APAC Clinical Labs: Capturing the $53 Billion Diagnostics Boom

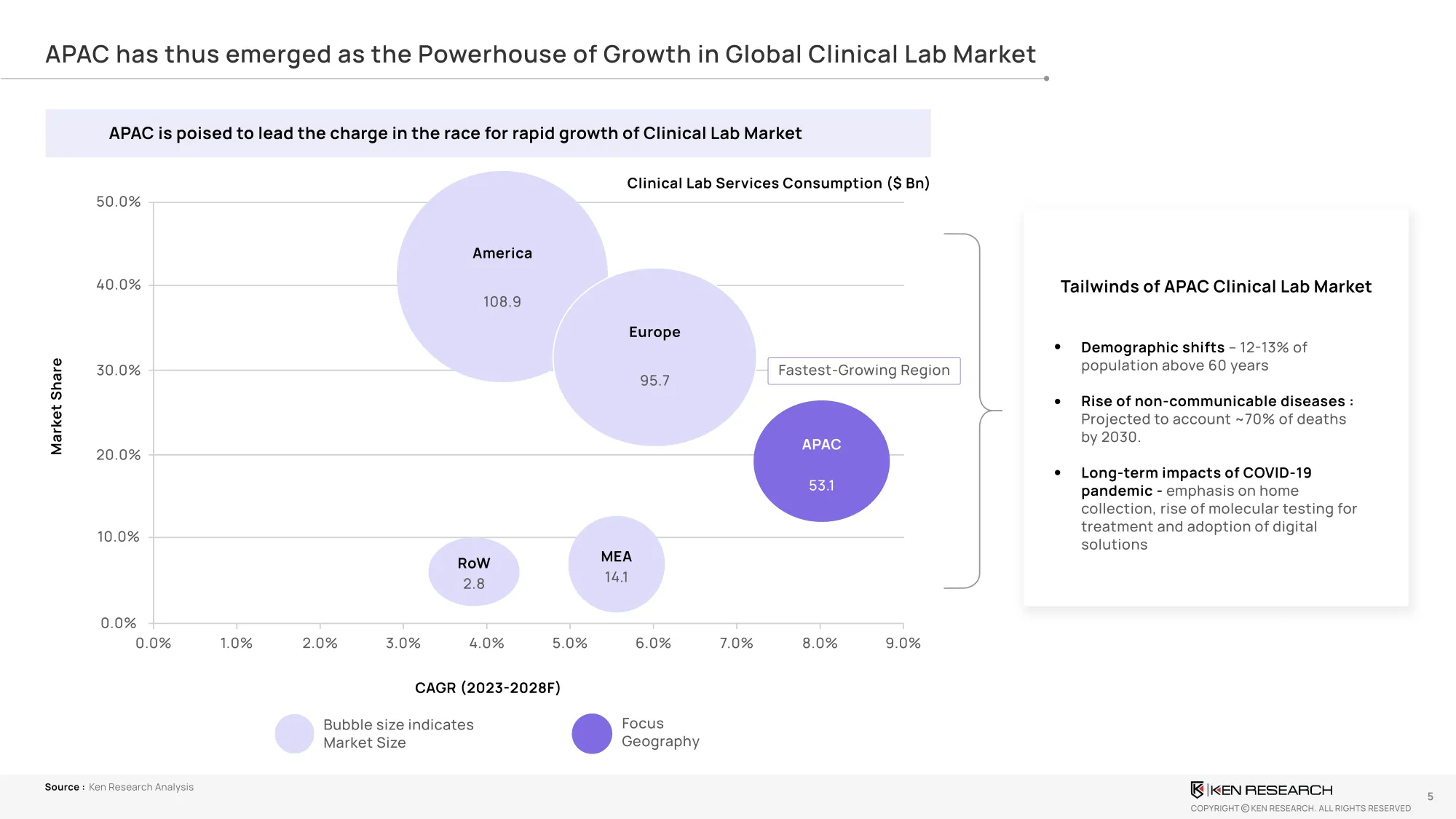

The Asia-Pacific Clinical Labs Market is witnessing an unprecedented transformation, projected to reach USD 53.1 billion by 2028. Driven by aging populations, rising NCD burdens, and rapid digital adoption, APAC is emerging as the fastest-growing diagnostics region globally

The Asia-Pacific clinical lab diagnostics market is no longer playing catch-up—it is setting the global pace. Poised to grow at an astonishing CAGR of 53.1% between 2023 and 2028, the APAC region is fast becoming the strategic nucleus of global diagnostics. With affordability, digital access, and non-communicable disease (NCD) burdens converging, APAC presents an unmatched growth curve.

This Point of View (POV) decodes how low test penetration, delivery innovation, and aging demographics are turning APAC into the fastest-growing diagnostics ecosystem. For stakeholders, the market isn’t just expanding—it’s transforming.

15 Slides | Country Comparisons | Delivery Models | Strategic Levers

[Download Full Consulting POV Now]

Built For Leaders Across

- CXOs and strategists in diagnostic chains, hospital systems, and health platforms

- Investors and PE/VC funds evaluating lab-based healthcare, AI pathology, and M&A plays

- Policy leaders and public health planners building national diagnostics infrastructure

- Healthtech and diagnostics innovators targeting underserved and emerging markets

[Access Growth Forecast Tools, Segment Prioritization Models, and Regional Heatmaps]

EXECUTIVE SUMMARY

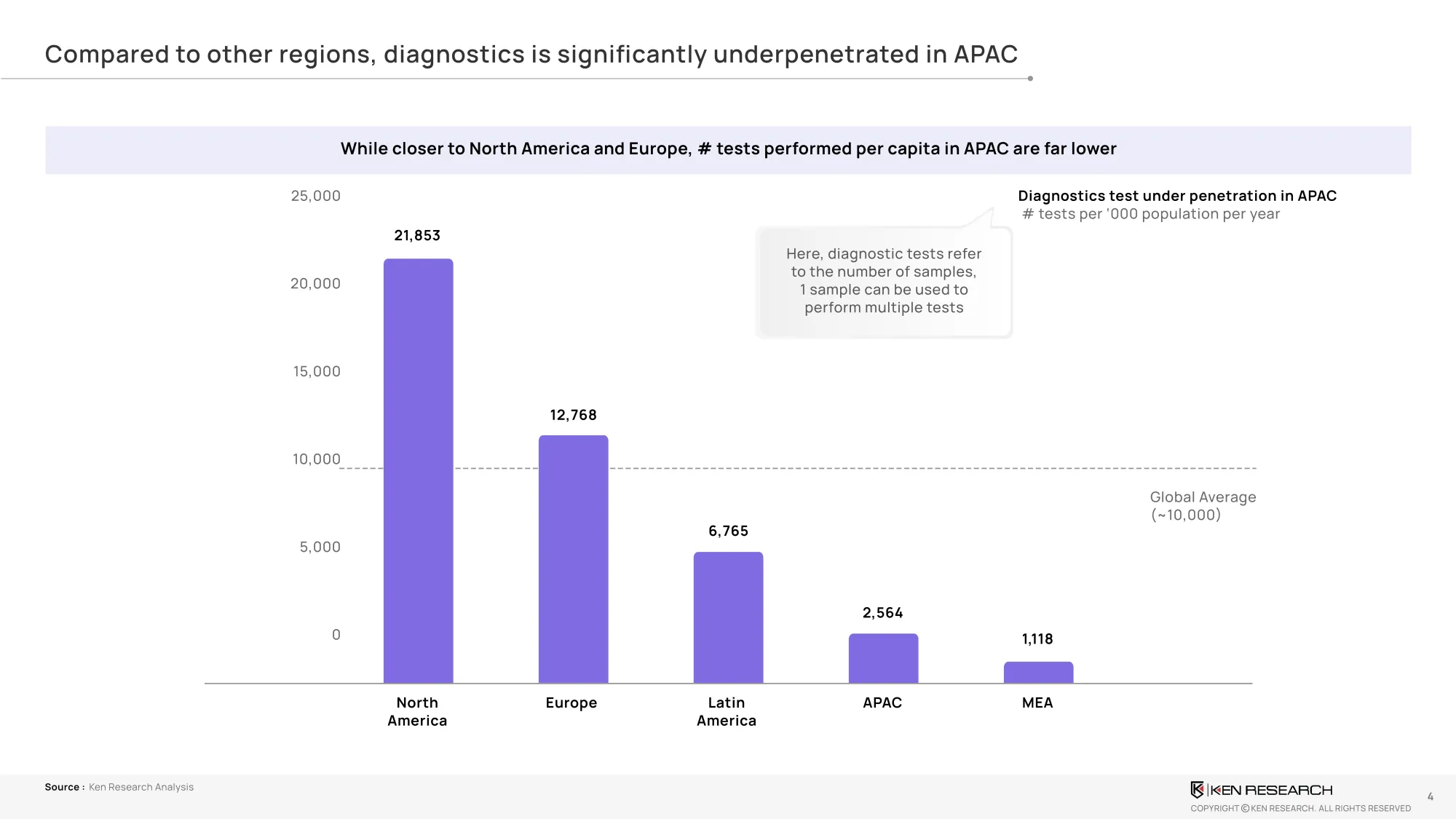

APAC’s diagnostics infrastructure is underpenetrated but highly agile. With aging populations, chronic disease burdens, and increasing self-diagnostics, the region is leapfrogging into tech-integrated lab systems. While APAC records far lower test volumes per capita than developed markets, its acceleration is exponential.

Key Statistics:

- Market expected to grow from current size to USD 53.1 billion by 2028

- Test penetration remains at ~2564 per 1,000 people (vs. 21,853 in North America)

- Diagnostics in APAC cost 40–60% less than global averages

- Uninsured test rates in developed countries are 8x higher than in APAC

- By 2030, ~70% of deaths in the region are projected to be due to NCDs

- 12–13% of the population in APAC is now aged 60+, demanding more frequent longitudinal diagnostics

[Explore Full Market Size Sheets and Regional Age Index Overlays]

MARKET SNAPSHOT – DEMAND AND DELIVERY GAPS

The average number of lab tests per 1,000 people is:

- North America: 21,853

- Europe: 12,768

- APAC: 2564 (among the lowest globally)

However, this underpenetration reveals immense upside potential, driven by:

- Affordability: Indexed pricing in APAC is significantly lower

- Rising chronic disease diagnostics demand (diabetes, cardiovascular, cancer)

- Self-initiated and preventive diagnostics growing post-COVID

This latent demand has created a landscape where even mid-tier cities are seeing double-digit test volume growth, particularly where digital and franchise-based models exist.

[Download Indexed Test Price Tracker + Volume Gap Matrix by Country]

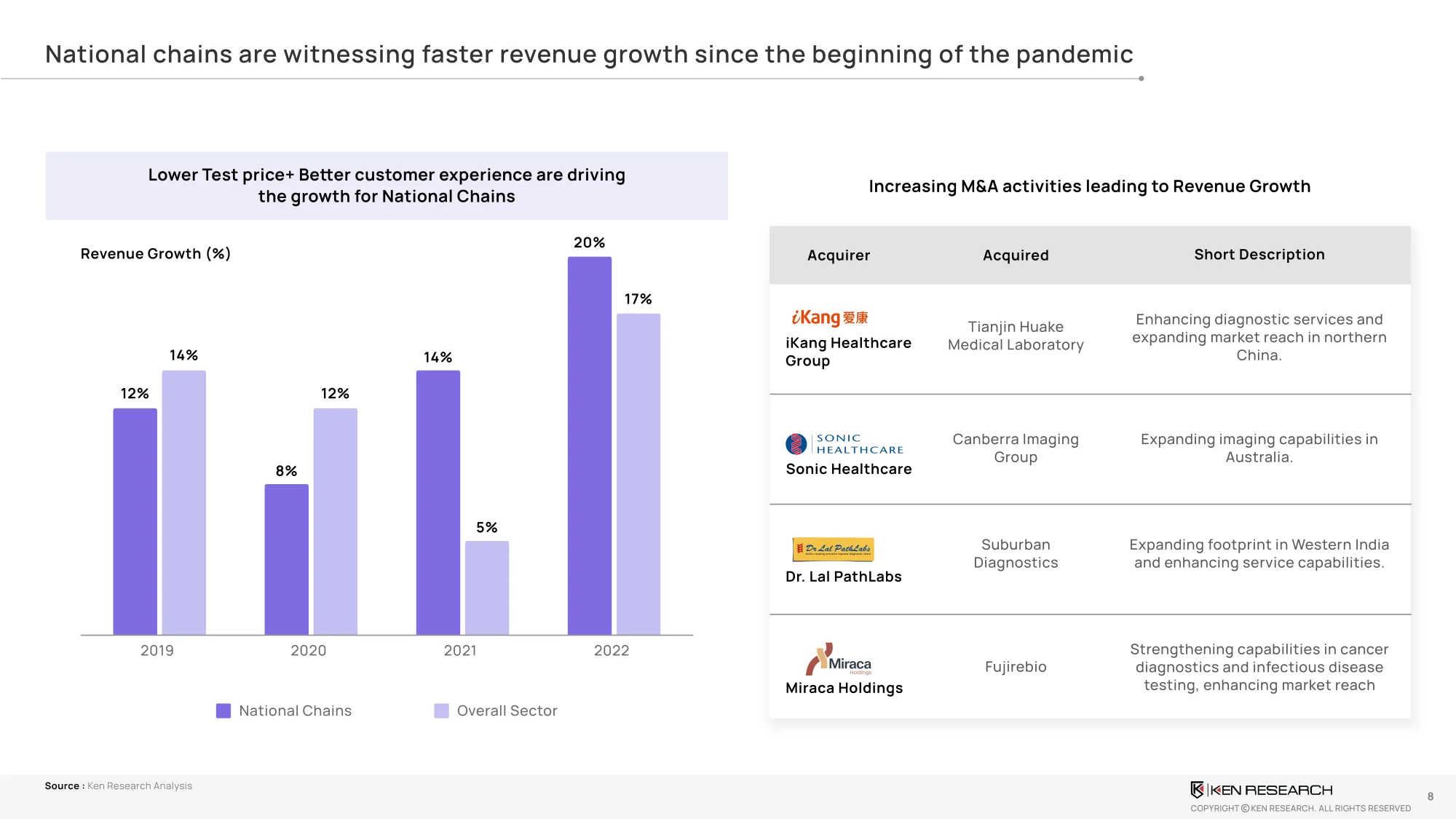

DELIVERY MODELS – NATIONAL CHAINS, HOSPITAL LABS, INDEPENDENTS

APAC’s lab providers fall under three broad categories:

- National Chains – Invested in tech, branding, and logistics integration

- Hospital Labs – Strong in standardization, trust, and shared infra models

- Standalone Independents – Flexible, hyperlocal, often franchise-run

Chains are gaining share due to:

- Wider test menus (including genetics, panels, and wellness bundling)

- Customer experience leadership (WhatsApp reporting, real-time updates)

- Accreditations like NABL, CAP, ISO, which boost confidence and B2B uptake

[Access Lab Format Comparison + Accreditations Penetration Table]

PATIENT EXPERIENCE & DIGITAL TRANSFORMATION

Post-pandemic trends have revolutionized service expectations:

- Online test booking with time-slot based collection

- Home sample collection—now a norm, not a premium

- Digital reporting via email, apps, and WhatsApp—reducing TAT perception gaps

- Delivery management software for logistics routing and phlebo performance

- Integrated CRM & patient communication tools that improve retention

Patient engagement models in APAC now rival Western standards—at a fraction of cost.

[Download Patient Journey Mapping Toolkit + CX Adoption Benchmarks]

BUSINESS MODELS – TRANSFORMING THE DIAGNOSTIC VALUE CHAIN

Levers being deployed by market leaders:

- Franchise and asset-light models to expand in Tier 2/3 cities

- Network optimization using AI and routing algorithms to reduce sample loss

- Adjacency expansion: teleconsultation, teleradiology, telepathology

- Inorganic expansion: chains acquiring regional brands or digital labs

- Wellness bundling: diagnostic packages combined with chronic care programs

Operational excellence is becoming a differentiator, not just market presence.

[Access Growth Playbook by Format + M&A Opportunity Grid]

TECHNOLOGY ADOPTION – ENABLING SCALABLE DIAGNOSTICS

From back-end processing to front-end UX, technology is transforming diagnostics:

- AI in radiology and histopathology: accelerating interpretation and accuracy

- Real-time visibility of sample collection, transit, processing, and reporting

- Integrated lab IT infrastructure: managing bookings, payments, inventory, and data

- Patient engagement tools: reminders, feedback, loyalty programs

- Operational dashboards: enabling lab heads to track TAT, QC, and SLA performance daily

[Explore LabTech Use Case Sheets + Deployment Maturity Models]

STRATEGIC IMPERATIVES – WHAT LABS AND INVESTORS MUST DO

- Prioritize patient-centricity through digital experience layers

- Scale multi-location networks using asset-light partnerships

- Deploy tech infrastructure across entire value chain (phlebo to report)

- Invest in chronic disease bundling (NCDs to drive >70% diagnostic load)

- Adopt real-time logistics & performance tracking for cost-efficiency

[Access Strategic Action Grid + KPI Dashboard for Lab Operations]