Colocation Data Centers in APAC – Market Trends, Strategic Insights & Growth Opportunities

Discover how colocation data centers are powering APAC’s digital boom. Explore key trends, strategic moves, and growth hotspots till 2028.

As APAC rapidly digitizes, demand for high-density, low-latency, and scalable infrastructure is surging. Colocation data centers—offering shared space, power, and security—are now core to enterprise cloud strategy. From hyperscaler expansion to SME digital adoption, the region is witnessing a colocation boom. This POV explores the current market landscape, growth hotspots, investment trends, and winning playbooks for 2024–2028.

15 Slide Report | Market Forecasts | Use Case Deep Dives | Growth Strategies

WHO THIS REPORT IS FOR

- Founders and strategy heads at data center operators

- Digital infrastructure investors and sovereign funds

- Cloud providers, OTT players, and enterprise IT decision-makers

- Policymakers framing data localization and infrastructure policy

EXECUTIVE SUMMARY

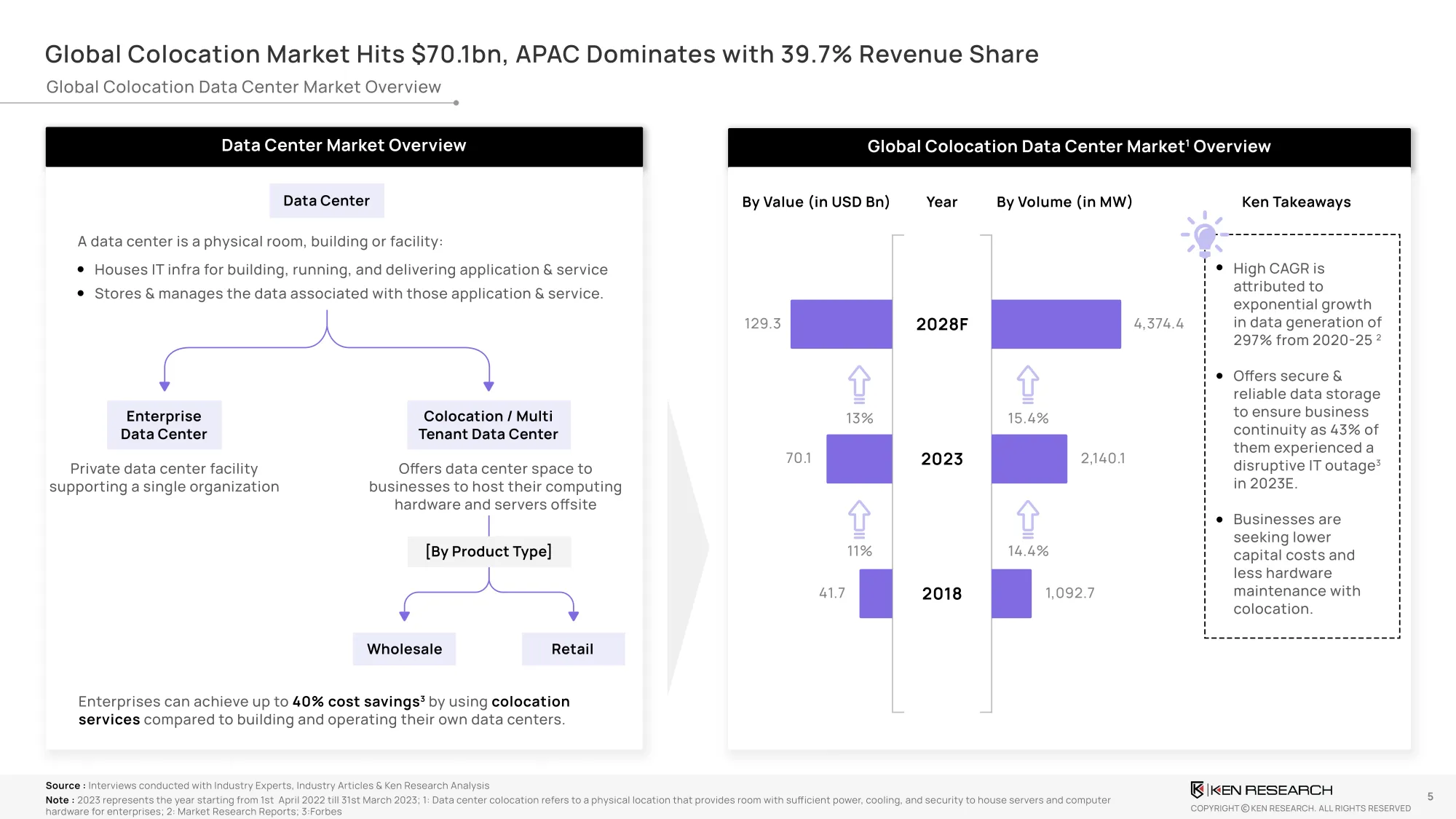

The global colocation market grew from USD 41.7B (2018) to USD 70.1B (2023) and is expected to hit USD 129.3B by 2028. APAC commands the lead with a 39.7% revenue share, driven by data-intensive sectors and sovereign digital strategies.

Key catalysts include:

- 5G and OTT demand fueling rack densification and cross-border edge computing

- $570B+ FDI inflows into APAC targeting digital infrastructure

- 1.4 trillion USD in projected IT spend in APAC (2024)

MARKET STRUCTURE & SEGMENTATION

By Colocation Type:

- Retail Colocation (USD 16.5B, 2023): Dominated by SMEs and decentralized operations

- Wholesale Colocation (USD 11.3B, 2023): Fastest-growing at 18.8% CAGR, driven by hyperscalers

By End-Use Sector:

- IT & Telecom (USD 8.3B): 5G expansion, cloud-native deployments

- BFSI (USD 6.3B): Regulatory compliance, disaster recovery

- Healthcare, Retail, E-Commerce: AI processing, real-time logistics, and video streaming

COUNTRY SNAPSHOT – GROWTH & COMPETITIVE LANDSCAPE

Country | 2023 Share | CAGR (2023–28) | Key Drivers |

China | 30.3% | 13.4% | Alibaba/Tencent infra, Made in China 2025 |

India | 12.4% | 21.7% | OTT growth, Digital India, FDI-led DC investments |

Japan | 16.1% | 17.6% | Global connectivity hub, submarine cable investments |

Indonesia | 5.5% | 16.9% | Startups, e-commerce, tax incentives |

Singapore | 7.4% | 13.9% | Data governance leadership, smart grid integration |

OPPORTUNITY ZONES – WHERE TO INVEST & SCALE

- India Tier II Cities: Noida, Hyderabad, Pune emerging as cost-effective DC hubs

- Indonesia & Vietnam: Underserved SME market, low penetration, high margin

- Singapore Edge Nodes: Smaller, energy-efficient DC formats for urban deployment

STRATEGIC MOVES BY INDUSTRY LEADERS

- Equinix: Acquired GPX India DCs for USD 161M, 100% renewable APAC coverage

- Digital Realty: 250MW DC in Sydney, USD 250M expansion in Mumbai

- NTT: USD 2B invested in India; built 45MW Jakarta site, expanded to Noida

- China Telecom: Operates 450+ on-net DCs, deploying 40,000 HPC racks in Shanghai

FUTURE-READY STRATEGIES FOR OPERATORS

- Retail Colocation Customization: Modular service tiers to capture SME & fintech demand

- Certified Government Workloads: Launch domestic-compliant DCs with EDB/IMDA partnerships (SG)

- Sustainable Cooling: Shift to Direct Liquid Cooling and AI-driven airflow for power density optimization

- OEM Co-Development: Launch cloud-native colocation blueprints with AWS, GCP, or Azure

ROI METRICS & FINANCIAL MODELING INSIGHTS

- Colocation ROI timeline: 3.2–4.5 years (median); up to 25–30% EBITDA margin for efficient rack scaling

- Power-efficient DCs with PUE < 1.5 outperform older facilities by 35% cost savings annually

- Land + Power Capex recovery accelerates with multi-tenant layering and SLA optimization

THE NEXT FIVE YEARS IN COLOCATION

Colocation is no longer optional—it is foundational to APAC’s cloud-first, data-resilient, and AI-enabled future. Operators that align with national priorities, offer modular scalability, and build for green power and AI workloads will dominate the region’s USD 55B+ opportunity by 2028.