CPaaS Market in APAC – Strategic Outlook, Sector Trends & Growth Pathways (2024–2031)

The CPaaS (Communications Platform as a Service) market in Asia-Pacific is poised for rapid growth from 2024 to 2031, driven by rising enterprise demand for scalable communication solutions.

As Asia-Pacific accelerates its journey toward hyper-connected ecosystems, CPaaS (Communications Platform as a Service) emerges as a foundational enabler. With enterprises prioritizing automation, personalization, and customer retention, CPaaS is powering a new generation of API-first, omnichannel engagement models. This Point of View offers an actionable and forecast-backed lens into how the APAC CPaaS market is transforming communications infrastructure from cost-center to growth engine.

15 Slide Strategic Brief | Forecast & Sizing | Sectoral Playbooks | Partnership Insights

WHO THIS POV IS FOR

This strategic POV is built for:

- CXOs, CDOs, and Digital Strategy Heads at high-volume B2C and platform-first organizations

- Heads of Product and Customer Experience in BFSI, Retail, Healthcare, and Logistics

- Growth-stage and late-stage investors seeking programmable SaaS and infra-tech opportunities

- Telecom & Tech policy architects shaping real-time communications infrastructure

EXECUTIVE SUMMARY

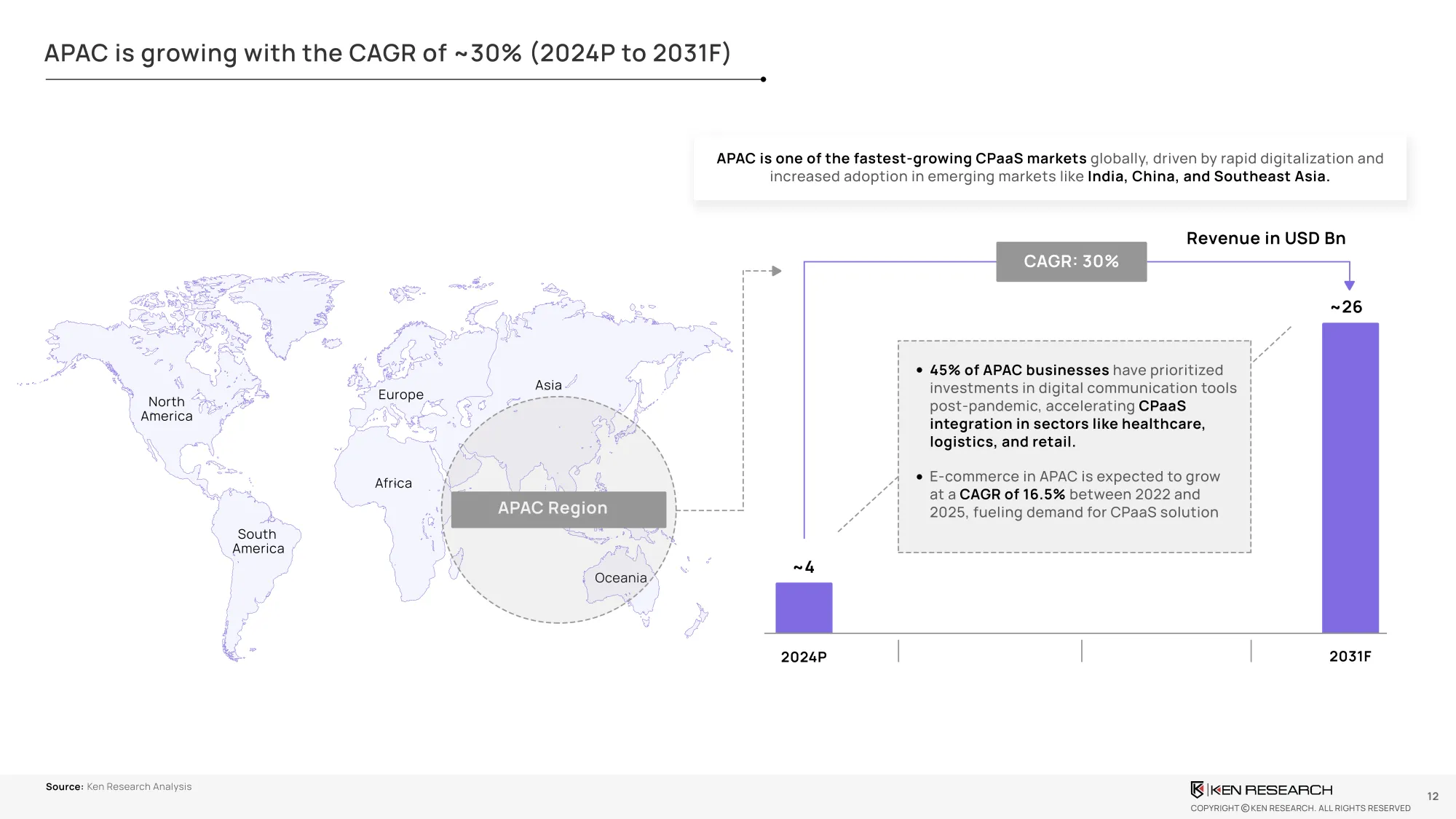

The CPaaS market in APAC is forecasted to grow from USD ~ 4 Bn in 2024 to USD 26 Bn by 2031, expanding at a CAGR of ~30%, outpacing North America and Europe.

This growth is driven by:

- Mobile-first consumer behavior across APAC’s digital-native economies

- Cloud-led enterprise modernization, requiring integrated CX and security

- Policy tailwinds including real-time digital identity, digital payments, and localization

As digital-first sectors like BFSI, e-commerce, and logistics adopt CPaaS, organizations must shift from legacy communication stacks to API-first infrastructure. This POV distills regional patterns, sectoral triggers, and monetization models shaping the next chapter of CPaaS growth.

CPaaS OVERVIEW – WHY IT MATTERS IN APAC NOW

CPaaS enables organizations to embed communication features—voice, SMS, video, WhatsApp, authentication—into applications and workflows via APIs.

Why CPaaS adoption is scaling rapidly:

- Transactional messaging at scale: OTPs, fraud alerts, payment status, etc.

- Personalized multichannel engagement: Retail promos, banking alerts, e-health reminders

- Programmable infrastructure: Reduces friction and improves speed-to-market

CPaaS VALUE CHAIN – WHO POWERS THE ECOSYSTEM

The APAC CPaaS stack includes:

- Core Infrastructure Providers: Twilio, Sinch, Infobip, Vonage

- Telco Enablers: MNOs, SMS/voice carriers, regional aggregators

- Software Integrators & ISVs: Route Mobile, Comviva, Tanla, Kaleyra

- Channel & Implementation Partners: System integrators, marketing cloud partners, CPaaS marketplaces

- AI/Analytics Providers: Integrating bots, personalization engines, compliance dashboards

CPaaS BUSINESS MODELS – FROM APIs TO MONETIZATION

Revenue models across APAC CPaaS players include:

- Usage-Based APIs (Twilio Model): Pay-per-message, pay-per-minute

- Platform License (Vonage/Infobip): CX suite for enterprise campaigns

- Telco Aggregation (Route Mobile): Partner APIs + regulatory enablement

- AI-Led CPaaS (Sinch/Infobip): Context-aware conversational flows + analytics

Growth Trend: Shift from raw messaging APIs to CX Intelligence Suites that combine communication, data, and insights.

APAC MARKET FORECAST TO 2031 – WHERE GROWTH IS CONCENTRATED

- Total APAC CPaaS Market: USD ~4B (2024P) → USD ~26 Bn (2031F) | CAGR: ~30%

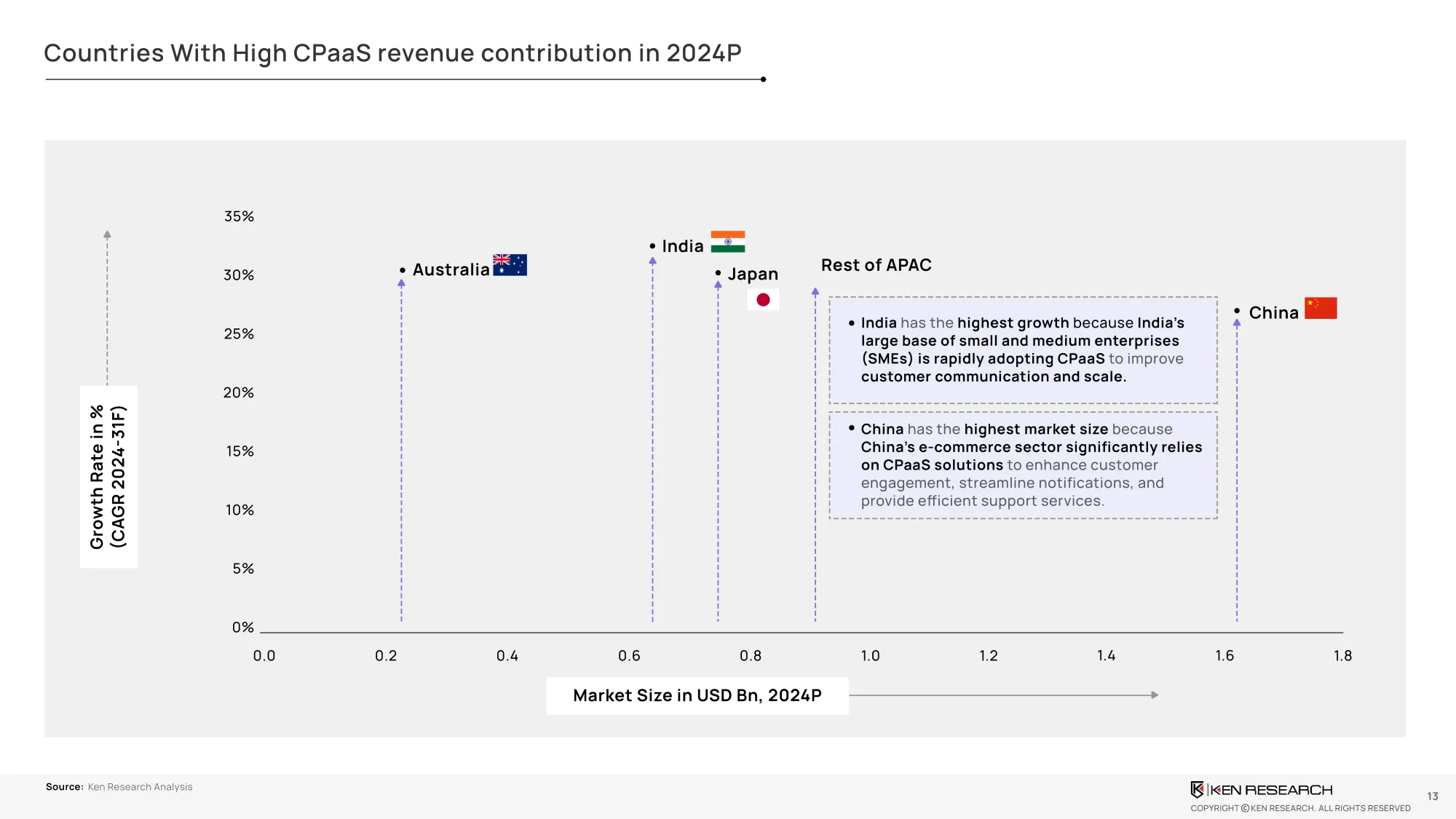

- India is the fastest-growing, with ~38% CAGR, driven by fintech and SME SaaS adoption

- Southeast Asia has latent demand due to high mobile penetration and low CX tech maturity

COUNTRY HIGHLIGHTS – CPaaS LANDSCAPE BY REGION

|

Country |

2024 Position |

Key Drivers |

Growth Outlook |

|

China |

Largest

Revenue |

Ecosystem

maturity, tech unicorns, embedded CPaaS |

Stable,

platform-led |

|

India |

Highest CAGR |

UPI,

vernacular, regional SaaS adoption |

Explosive

growth |

|

Japan |

Telco-Led |

Regulatory

clarity, enterprise CX projects |

Moderate,

secure-focused |

|

SEA (ID, PH,

TH) |

High Latency

Base |

Mobile-first,

BPO, remittance, travel sectors |

High growth

runway |

TOP CPaaS USE CASES IN APAC

|

Sector |

Strategic Applications |

|

BFSI |

OTP, loan alerts, verification,

cross-sell journeys |

|

E-Commerce |

Cart abandonment, shipment

tracking, review prompts |

|

Healthcare |

Teleconsultation, RX reminders,

vaccination alerts |

|

Retail |

Coupon activation, store

locator, order status |

|

Mobility/Logistics |

Driver ETA, emergency dispatch,

customer ticketing |

PARTNERSHIP STRATEGIES THAT UNLOCK CPaaS SCALE

- Sinch + Singtel: CPaaS on 5G, rolled out RCS and WhatsApp for enterprise

- Infobip + Globe Telecom: CPaaS for Filipino SMEs with AI voice bots

- Twilio + SoftBank: Telco-led CPaaS for compliance-first enterprises

- True + Route Mobile: Layered CPaaS + CCaaS stack for BFSI in Thailand

COMPETITIVE LANDSCAPE – PLAYER COMPARISON & POSITIONING

|

Provider |

Capabilities |

Strategic Focus |

|

Twilio |

Global-scale

APIs, developer-first |

Marketplace +

infra |

|

Infobip |

Omnichannel

CX suite, local scale |

Conversational

CX + AI |

|

Sinch |

Messaging +

AI + Telco control |

Regional

dominance + B2B CX |

|

Vonage |

CPaaS + UCaaS

+ APIs |

Bundled cloud

comms |

|

Route Mobile |

Regulatory

aggregation + D2B CX |

India, GCC,

Southeast Asia |

CPaaS AS AN INFRASTRUCTURE PILLAR FOR 2024–2031

CPaaS is more than a messaging API—it is the programmable interface of enterprise-customer interaction. In APAC, where real-time, secure, mobile communication defines the customer journey, CPaaS adoption will define who leads digital CX over the next decade.