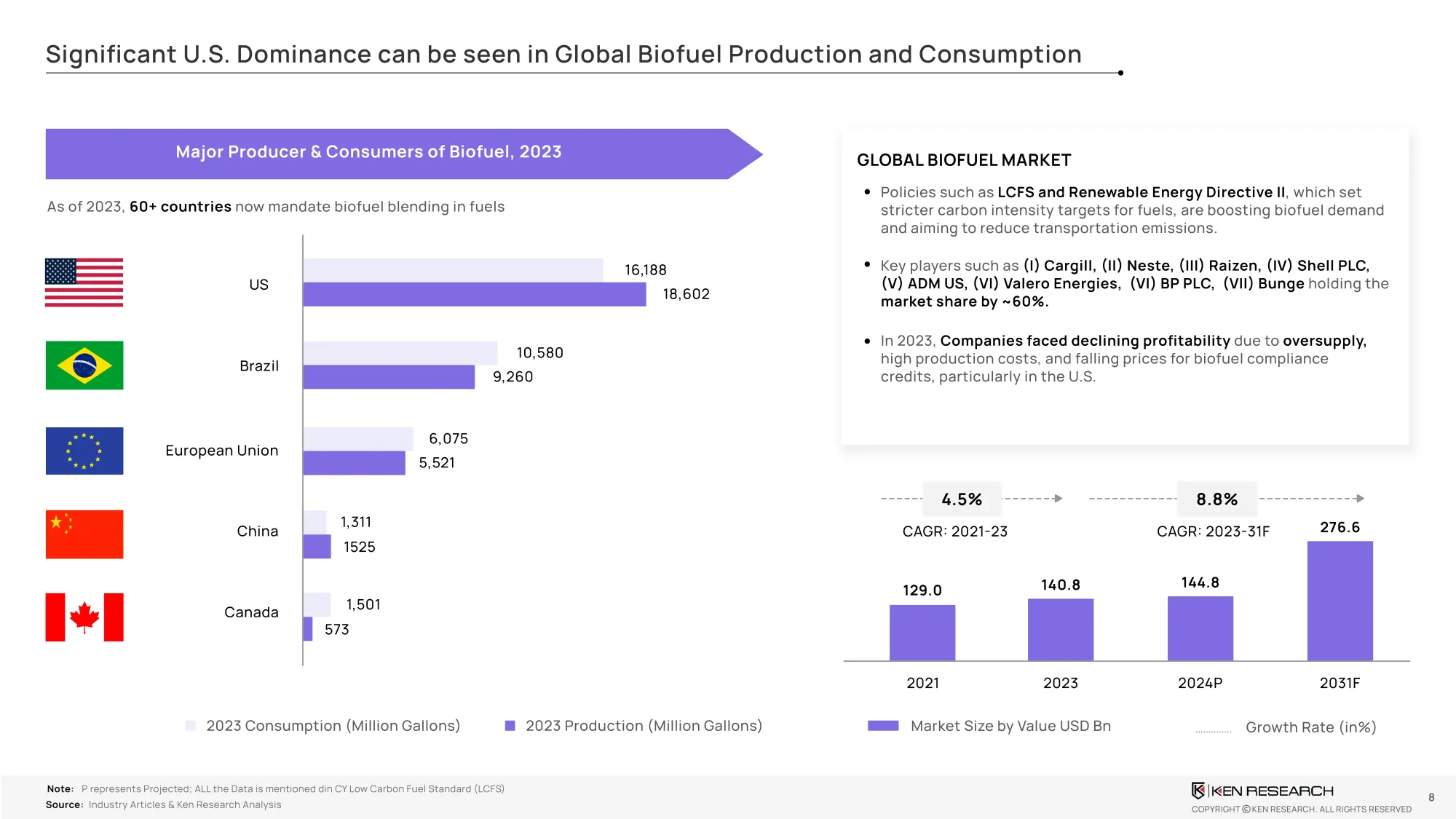

Biofuels have re-entered the energy spotlight. Global revenues exceeded USD 140.8 billion in 2023, and with increased government mandates, technological advances, and diversified applications, the market is expected to cross USD 276 billion by 2031—growing at a CAGR of ~8.8%.

Three strategic forces underpin this surge:

- Mandated demand: 60+ countries require biofuel blending across transport sectors

- Feedstock innovation: Lignocellulosic, algae-based, and waste-to-fuel pathways reduce land-use competition

- Real deployment: SAF, biodiesel, and bioethanol are already operating in aviation, agriculture, and urban fleets

Access Benchmark Frameworks and Investment Tools for Biofuel Strategy Leaders

Market Snapshot – Verified Growth & Segmentation

In 2023, the global biofuel market was valued at USD 140.8 billion, with production exceeding 40 billion gallons. The market is projected to reach USD 276 billion by 2031.

Revenue breakdown by segment:

- Bioethanol: 60% of total market value

- Biodiesel and Advanced Fuels: 40%, led by Sustainable Aviation Fuel (SAF)

- Top revenue contributor: Transportation sector at 26.8 %, outpacing electricity generation (39.1%)

Access Segment-Level Revenue Forecasts and Region-Wise Adoption Maps

Technology Landscape – From Legacy Inputs To Advanced Pathways

Biofuels today span both mature and next-generation formats:

- First-Gen: Corn, sugarcane, vegetable oils, food waste

- Second-Gen: Cellulosic ethanol, algae, lignocellulose, forest residue

- Advanced Fuels: SAF, biosynthetic gas, hydrotreated vegetable oils

Performance trends:

- Enzyme hydrolysis is reducing input costs by 25%

- GE-modified crops increase biomass output by 15% per acre

- Biorefinery diversification enables new revenue streams (e.g., bioplastics, nutraceuticals)

Download Biofuel Tech Readiness Framework & Feedstock Optimization Grid

Competitive Edge – Where Biofuels Win

Biofuels provide critical advantages in hard-to-electrify and infrastructure-constrained sectors:

- Compatibility: Drop-in usage in existing engines and heating systems

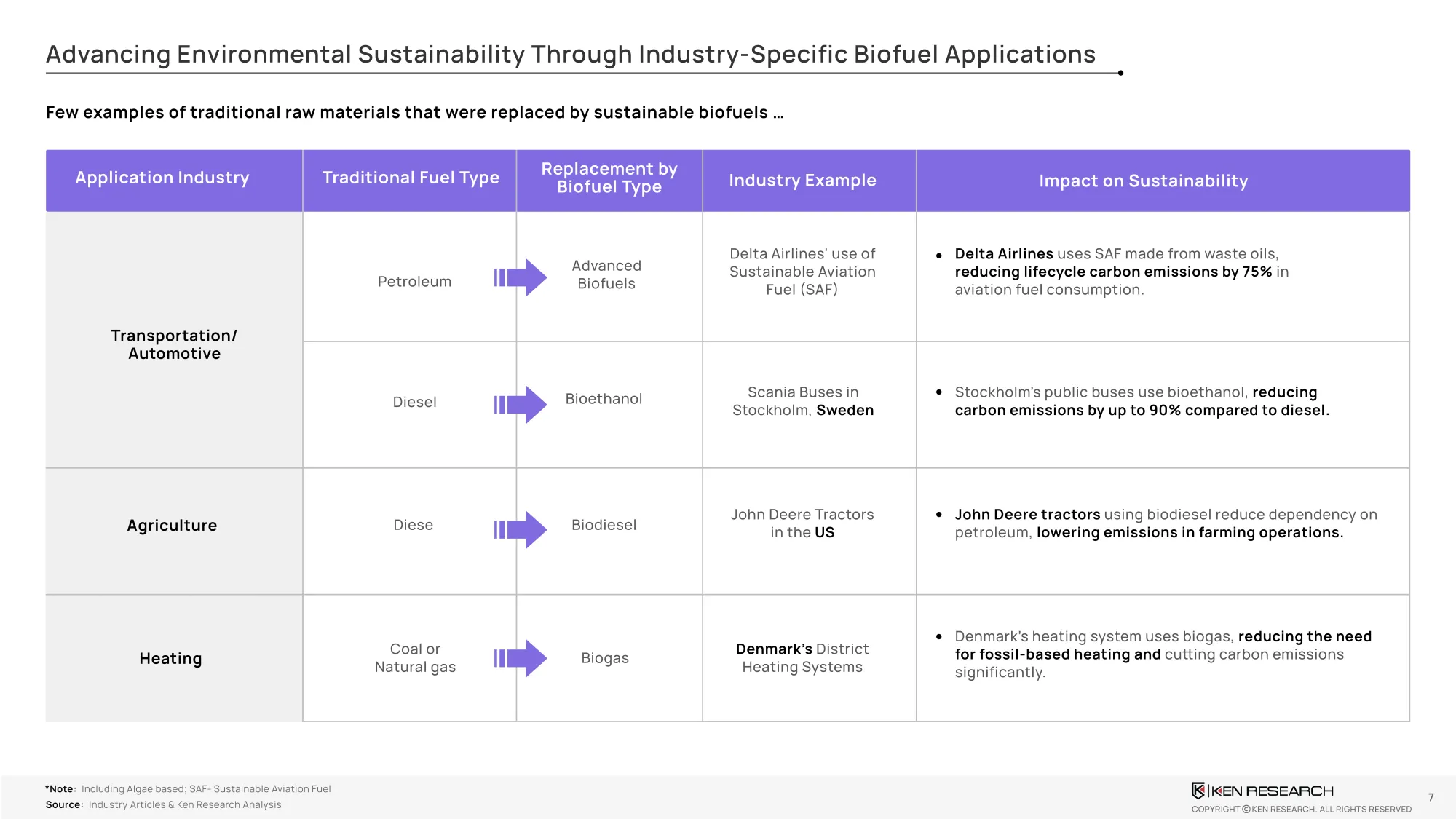

- Carbon Impact: Up to 90% CO₂ reduction with bioethanol (e.g., Scania fleets in Stockholm)

- Economic Resilience: Lower exposure to oil price volatility; 30% cost reduction in processing through tech advancement

View Strategic Comparison: Biofuels vs Solar, Wind, and Hydrogen Pathways

Policy Signals – The Global Regulatory Landscape

Policy is reinforcing market direction:

- U.S.: IRA incentives, SAF credits, LCFS regulation

- EU: Renewable Energy Directive II, biofuel lifecycle mandates

- India: 20% ethanol blending target by 2025; rapid capacity scale-up

- 60+ countries now have binding blending mandates in transport fuels

Access Global Blending Mandates & Incentive Timeline by Country – 2024 to 2035

Application Cases – Verified Industry Impacts

- Aviation: Delta Airlines reduced lifecycle CO₂ emissions by 75% using SAF from waste oils

- Urban Transit: Stockholm’s Scania buses cut emissions by up to 90% using advanced ethanol

- Agriculture: John Deere’s biodiesel-powered tractors lower petroleum reliance and field emissions

- Heating: Denmark’s district systems integrate biogas to displace fossil fuels

Download Sectoral Impact Report: Biofuel Adoption and Emission Reduction Benchmarks

Strategic Imperatives – What Leaders Must Do Now

To lead in the emerging biofuel economy, executives should:

- Build flexible feedstock portfolios to de-risk procurement

- Anchor production near policy-backed regions for tax and credit leverage

- Diversify output to include SAF, fertilizers, and bioplastics from the same refinery footprint

- Lock in long-term offtake agreements to ensure volume security

Download Sectoral Impact Report: Biofuel Adoption and Emission Reduction Benchmarks

Where Biofuels Go Next

Biofuels are no longer a climate hedge—they’re a core enabler of sectoral decarbonization. With mandates, investment, and scalable demand aligned, leaders must prioritize feedstock flexibility, policy navigation, and integrated value chain strategies.

Download Biofuels 2030 Strategic POV – Full Market Outlook, Use Cases, and Execution Plan