Automating Warehousing Solutions in the APAC Region

Warehousing in the Asia-Pacific Region (APAC) has performed better than the expectations set. It is expected to reach 50% by 2029.

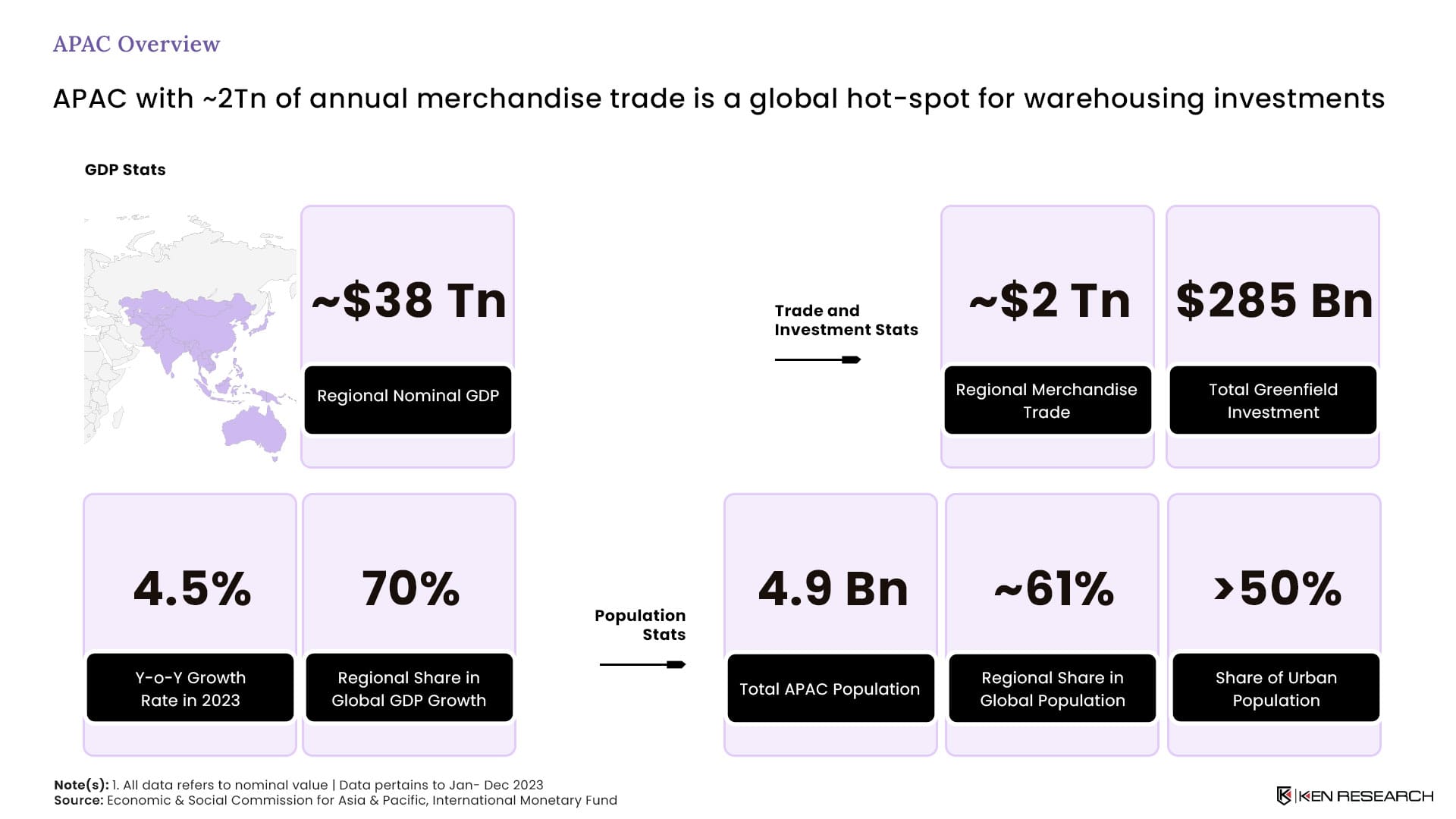

Warehousing in the Asia-Pacific Region (APAC) has performed better than the expectations set. It is expected to reach 50% by 2029 where China, South Korea and Japan have been driving the growth of the market but in the recent developments India, Vietnam and Indonesia are contributing to new warehousing establishments creating new markets.

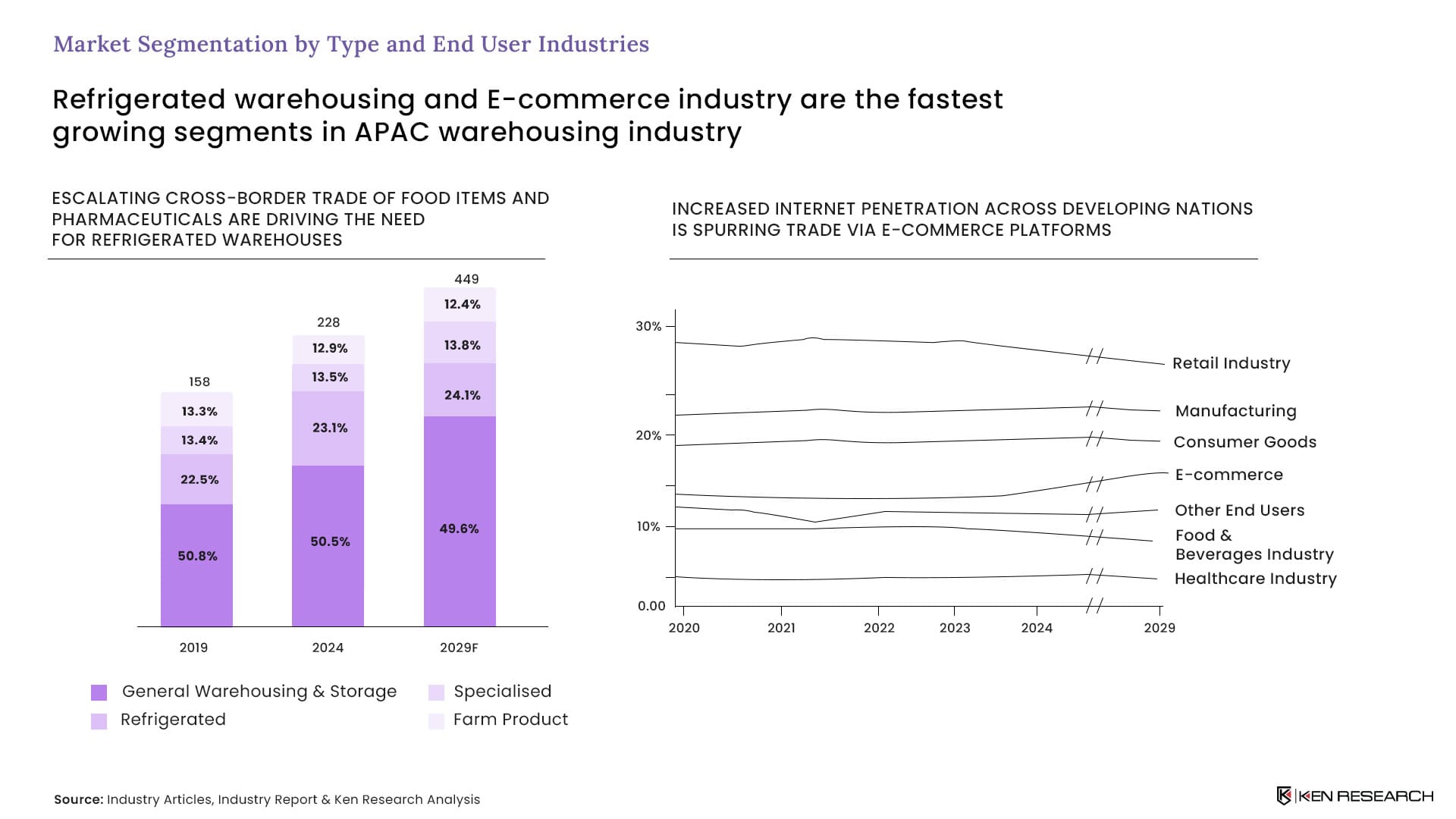

The sector is projected to grow at 14.5%, roughly twice that of the rest of the world (RoW) with the refrigerated warehousing and e-commerce industry as the fastest growing industry in the APAC warehousing industry.

Micro-Warehousing and Flexible Storage Solutions leading the market to 49.6% by 2029: Deliveries can be done within the city super-fast with strategically placed small warehouses all over. There should be flexible, on-demand storage spaces providing for all varying inventory of businesses.

Pharma-Grade Cold Storage and Hybrid Warehouses to have 24.1% of the market share: In the refrigerated industry warehouses need to be designed to meet all the requirements of the pharma-storage. These facilities also must be a combination of refrigerated and ambient storage solutions to cater for all different types of product needs.

Secured and Compliance Warehousing taking over 13.8%: Specialized facilities with advanced securities measures for high-value goods and storage solutions that align with the regulations and standards of the industry.

Climate-controlled warehouses and Argi-Hubs to make up 12.4% of the market: Combining storage, processing and distribution of farm products and taking advantage of advanced climate-controlled environments for preserving agricultural produce so that their quality does not get affected.

Increased Internet Penetration across APAC via E-commerce Platforms

The retail industry trends show consistent growth reaching 30%, with a slight decline in 2025. The retailers are adopting omnichannel strategies and digital technologies to efficiently manage inventory while making sure that rapid delivery has grown. The increased demand from consumers with the speedy urbanization is driving the retail industry’s dependance on improved warehousing solutions.

Manufacturing industry tends to uphold 22% till 2024 but will decline to 21% in 2025. There is a need for efficient warehousing solutions and manufacturing activities that depend on just-in-time inventory systems, which are pushing for economic growth. Although in the current scenario, advancements in automation and IoTs have improved the warehousing solutions, creating suitable options available for the manufacturing sector's needs.

Consumer goods have been consistent with a market share around 19-20%. Utilizing direct-to-customer models by consumer goods companies have expanded their dependence on warehousing for inventory management distribution. Also, to meet online demand the generation of mobile commerce made it compulsory for consumer goods companies to have better warehousing solutions.

E-commerce industry is expected to rise to 13% in 2025. Led by an elevated market demand, the increase of smartphones and Internet to all households have created a substantial difference in the market. A lot of investments have been made in delivery infrastructure, logistics and warehousing which are fundamental for supporting the growing volume of e-commerce transactions.

With 8% market share, chemical and automotive industry continue to remain stable. With continuous innovations and increased production range, the chemical industry needs warehouses to manage the supply chain for chemical products and secure timely delivery and maintain the quality of products. The automotive warehouses manage and store parts, components and even finished products at times. Just-in-time manufacturing principles minimize the cost of inventory and reduce waste adding to the steady demand for smart solutions.

Remaining stable at 3% all the years, the food and beverage industry faces a slight dip to 2% in 2021. Improved connectivity and data analytics have enhanced supply chain optimization to make sure that there is efficient storage and transportation of food and beverages. Even the rise of online grocery shopping has added to the need of increase in refrigerated warehousing solutions to manage perishable goods.

Consistently holding 9% of the warehousing market, the healthcare industry stays stable throughout. There is requirement for storing vaccines and biologics, also known as temperature sensitive products, that need refrigerated warehousing. Telemedicine and the growth in online pharmacies have increased the demand for specialized warehousing solutions to manage supplies and pharmaceuticals.

How Have Major Industries Adopted Basic Automation Technologies?

Integrating basic levels of automation like scanners, mobile devices with radio frequency: This automation like handheld or fixed devices captures data from QR codes, barcodes and other identifiers and mobile devices equipped with radio frequency technology allow them to have real-time communication. With low initial investments and easy implementation, these give a high return on investment.

Automative guided vehicles (AGVs) and conveyor systems on intermediate level of automation: Mechanizing movements of materials for transporting bulk items on fixed paths and reducing manual handling and with AGVs they create a predefined path to avoid obstacles and maximize material flow. This needs a little more investment and their implementation process is also moderately difficult while the return on investment remains adequate.

The advanced levels of automation where automated storage and retrieval systems with robotic palletizers and de-palletizers are getting adopted: Robots administer the stacking and unstacking tasks mechanizing the loading and unloading of goods onto pallets where there is moderate difficulty in implementation and initial investments with an adequate return on investment. But using robotic cranes to store and retrieve items from racks and shelves has a complex process of implementation with high costs at the initial level and a low return on investments.

Fully automating using collaborative robots called cobots and IoT sensors: Robots working alongside humans, assisting them in daily tasks like picking, packing and assembly require a high initial investment with a complex implementation process but it is gradually uplifting the technology with a moderate return on investment. IoT sensors, however, collect real-time data on temperature, humidity, location and more while improving visibility and facilitating predictive maintenance. These demand a higher initial investment giving a higher return on investment, greatly impacting the technology.

Areas of Automation

Warehousing automation is set to generate $51bn by 2029 with emerging nations upgrading their businesses from basic to intermediate automation levels. The APAC warehouse market is expected to grow $449bn by 2029.

Countries at Focus:

India and China have large-scale of imports and exports driving the need for warehousing solutions. The economy is growing actively, which is increasing the demand for modern warehousing to support the growing industries where a larger customer base is increasing efficient warehousing for distribution and retail. Even governments are forming manufacturing-centric policies to promote automated warehousing.

Vietnam and Thailand are fast-growing economies experiencing rapid industrial growth driving the need for modern warehousing solutions. There is heavy reliance on exports which require efficient logistics and warehousing since these are export-orientated economies. The extensive network of free trade agreements is facilitating international trade and increasing warehousing needs where they have a geographic advantage due to the strategic locations for trade routes adding to the warehousing demands.

Industries at Focus:

Retail and E-commerce are the main industries scaling the market. E-commerce has the highest growth due to the exponential growth of online shopping requiring efficient and scalable warehousing solutions. Efficient order processing and inventory management are the most needed so to handle larger volumes of transactions and making sure that the customers are satisfied.

The large chains and supermarkets in retail depend heavily on optimized warehousing to maintain inventory levels, where the retailers aim to reduce costs associated with stockouts and overstocking by properly utilizing advanced techniques for warehousing.

Technologies on Focus:

In the current scenario, there are only two levels of automation - basic and moderate. Using mobile radio frequency to permit real-time location and status updates of goods while optimizing workflows for the tracking leads to better workflow management and efficiency. This will also reduce the number of errors as tracking helps in minimizing manual errors, making sure there is better inventory control.

In the moderate level of automating technology, automative guided vehicles (AGVs) operate continuously 24/7, increasing efficiency and minimizing human errors compared to manual handling. These also offer consistent performance as they are reliable and predictable, improving overall performance and productivity.

On the other hand, voice directed systems can perform tasks more efficiently without needing to handle devices since they offer hands-free operations. Reducing cognitive loads using voice commands simplifies complex tasks, making them easier to execute. They even provide immediate feedback and data for improving accuracy.

Implications and questions for Industries to reflect on

The APAC region has the potential to capture the global warehousing market through its automation techniques for warehousing and smart storage solutions. However, challenges regarding transitioning to warehouse automation and growing retail and e-commerce penetration remain but are the drivers of economic growth.

Companies planning to enter their businesses in the APAC region must strategically ponder some questions like how can they optimize automation so that their return on investment remains high while not having the difficulty to implement the technologies?

The same way, the companies in the APAC region should make the best way to implement strategies of automation into numerous sectors of the market so that all of them stand out and efficiently optimize the supply chain.