How Taxi Revolution of Al Fujairah Transforming the Transport Sector of UAE?

Al Fujairah, a key emirate in the (UAE), United Arab Emirates while traditionally hasn't maintained much if an active profile as compared to its bustling neighbors such as, Dubai or Abu Dhabi is seeing major growth in its transportation sector, particularly the taxi service market.

Introduction

Al Fujairah, a key emirate in the (UAE), United Arab Emirates while traditionally hasn't maintained much if an active profile as compared to its bustling neighbors such as, Dubai or Abu Dhabi is seeing major growth in its transportation sector, particularly the taxi service market. As the country sees rapid growth in development and tourism, demand for mobility solutions is also rising, resulting in a rapidly demanding taxi service market that is seeing major changes and trends.

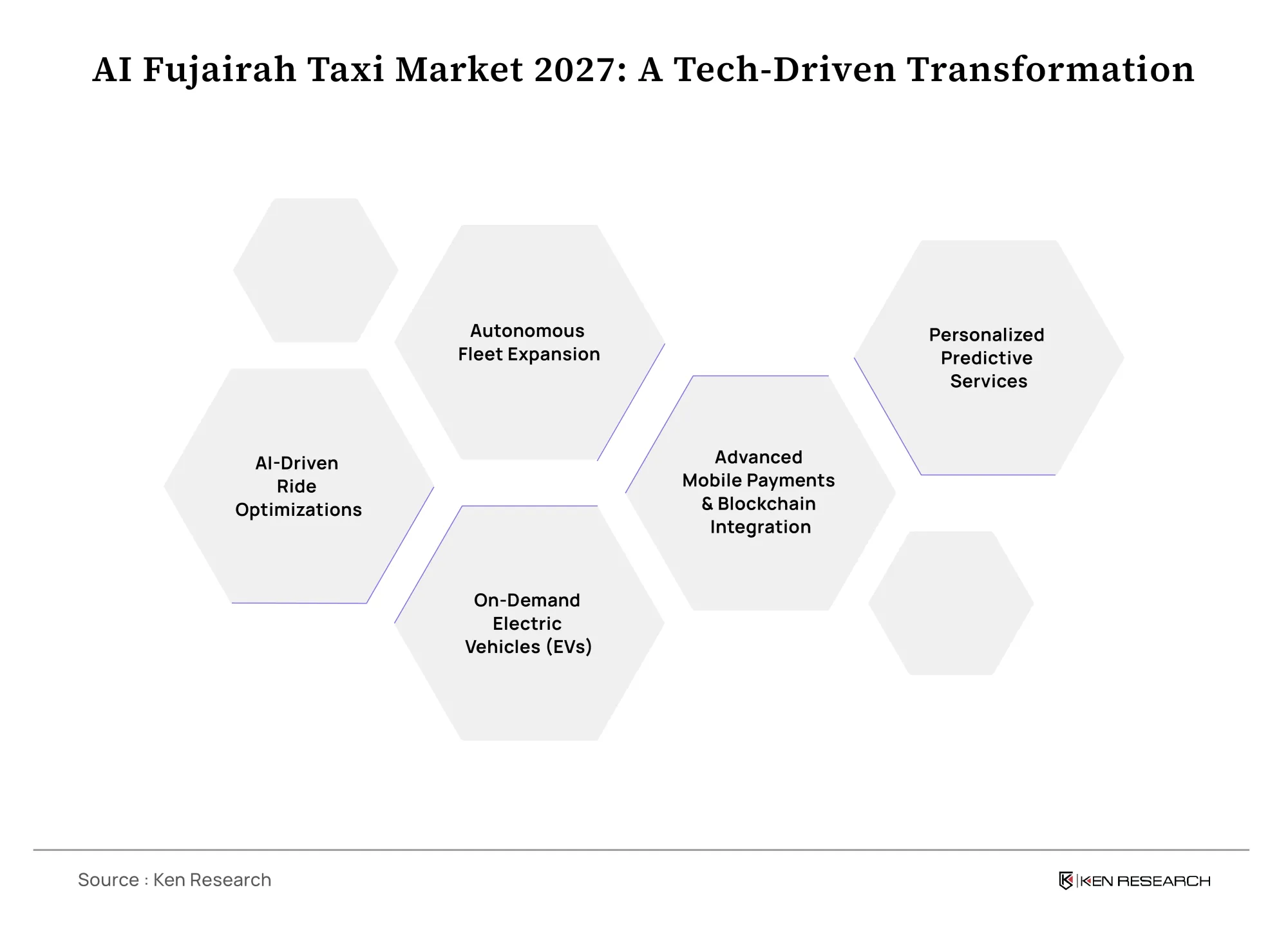

By leveraging real-world data and market insights, we present a future-focused analysis of what the Al Fujairah taxi service market might look like by 2027 below:

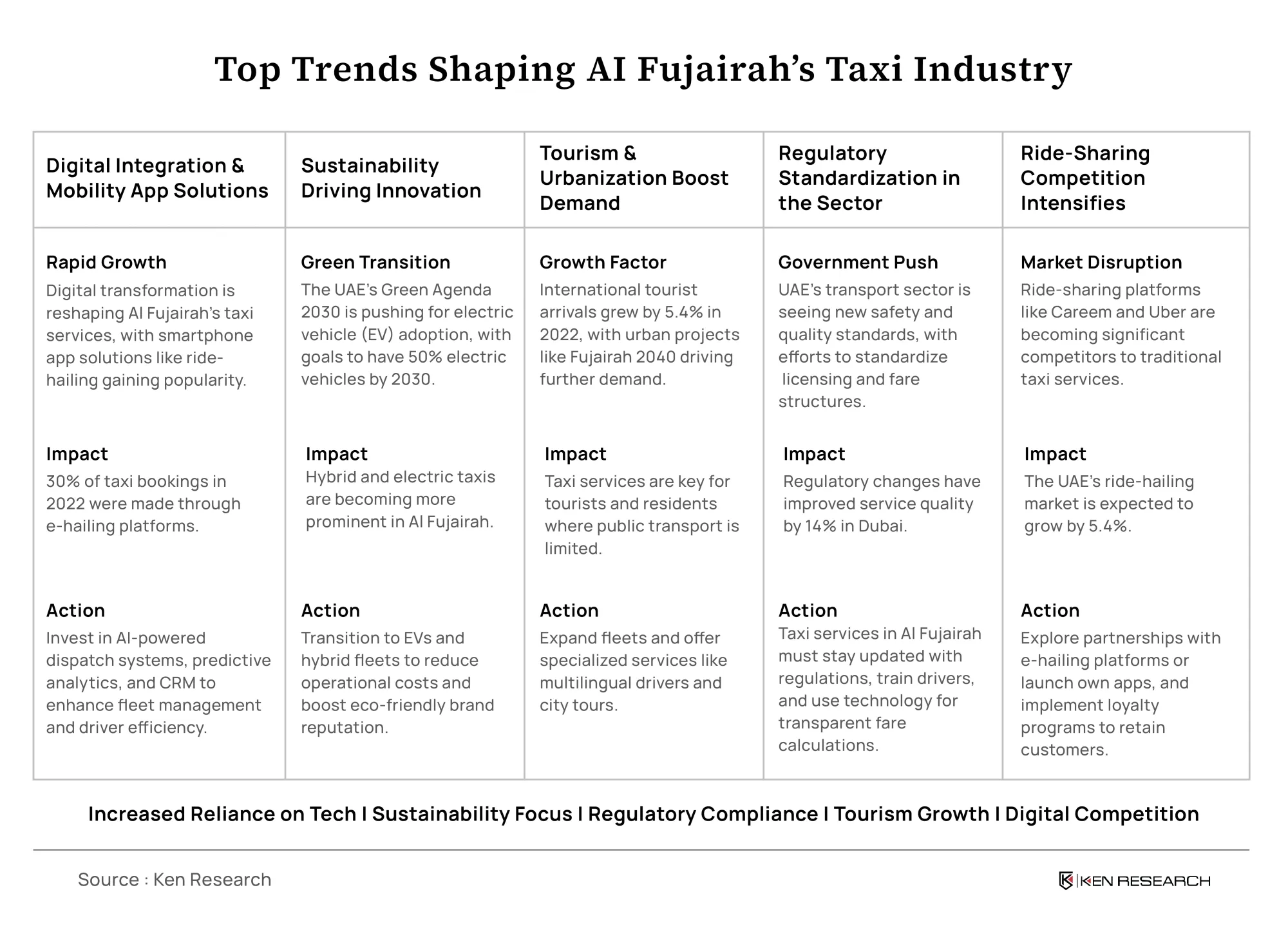

Trend 1: Digital Integration and mobility app solutions seeing rapid growth

With digital transformation making deeper penetration in the UAE, it is on the way to transform the traditional markets and industries Al Fujairah’s taxi services being no exception to it. Taxi services and operations are increasingly integrating ride-hailing technologies such as those of Uber and Careen in other UAE emirates. With smartphone usage increasing day by day, more and more people are utilizing mobile solutions to hail taxi services. UAE’s smartphone penetration went up to 97.6% in 2022.

For example, the Dubai Roads and Transport Authority (RTA) reported that e-hailing accounted for over 30% of taxi bookings in 2022.

Impact and Actions

- To meet the demands of the tech-savvy customers taxi service providers in Al Fujairah must Integra digital platforms and use of smartphone services to improve efficiency and provide mobility solutions.

- Investing in AI-powered dispatch systems, predictive analytics, and customer relationship management (CRM) platforms will be essential in enhancing fleet management and driver utilization.

Trend 2: Growing necessity for sustainable methods

Sustainability is becoming a central theme in the UAE’s transportation sector, driven by national initiatives such as the UAE Green Agenda 2030 sustainability has become an important factor even in the UAE’s transportation sector. Electric vehicle (EV) adoption is increasing, and the UAE aims to have 50% of vehicles in Dubai to be electric by 2030. This slow push is leading the Al Fujairah’s taxi industry towards a greener approach such as hybrid and electric taxis, which are expected to become more prevalent in the coming days.

Impact and Actions

- Taxi companies must start transitioning to electric or hybrid vehicles, leveraging government incentives and subsidies for EV adoption.

- A shift to greener fleets not only reduces operational costs through fuel savings but also enhances brand reputation in an increasingly eco-conscious market.

Trend 3: Rising Demand from Tourism and Urbanization

With its strategic location and natural attractions along the Gulf of Oman, Al Fujairah is getting popular as a tourist destination with a growth rate of 5.4% in international tourist arrivals by 2022. This, coupled with ongoing urbanization projects such as the Fujairah 2040 Plan, is driving the demand for reliable transportation services. Taxi services remain a key mobility solution for both tourists and residents due to the limited availability of public transport.

Impact and Actions

- By offering specialized services such as guided city tours and multilingual drivers to aid language gap taxi operators can capitalize on the tourism boom and cater to the international tourists.

- Particularly in tourist hotspots and urban centers, Fleet expansion will be essential in the projected demand growth to provide solutions where transport accessibility is paramount.

Trend 4: The push for standardization leading Regulatory changes

With the aim to improve safety standards, customer satisfaction and service quality the UAE government has been actively improving and standardizing the transport sector. For instance, new licensing requirements and Fare structures are being introduced across the whole of emirates with a special focus on standardizing taxi services. For instance, the **Dubai Taxi Corporation** reported a **14% rise in service quality index** due to regulatory interventions. It is anticipated that Al Fujairah will follow suit, implementing similar measures and regulations to streamline operations.

Impact and Actions

- Taxi service providers in Al Fujairah must stay alert of regulatory changes to ensure compliance and maintain operational efficiency.

- To help the drivers align with new standards and enhance customer trust, invested in training programs for drivers and technological adoptions to ensure transparent fare calculations can be made.

Trend 5: Ride sharing services giving major competition to the traditional taxi services

In Al Fujairah’s transportation landscape, traditional taxi services dominate the market but rapid competition from ride-sharing services such as Careem and Uber is intensifying. The ride-hailing market it UAE is expected to grow at a rate of 5.4% .Although Al Fujairah’s market is less saturated, the arrival of new competitors threatens to disrupt established taxi operators.

Impact and Actions

- By exploring partnerships with e- hailing platforms or launch their own apps Taxi provider companies can hope to remain competitive.

- To retain customers traditional taxi service providers can maintain a leg up from their competitors by Implementing loyalty programs and personalized services which can help build customer engagement as well.

Implications for Businesses in Al Fujairah’s Taxi Service Market

1. Fleet Modernization and Tech Integration

Taxi services in Al Fujairah must integrate cutting edge technology into their systems and focus on fleet modernization by integrating advanced telematics, real-time traffic monitoring, and predictive analytics to increase operational efficiency. According to recent reports on the transportation sector, implementing such technologies can lead to a decrease in almost 60% of the congestion in traffic. By adopting IoT-based fleet management systems businesses will be able to offer faster and more reliable services, improving overall customer experience.

2. Adoption of Electric Vehicles (EV)

for the taxi service market in Al Fujairah the global shift towards more sustainable methods in the transportation sector especially electric vehicles will have major implications. With the UAE’s strong push toward sustainability, and the rising demand for eco-friendly transport, operators should start investing in EVs and the required charging infrastructure. A report by **Frost & Sullivan** projects that the UAE's EV market will grow at a CAGR of 1 2.7% by 2030. Especially as the government is anticipated to support this transition, taxi operators must also adopt EVs into their services after weighing the long-term cost benefits against the initial operations.

3. Collaborative Business Models

Businesses in Al Fujairah should explore forming strategic partnerships with local businesses, such as hotels, malls, and airports, to offer integrated transportation solutions. For example, exclusive airport transfer partnerships or ride-and-stay packages can enhance customer acquisition. This collaboration model not only creates a wider service offering but also ensures that taxi companies can increase their visibility in key tourist and commercial hubs. As the local tourism industry continues to grow, these partnerships can be a vital source of consistent revenue.

4. Leveraging Corporate Transportation Contracts

Given Al Fujairah’s strategic proximity to the major industry houses such as oil and gas industries, taxi providers have a significant opportunity to tap into by securing corporate contracts for employee transportation. These will prove beneficial for the taxi providers only especially the traditional taxi services and can provide a stable source of income, particularly during low tourism seasons or other climatic factors.

The corporate transportation market in the UAE is expected to grow by 3.07% annually highlighting the potential for long-term contracts with major employers in the region.

6. Partnering up with Ride-Hailing Services

Big mobility solutions such as Careen and Uber are major competitors for the taxi service providers in the Al Fujairah’s transportation industry but rather than viewing these platforms as their competitors, taxi operators can look at partnership opportunities. Traditional taxi providers and big platforms like these can come to a mutual solution such hybrid model that leverages the technological and user advantages of ride-hailing platforms while maintaining traditional taxi services which can lead to cost reductions.

By 2028, the number of taxi users is projected to reach 3.0 million users approximately. Such collaborations also allow access to a broader customer base without the need for massive marketing expenditures.

By taking these strategic actions, businesses operating in the Al Fujairah taxi service market can capitalize on emerging opportunities while navigating the challenges of a rapidly evolving landscape. Embracing technology, forming collaborative business models, and staying ahead of regulatory changes will be critical to maintaining long-term competitiveness in the market.

Future Outlook

By 2028, Al Fujairah’s taxi service market is expected to reach notable growth expected to reach 53.3 AED Bn at a growing rate of 8.15, spurred by rapid digital transformation, urban development sustainability initiatives. The rising importance of customer experience, coupled with increased competition from ride-sharing services, will force traditional taxi operators to innovate continuously. Businesses that can successfully integrate technology, adopt and offer personalized services will emerge as key players in this evolving market.

According to projections, the taxi and ride hailing market in the UAE is set to grow at a CAGR of 5.8% by 2027, with Al Fujairah poised to see similar upward trends due to the growing tourism and urbanization efforts.

Conclusion

The Al Fujairah taxi service market is entering a dynamic phase, with opportunities for growth shaped by sustainability, digital adoption, and a growing tourism sector. Taxi operators that invest in technology, expand their fleets with eco-friendly options, and adapt to evolving customer demands will be best positioned to succeed. Collaboration with key industries such as tourism and transportation will also play a crucial role in ensuring the sector's sustained growth.

Now is the time for taxi operators to embrace change, innovate, and stay ahead of the curve to thrive in the future landscape of Al Fujairah’s transportation market.