The $100B Biosimilars Shift in APAC – How Asia is Redefining Global Biopharma Economics

Discover how Asia is transforming global biopharma through cost innovation and patent expiries. A $100B biosimilar opportunity awaits forward-thinking leaders.

Asia is Reshaping Global Biopharma Dynamics Through Affordable Innovation, Expiring Patents, and Strategic Local Leverage.

13 Slides | Market Opportunities | Investment Landscape & ROI Trends | Competitive Mapping

Built for Leaders Across

If you’re leading product strategy, portfolio planning, market access, or regional commercialization in biopharma, this is your field guide to the next $100 billion global disruption.

This POV is designed specifically for:

- CXOs & Global Expansion Leaders in biologics, biosimilars, and chronic therapies

- VCs & PE Funds evaluating biotech returns and M&A possibilities in Asia

- CDMOs, API Suppliers, and Local Biotech Firms scaling production in India, China, Korea, and Japan

- Health Economists and Policy Regulators working on biosimilar guidelines and cost frameworks in emerging health systems

Executive Summary

Biosimilars are no longer a regulatory side story. In APAC, they are becoming the foundation for a new era of accessible biopharmaceutical innovation.

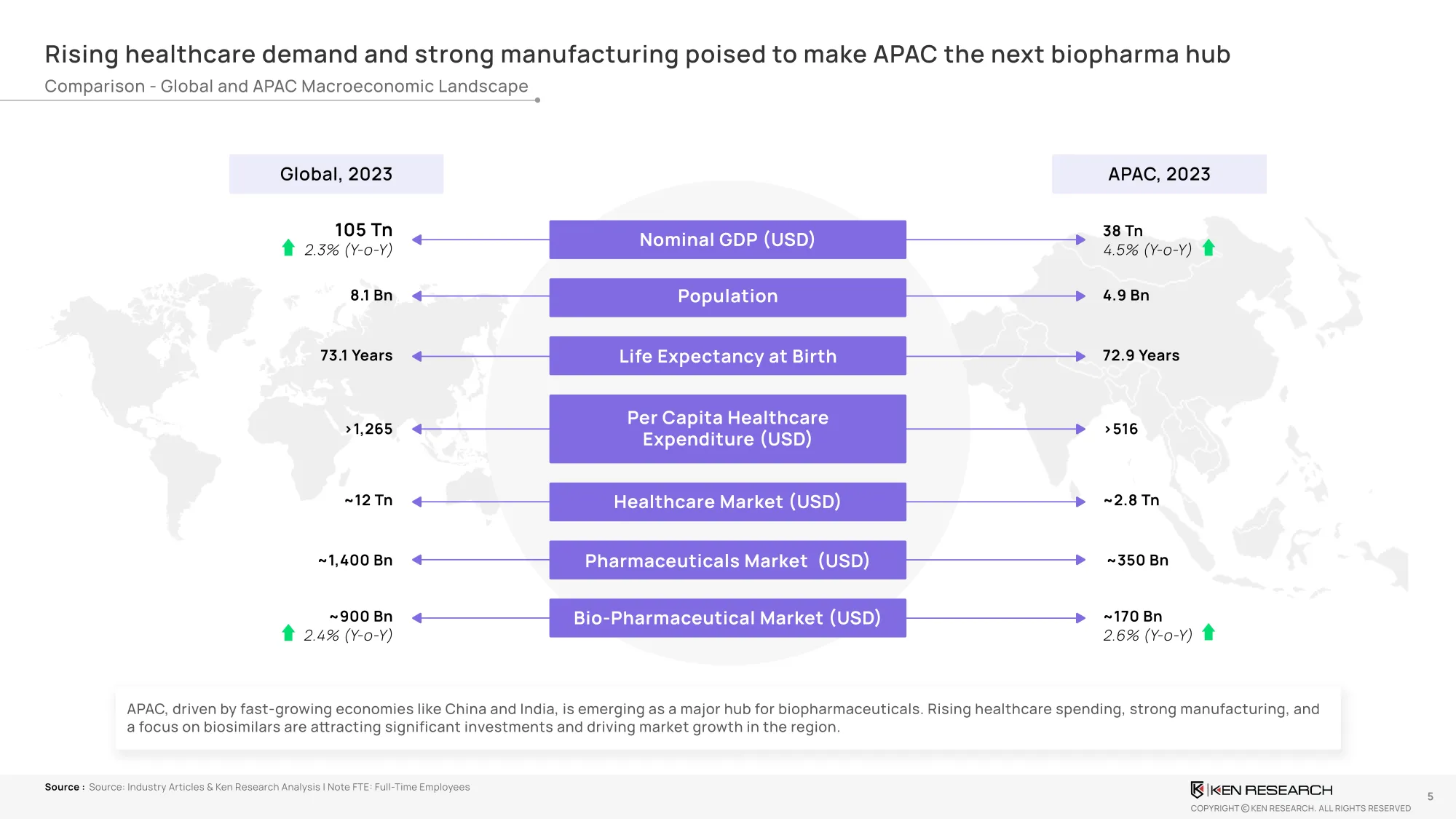

The Asia-Pacific region is expected to add $77.7 billion in new biopharma value between 2023 and 2029, with biosimilars driving much of this growth. APAC's market—currently worth $170.5 billion—is projected to hit $248.2 billion by 2029. But what's more important is how this growth is happening:

- Biosimilars in APAC are priced at 30–70% less than branded originator therapies

- Local production and regulatory acceleration are enabling faster market access

- Patent cliffs across blockbuster biologics are creating a $100B opportunity window

From oncology to autoimmune and cardiovascular, the region is scaling biosimilar production at a pace never seen before.

The Market Snapshot – How Big Is This Shift?

Market Size & CAGR:

- Global Biopharma (2023): USD 905.3B

- APAC Biopharma (2023): USD 170.5B

- APAC Forecast (2029): USD 248.2B

- CAGR (2023–2029): 6.5% (faster than global biopharma average of 5.1%)

Affordability Metrics:

- Biosimilars cost 30–70% less than their innovator equivalents

- Countries like India, Vietnam, and China offer a 6–8x pricing differential vs Western markets

- Treatment costs for HER2+ cancer in India have dropped from USD 40,000 to under USD 4,000 due to biosimilars

Policy & Production Levers:

- Government-linked price caps and tax incentives in China and Korea

- Japan’s prescribing incentives for biosimilar switches

- India’s regulatory acceleration through CDSCO and make-in-India provisions

Download Regional Benchmarks and Country Profiles

Biosimilar Penetration – Where Is The Growth Real?

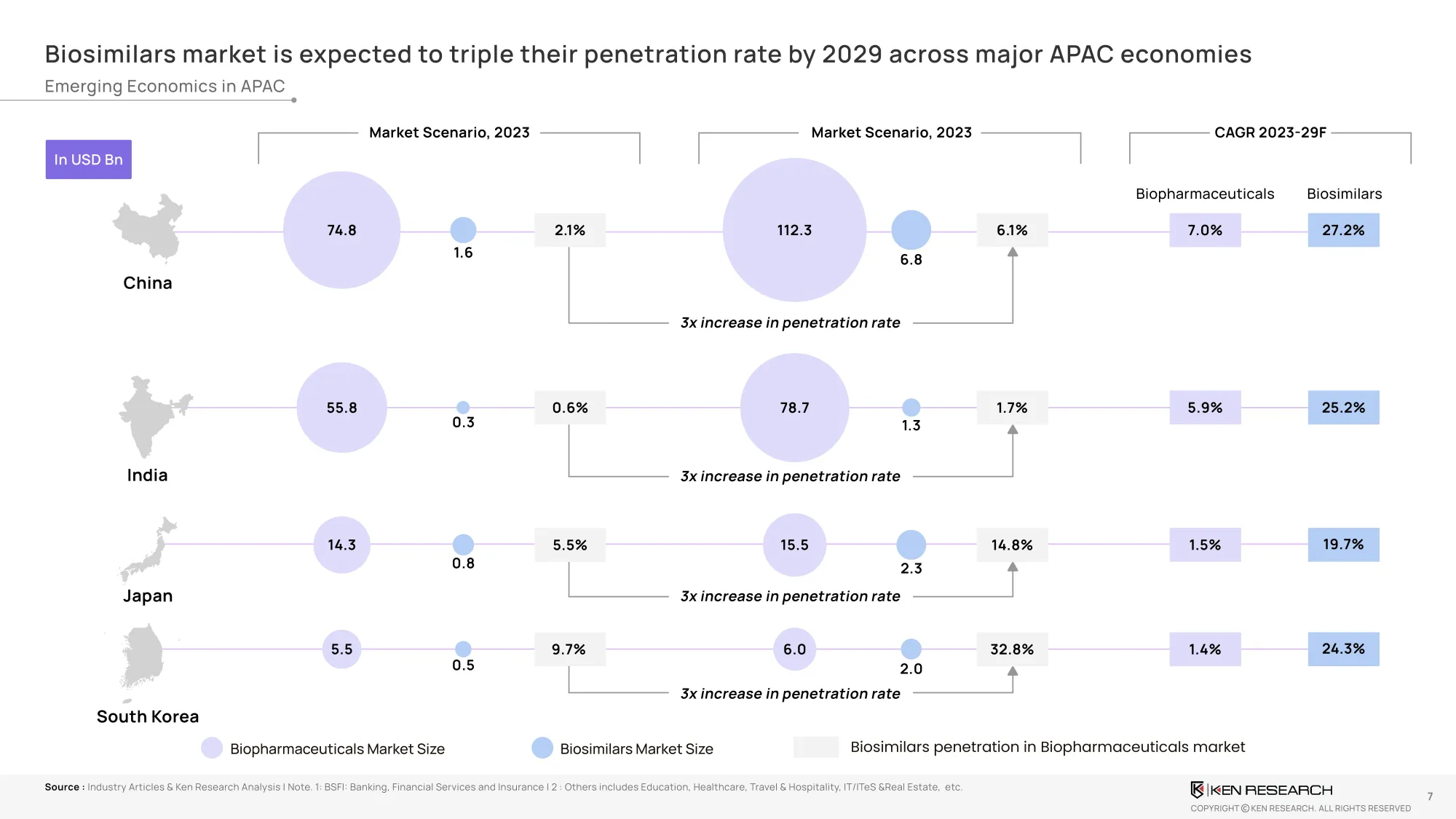

Penetration in key markets is expected to triple by 2029, with clear leadership emerging:

- India: from 0.6% → 1.7%

- China: from 2.1 % → 6.1 %

- South Korea: from 9.7% → 32.8%

- Japan: from 5.5% → 14.8%

This is not just statistical growth—it’s a structural reallocation of market share. Biosimilars are now replacing innovator mAbs in public procurement. National health systems are integrating biosimilar-led therapy options into their formularies.

Download Country-Wise Penetration Forecasts

Patent Cliffs & Pipeline – Where The Value Is Shifting

More than USD 100 billion in biologic drug revenue is at risk from expiring patents between 2023–2030.

Top Drugs Losing Exclusivity:

- Keytruda (USD 17.2B)s

- Humira (USD 16.1B)

- Opdivo, Eliquis, Enbrel, Avastin, Rituxan…

Impact:

- 50+ biosimilar candidates are expected to enter the market by 2030

- Oncology, autoimmune, and cardiovascular dominate this pipeline

- APAC firms like Celltrion, Biocon, Dr. Reddy’s, and Samsung Bioepis are leading filings

Download the Competitive Opportunity Map

Strategic Shift – The Third Global Wave Of Biosimilars

The world has seen two biosimilar waves before:

- Wave 1: Europe – Cytokines, hormones (2005–2015)

- Wave 2: US – Rheumatology, mAbs (2015–2020)

Now comes Wave 3 – APAC, focused on:

Oncology

- High-cost chronic therapies

- Multi-indication biologics

- Regional IP-driven manufacturing

This is APAC’s moment to lead global biosimilar affordability and accessibility, just as it once led generics in small molecules.

Access the Strategic Wave Framework Now

TAM – The $102.6b Biosimilar Opportunity By 2029

Therapy Area Breakdown:

- Oncology: USD 64.3B

- Cardio-Metabolic: USD 16.4B

- Autoimmune: USD 2.9B

- Neuro/Hormonal/Others: USD 19B+

Top 4 Focus Countries:

- India: Biosimilar exports and CDMO play

- China: Local approvals + global licensing

- Japan: Prescriber shift via centralized incentives

- South Korea: Leading on biosimilar APIs and bulk drug capacity

Download Full TAM & Regional Opportunity Slide

Who’s Winning – M&A, Jv, And Launch Landscape 2024

Recent strategic deals include:

Celltrion’s $278M acquisition of Takeda’s biosimilar assets

Samsung Bioepis expanding via Biogen divestiture (~$775M)

Biocon’s five-year alliance with Sandoz (Australia roll-out)

Zydus + Dr. Reddy’s co-developing HER2+ oncology biosimilars

Track strategic plays shaping the biosimilar map across APAC and beyond